Hi everybody,

This weekend I thought I would share some thoughts about my rationale behind adding a Canadian oilfield service stock. To drop the suspense, the name of that stock is Precision Drilling (TSX: PD, NYSE: PDS). It’s the largest land driller in Canada and they also have exposure to the Untied States with a very small international division. It seems crazy to a lot of people to add oilfield service stocks in a declining oil price environment and for good reason, even NCP generally would expect activity to fall as commodity prices tank but Precision Drilling has some nuances. It is important however to note there is a lot more to drilling then simply oil, as Precision’s important markets extend to Canadian condensate with significant market share in natural gas. It’s also a misconception that you need production growth for success in the oilfield service space given the high decline nature of both US and Canadian short cycle basins. The amount of drilling and completions to maintain the status quo on production in an enormous feat in itself that never takes a rest.

THE RATIONALE

Precision Drilling predominantly focuses on two major basins in Canada in which they have dominating market share: the Montney and the Clearwater. The Canadian Montney is home to giants like Tourmaline and Arc Resources, two companies which have very significant growth plans on the liquids and natural gas side. It’s also about to see LNG takeaway out of British Columbia which is expected to tighten the AECO basis differentials which should bode well for increased natural gas activity. Even better for demand is that the Montney is home to an oil-like product known as condensate, which is unique to the basin in Canada and required for blending western Canadian bitumen to make the product flowable. Much like the Permian basin, when a drilling target produces liquids, a high degree of “associated natural gas” comes out of the well so all targets tend to be gassy. The Montney is also home to dry natural gas, an industry that is growing on the British Columbia side of the basin and is likely to continue to see growth in future years as the Canadian LNG industry develops.

In the Clearwater, a quickly growing oil basin in Alberta, break evens are amongst the lowest in the industry. Precision Drilling’s “Super Single” rig has the most dominant market share in the basin and remains in high demand. Well the Clearwater is not a complicated basin from a drilling and completion angle as the Montney is, the speed in which the Precision rigs can save time over competitors with higher efficacy gives the company an advantage over traditional singles or teledouble rigs. Operators like Tamarack Valley, Headwater, Canadian Natural, Rubellite, Spur all continue to ramp up growth in the basin citing favorable economics and extremely low break-evens.

Precision also has exposure to the United States, with around ~30% of their revenues coming from American shale basins. The lower 48 business has not been nearly as strong as Canada as the company has seen declining service margins for six quarters in a row despite having the best equipment in the industry. Other lower 48 service providers have seen the same as rig efficacy has allowed for US shale E&P’s to operate with a very low number of drilling rigs while maintaining production to the ire of oil bulls who often point to the “low rig count” as evidence of a near-term turnaround in the commodity. According to the latest calls, there is still modest spare capacity in the lower 48 on the drilling rig side which is leading to further pricing concessions. NCP is of the view that oilfield service margins are likely at or very close to a cyclical trough in the Untied States. Either incremental demand or declining acreage potential seems likely to result in a turnaround at some point in the US drilling space.

UNCHANGED EBITDA ESTIMATES, IS IT POSSIBLE?

To start the year, Precision was guiding for $241 million dollars of free cash flow. On the year-end conference call held last month, CEO Kevin Neveau informed investors that the company expects EBITDA to be flat on a year-over-year basis. While Neveau did correctly identify broader macro risks as a potential factor for weaker activity levels, he sounded relatively confident in base line activity stating that many rigs were contracted and that the Super Triple’s and Single’s were nearly completely sold out. It should be noted the defensive nature of both the Clearwater and Montney in Canada are cornerstone to my thesis on the company, as NCP is of the view the revenue expectations from these basins is very reliable. It is highly unlikely that Montney E&P’s pull many rigs at the current commodity prices in either basin.

Precision shares have been under pressure along with other oilfield service names, particularly those exposed to the US where activity has been weak. It should be clearly noted that Precision derives the majority of its income from Canada, where the rig count is actually up year-over-year and current activity trends continue to come in flat with little to no evidence that activity will materially weaken. The “bleak” US guidance is already priced into the stock and forward guidance has been given very clearly by the management team. Any upwards revisions to the United States activity levels would surprise to the upside while the downside is likely already priced in. While there is a chance US activity gets ‘modestly’ worse, it is unlikely to make a material impact to Precision Drilling’s bottom line in the near-term.

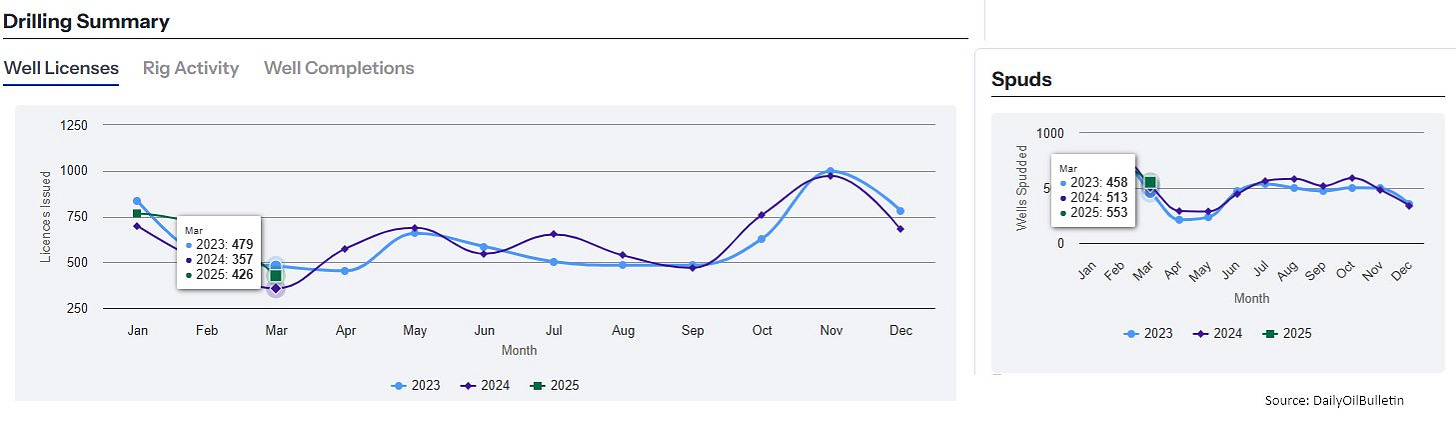

Latest data that NCP has viewed from our Daily Oil Bulletin subscription shows that both drilling licenses issued and new spuds were up year-over-year for March 2025. NCP uses “licenses issued” as a critical forward looking indicator, as it tells us that E&P’s are likely planning to drill wells in the near-term. New spuds is an important indicator for drilling company tracking as it tells us how many new holes were actually drilled in the ground and will soon to go on to be completed. It appears that confidence and optimism in the Canadian energy sector is still relatively high and NCP is of the view that such sentiment is most certainly warranted.

According to the latest data, Canada’s rig count remains strong in all provinces. The most important are British Columbia and Alberta. Saskatchewan is home to the lower spec rig market which Total Energy Service dominates, another name which NCP has written about and had as a top pick in the past couple years. Drilling rig utilization is on the high side with spare capacity likely only existing in the lower spec singles and double rigs; the high spec triples and super single market is nearly sold out. NCP is of the view that it will remain that way, as there is nothing for incremental builds in Canada or even the United States and that the basins most likely to weaken will be in areas that are not material to Precision Drilling’s operations. Canadian E&P’s are still weary to release good rigs and crews as there is no guarantee that they will be able to retain their service should the market tighten. The ability of a rig and crew to safely and with efficacy drill a well is paramount to an E&P’s success. In the past couple years there have been E&P’s willing to pay a rig to operate on a standby even when not working to retain the service as the market has maintained considerable tightness.

THE VALUATION

The valuation of Precision Drilling is the lowest I have ever seen it. Using the company’s internal numbers, they project $241 million free cash flow. Latest analyst estimates that I have come across from respectable banks (ATB, Peters & Co) are pricing in around ~$520-539 million EBITDA. Using these numbers after the latest sell-off would put Precision Drilling at an EV/EBITDA multiple of 2.93x, a very unusual valuation for the highest quality drilling company in the space. To get such a valuation, one would normally expect declining service margins and weakening activity outlook. In the view of NCP, the opportunity here is that the weakness is already reflected based on bleak US guidance while Canada remains relatively unscathed in terms of activity levels. The higher quality nature of Precision Drilling’s equipment makes this outcome very likely given their clients remain highly profitable at the current commodity price and many are natural gas weighted. In the past year, Precision has bought back 6.3% of all shares outstanding while reducing net debt by 11.3% ($102 million dollars). It is expected the company continues to mow down their share count and continue to re-pay debt in 2025. Tuck in acquisitions are possible but share issuances sound out of the question given low trading multiple.

THE CASE FOR CANADA DRILLING

While it is unusual to be bullish oilfield services in a declining market, it is important to note the changes that Canada has seen on this front. Over the past decade, the shift towards longer laterals in the Montney and Duvernay away from traditional shallow oil and natural gas basins has been profound. The incremental capacity that existed in the space is mostly obsolete due to this shift, as only the most dominant and advanced drilling and completion services have high demand. Investment in this space has been limited while competition is rather scarce given the lack of new entrants. Older equipment has generally been cannibalized or turfed outright which has led to a tighter market. Some companies have gone bankrupt while others have consolidated. Precision Drilling has been amongst the consolidators in the past couple years with acquisitions of High Arctic and CWC Energy Services.

The current set-up in Canada for both oil and natural gas is more promising then it has been in well over a decade. Currently, WCS differentials are hovering at -$10, sometimes going even below that which is unprecedented, while Canada’s LNG industry is coming to life with ships preparing to leave Kitimat with Montney natural gas. The expansion of the domestic Nova Gas Pipeline Transmission System has been helpful, as more conduits have been created to take gas away within Canada and also the United States. The growth of domestic consumption such as natural gas powerplants has also been helpful, as Alberta has moved away from coal. The ramp up of the oilsands has increased demand for natural gas as SAGD production is a major consumer of the commodity. In the coming months, respected natural gas experts I follow seem to believe that AECO basis differentials could tighten. If this happens it would further support natural gas drilling activity in Canada.

Other positive factors in the current are a favorable forex conversion rate to the United States dollar, as our commodities are sold in USD which creates a favorable backdrop for producers. Tighter differentials as noted above is a huge tailwind. Incremental pipeline capacity for both oil and natural gas plus liquids still exists and producers continue to ramp up to fill it. On the political front, this election is not as consequential as oil bulls try to make it out to be. There has been a modest shift within the Liberal Party towards accepting that oil and gas is likely here to stay. Stephen Guilbeault has been turfed as the Environment Minister and Mark Carney, known as Carbon Tax Carney has abandoned the consumer carbon tax. While a Conservative win would likely be seen favorable, albeit modestly, by investors, NCP is not of the way it is so important to the sector in the near-term. It seems all political stripes in Canada from east to west are at least ‘somewhat’ in acceptance that Canadian oil and gas is an industry worthy of support and there is no further active campaign to shut it down or block existing pipeline projects.

In the south, American President Donald Trump is often seen as an adversary to the country but in NCP’s view the new President is more like a friend of the energy sector, at least in terms of resource extraction. Not only has he upended the ESG mandates with the stroke of a pen, but he has openly called for the resurrection of defunct Keystone XL in the past months, oddly, amidst a self imposed trade war in which he flirted with the idea of tariffing Canadian oil exports. Over the longer run as tensions subside, NCP believes this is a proposal that is likely to see further interest with a possible business case plotted. Of course the demand may not be there today for such a project, but if shale ever shows signs of exhaustion, it is likely a project that will see immense interest for US Republicans with full support from Canadian politicians who even under former Prime Minister Trudeau, were openly in support of. In this case, no new pipeline is part of my thesis unlike prior years, but NCP is of the view the willpower is there from both Canadian and American leadership to get another line pipeline built over the years. Such an event would be a sentiment uplift for the space.

IN CONCLUSION

NCP has to admit to being an oilfield service “fanboy.” One thing I learned over the many years of successfully investing in the oilfield service space is that the only time you ever want to add that space is when pessimism is high and the broad consensus is negative. Ideally, you want to get ahead of activity levels that are not obvious which leads to EBITDA expansion. In this case, NCP is entering because we expect both drilling activity to inevitably increase, albeit, not in the next few months, and also because of extreme valuation discounts which NCP expects to hold on both a low multiple and high free cash flow yielding basis. Even if we deduct a 10% drop in analyst EBITDA estimates, NCP is still of the view that we can come out ‘way ahead’ on our entry point given the significant margin-of-error. Entering service stocks because of ‘extreme valuation’ discounts on a trailing basis is dangerous because oilfield service revenue tends to be shaky and not repeatable at times. While it may prove to be too early because of broader macro risks which will impact everything investing wise in the short-run, we are relatively confident of the Canadian outlook and expect guidance to hold in the E&P space with very modest adjustment potentially downwards from the weakest operators. If the shares weaken further, NCP is likely to increase our position in Precision Drilling and possibly other operators.

US oilfield services is running at barebones and will be feeling the pain of the latest OPEC move to swap them in tandem with their President who appears to be using the tools in his tool box to lower the oil price and get inflation down as promised. The collateral in short-order is the energy space for the Trump administration. But NCP knows very well when you beat down the service sector to an unsustainable level, it almost always comes back stronger as the weaker players in the space fold . This normally ends up creating a significant bout of pricing power, where oilfield service companies end up outperforming and having ‘beta” as on the ramp up, E&P’s rush to restore lost rigs amidst crews and manned equipment in short supply. This tends to take carrot waving at the service companies as there is a short period of immense competition to recruit skilled crews and retrieve the highest quality equipment. The next cycle for drilling companies may also see rigs in short supply, should shale acreage ever degrade from the “Tier 1” efficiencies while demand, particularly from US LNG growth ends up increasing demand for services. With service margins well below where “new build economics” has to be, it seems likely that the drilling space is still due for an inevitable ‘supercycle’ at some point in the coming few years.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Very timely post!

Do you plan to revisit tariff names like MRE.TO?

Very good!! What about NBR?