Hi everybody,

Well admittingly, I have to confess that NCP did not think that these tariffs were a realistic threat. Until now, I will not stand defeated in accepting my wrong as there was a breaking news updated this evening informing that Trump would be talking with our disgraced Prime Minister Justin Trudeau, who has shutdown parliament to avoid being ousted, and also the newly-elected Mexican President Claudia Sheinbaum on Monday morning, a day ahead of when the would-be tariffs will begin to collect. Trump is a market junky and to see US indexes sell-off in after-hours trading may give him a jolt. The strength of the USD is counterintuitive to what Trump has sought and not helpful to US manufacturing which is enduring a prolonged downturn.

Quite frankly, I did not think these tariffs would be implemented because they are so mutually destructive to the American-Canadian economies. It also seems rather senseless, to weaken your two main trading neighbors who all mutually benefit off an intertwined relationship for the most part. In the past 24-hours, I have come across numerous letters from US trade groups coming out warning on these tariffs: the retail association, the US energy lobby, the US homebuilders association, the US manufacturing industry, various governors, including the Gretchen Whitmer of Michigan, a swing state, where automotive jobs are the biggest employer.

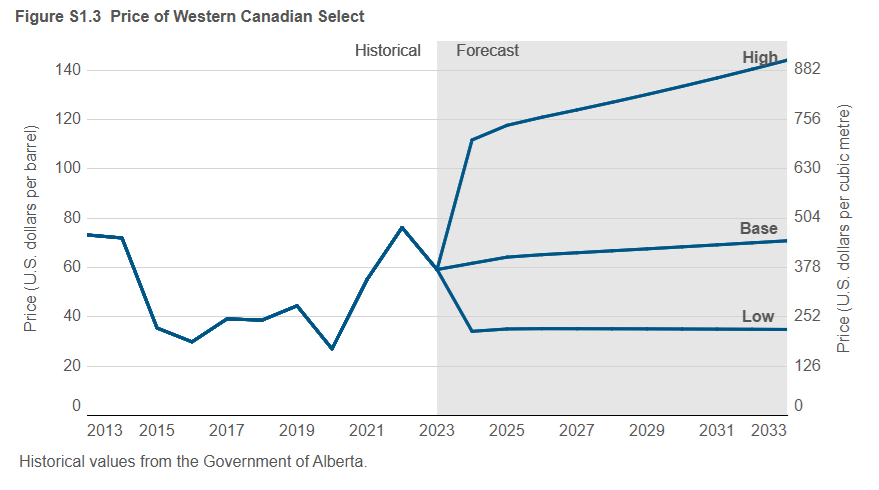

10% tariffs on Canadian oil and natural gas:

The tariff on Canadian oil and natural gas imports is unfair but seems unlikely to move the needle on production for oilsands producers. In the past decade, the Canadian energy sector has endured crippling blowouts of differentials in addition to an unfavorable political regime and low commodity prices. A meager 10% tariff, while deeply unfair, is unlikely to deter production in Canada. The oilsands companies are amongst the most profitable energy companies in the world, battle hardened with the lowest costs. Much of the risk has dissipated in those names as they paid off their large upstream investments particularly since the Covid-19 crash.

The Canadian differential is trading significantly better then it has been with the start-up of the Transmountain Expansion which has allowed for barrels to find alternative markets then the US Midwest, lessening the risk of differential blowouts from either downstream maintenance or a bottleneck in Hardisty. Until the TMX-E pipeline is fully booked, there should continue to be a favorable differential. Canadian condensate has also been trading at a discount which is helpful to the oilsands which requires blending with the bitumen to make it flow. Lower natural gas prices is typically another tailwind for SAGD-operators and a wide currency differential should help secure profits for Canadian producers as benchmark oil prices are denominated and negotiated in US currency which allows for a currency capture on Canada’s side.

Natural gas marketing has come along ways in Canada with various enhancements on North American midstream buildouts. While AECO prices remain rather grim at the time of writing, domestic AECO prices are not subject to the tariff so there should be no impact for intra-Canadian sales. Canadian natural gas producers have contracts to sell into various US markets and now that even includes some LNG benchmarks. The impact to natural gas producers here seems like a rounding error. It should be noted that a growing amount of natural gas production in Canada is also a byproduct of liquids-rich drilling, similar to the Permian basin, where the main product is condensate and where the natural gas is considered associated gas. In these cases, the producers are even less exposed amidst low natural gas prices given the target of wells in a basin like the Montney is liquids, which is benchmarked to WTI contracts.

Ultimately I believe the end result of the Trump administration will be positive for Canadian oil producers. Well it may not be apparent by the coming Tuesday, I believe that with time, this relationship should become more clear. The Republican Party has long been advocates for ‘more’ Canadian energy. Should Canadian energy companies sell-off on Monday I believe it would be a very good buying opportunity. I believe that the market is pricing in tariffs on Canadian energy as Canadian E&P’s have traded poorly for the past month. It seems rather clear that Donald Trump has decided to single out oil as a lower tariffed item for good reason. If we go back to the last Trump term, his administration attempted to rambo through the Keystone XL pipeline which would have allowed for another million barrels or so of Canadian oilsands production to enter the United States, providing an indisputable source of energy security.

Trump simultaneously makes a deal with Venezuela while hitting Canada

It seems too ironic that Trump has made a deal with Venezuela and sent high level delegates to negotiate with Maduro in Caracas the same time he has bullied Canada and imposed oil tariffs. He has also recently described himself as having “a good relationship” with Vladimir Putin. With the return of American hostages from Venezuela, it seems a path is being paved to put a halo around Maduro’s head. Chevon has already been working the clock to get permission to extract more Venezuelan oil. One of NCP’s longstanding predictions has been that Venezuela would be an easy target for more oil growth and a lever that Trump would pull. After all, Maduro, while probably not the best guy, is not cutting heads off in public squares. Compared to some of Trump’s friends in OPEC, Maduro is a welterweight of human rights abuse.

Biggest immediate risk to Canada is currency depreciation and automotive:

My first thought is that the biggest risk to Canada is the Ontario automotive sector and rapid currency deprecation. At the time of writing, the Canadian dollar has fallen further against the greenback by ~1.5% - which is a very significant move for a western currency. The Canadian dollar is now at a 2003 low, something that normally would be a positive for some industries like oil and gas or manufacturing.

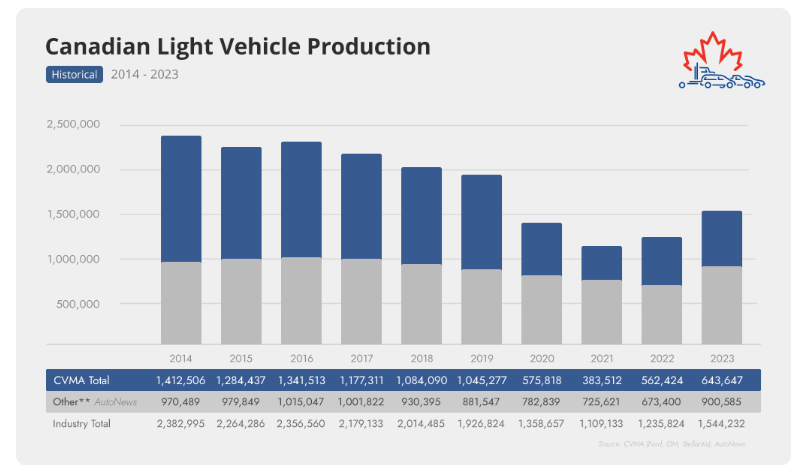

The problem this time around is that Trump has hit Ontario with a 25% tariff. Based on automotive executive comments, it seems unlikely that these tariffs are sustainable as Canada is a massive car exporter to the United States and the average vehicle sees parts cross the border eight times prior to a final installation. Bloomberg Economics reported that should Trump’s automotive tariffs on Canada and Mexico hold, the average vehicle cost would soar by $3,000.

Around 500,000 people are employed in the Ontario automotive sector indirectly and directly, so weakness in that sector would be devastating. Trades lobbyists are suggesting that plants could shut down in the next couple weeks if these tariffs are not lifted or exemptions provided. With the vast majority of Canadian vehicles exported to the United States, a tariff would be absolutely devastating. Toronto’s unemployment rate is already almost 9% with a free trade agreement in place.

Tomorrow I would expect significant weakness in prominent Canadian automotive parts makers like MartinRea (MRE), Linamar (LMR) and Magna (MG). MartinRea and Linamar have already been badly beaten up to a point they are highly attractive to NCP. Tariff overhang is at least partially priced in though certainly not entirely should the tariffs persist. Both companies have seen strong insider buying and both companies are buying back a meaningful amount of stock. NCP is of the view that these companies should be on the watchlist of any investor who thinks that US-Canadian automotive industries will continue to work together and that the tariffs on Canada will not hold, an outcome that seems probable in my opinion.

Bank of Canada seems poised to lower interest rates quickly as a response:

It was reported tonight that Tiff Macklem, the Bank of Canada Governor was actively rounding up key CEOs to discuss would-be measures to respond to the tariffs. It seems likely that Macklem is going to further cut rates in Canada. Today the Bank of Montreal put out a forecast that they expect Canada’s end rate this year to be 1.50%, with rate cuts to come at all six of the Bank’s meetings this year.

The prospect of much lower interest rates seems favorable to Canadian real estate and indebted borrowers. Some industries such as REITs will benefit off falling interest rates and should we see fundamental weakness in some areas of the market, the prospect of lowering borrowing costs, cheaper re-financing, seems like a positive offsetting mechanism to an otherwise grim situation. A 1-handle on Canadian bond yields would be absolutely fantastic for the space.

While NCP is of the view that the Canadian real estate sector has been seeing the tariff threat and economic weakness priced in for some time, further weakness seems like a very good buying opportunity as any economic despair is likely to lead to lower borrowing costs which has been the historically best time to enter the REIT space. The most exposed sector to trade wars would likely be Ontario industrial.

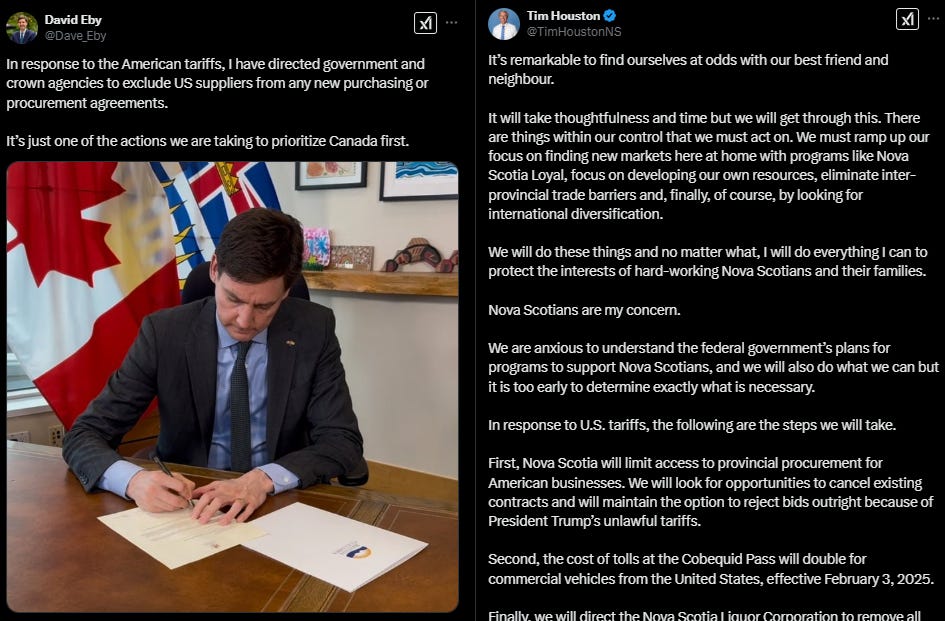

Canadian Premier’s of both “left & right” are suddenly united on resource extraction

Perhaps the most positive development that struck me in the past few days was the sudden unity and acceptance of Canada’s resource sector. BC’s Premier David Eby who is normally one I would consider “anti-oil” has come out swinging for fast tracking provincial resource projects with a promise to expedite significant mining projects in rural communities that would be disproportionately impacted by the newly imposed American tariffs. This was unprecedented in recent political history.

During the Premier’s conference last week, it was noted that Atlantic Canadian Premier’s had brought up the idea of Energy East being re-surfaced. Zeroing in on the Liberal frontrunners, even “Carbon Tax Carney” has decided to abolish the carbon tax and has touted resource development in his latest Tweets. While NCP is not about to run out and vote for him, the tone shift is a welcome change for a country that made it nearly impossible to build new pipeline projects.

All of a sudden, Canadians have realized that being exposed to one major client makes them suspectable to being held hostage, blackmailed and cheated with illegal tariffs. NCP expects Trump’s latest antics to leave a lot of scars in people’s minds in Canada, which is likely to have positive repercussions for Canadian investors in the years’ to come as more resource projects get the green light with support from all stripes.

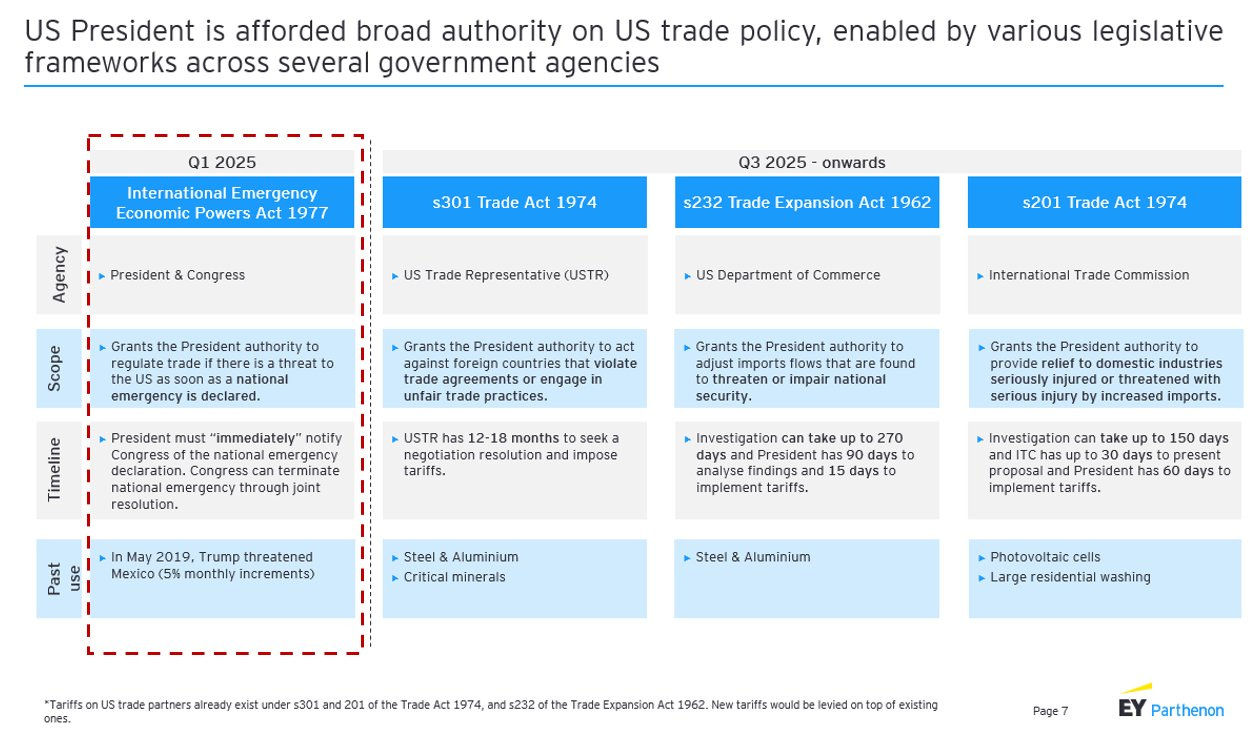

The legality of Donald Trump’s North American tariffs seem like in question

It seems what Trump is doing is in fact illegal. While he managed to find escape clauses in existing free trade agreements by pulling out the clause of a ‘national security crisis’ his rantings on social media clearly establish a different motive. Trump continues to claim Canada is ripping off the United States and has questioned our sovereignty, with the offer of becoming a ‘cherished’ US state. While NCP are not trade lawyers, it seems clear that Trump’s fentanyl claims are not likely true. China has already decided to take Trump to the World Trade Organization for illegal tariffs.

What does Trump really want?

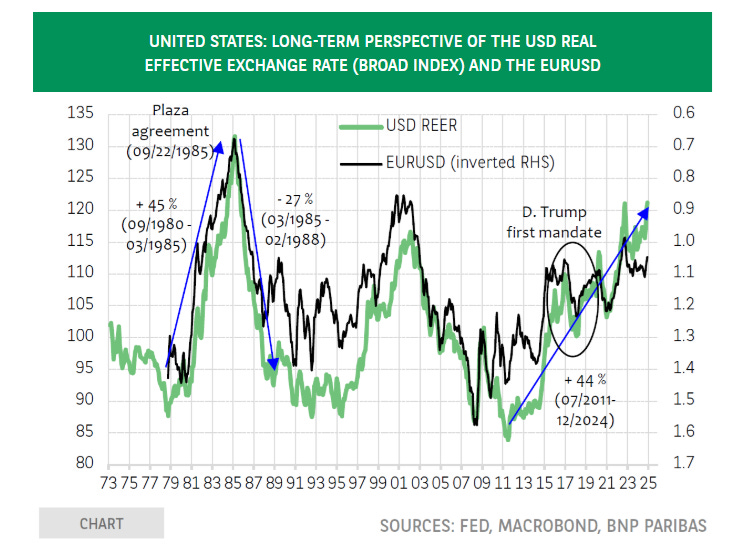

Some of the items we know Trump wants are lower bond yields, a lower USD, more domestic manufacturing, energy security. In regards to specific issues with Canada, the U.S. has constantly noted the unfair protectionism allowed by the telecom space, the banking space, the dairy space. It seems like the U.S. wants more expansion in Canada which is blocking American companies from its markets in key sectors.

A prolonged blanket trade war does not seem likely to achieve these targets, particularly on the USD which is now soaring to peer currencies which poses a further risk to US manufacturing. There is logic in NCP’s view in what the US wants out of Canada in regards to the aforementioned. I really do not believe there is an issue with illegal migration or fentanyl, but there is no question the border could use some added security and Canada could seriously fix its immigration system.

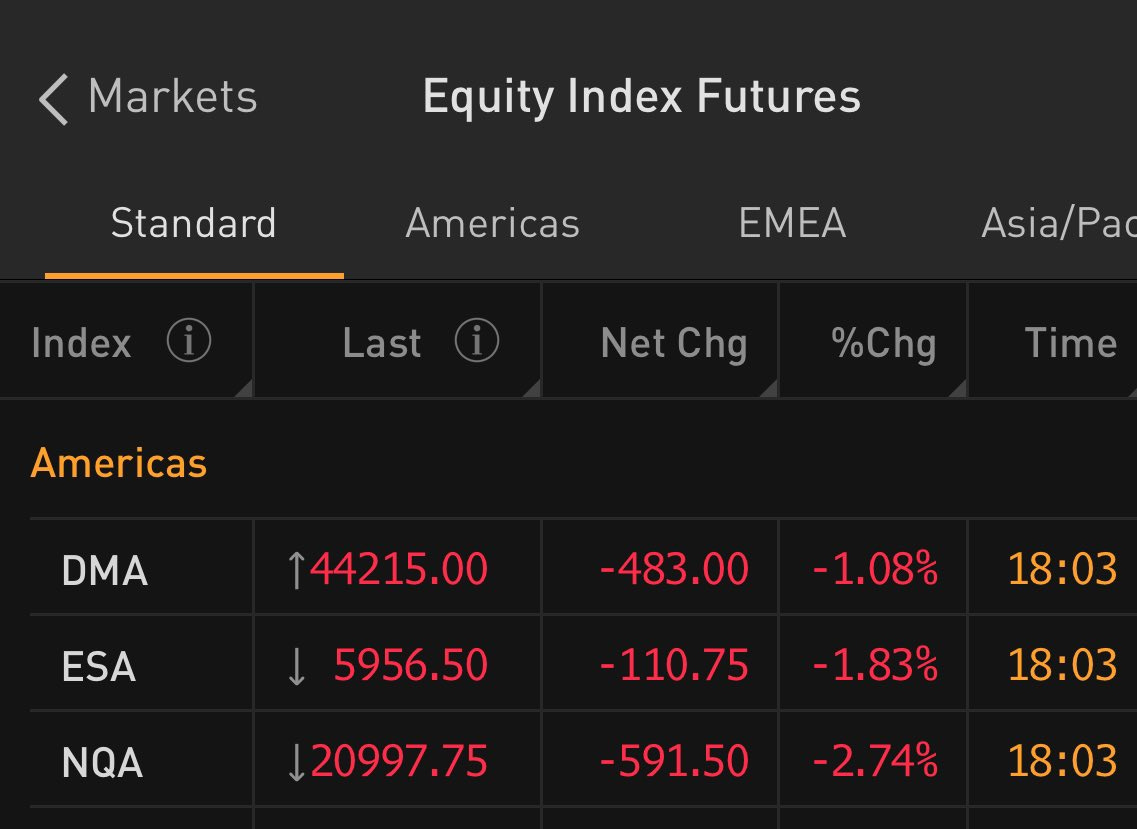

US index futures are selling off, growth is at risk but could be good for bonds

Started a trade war with your two closest trading partners and also China does not seem like a good way to stimulate growth. If anything, it seems like the recipe for a slowdown if not a recession. The rapid shock to American consumers and businesses, heightened uncertainty, all seem like an impeding disaster should these tariffs not be addressed very quickly. With US indexes at an all-time high, it seems likely that investors may be getting gittery. Bonds are still in a historically long bear market and a growth slowdown may pose very bullish for bonds.

The risk to this thought is that inflation is upped in the US which impedes The Federal Reserve from cutting rates. But since their mandate is also employment, should inflation rise and unemployment rise, the Fed will have to address this but potentially lowering interest rates anyways. Many US trade groups, including the automakers, are sounding the alarm: these tariffs will cost American jobs. On the flip side, Trump’s desire for all the manufacturing to return home in a country where unemployment is already low would likely prove to be highly inflationary.

I would not want to be long US index stocks right now given the elevated risks.

Conclusive thoughts

This is an evolving situation with major potential ramifications and very well could change again by tomorrow’s market opening. In any case I would like to congratulate any followers who have held gold to record highs or stayed overweight USD. The currency gain alone is a huge score and offers new investors in Canadian securities the chance to go it all over again on any resolution with the US. It seems there are some very good opportunities coming to Canada which is on the cusp of a powerful political shift. In the near-term there are some headwinds, most of which are resolved to a vacated parliament held prorogued by Trudeau and now a viscous potential trade war with Donald Trump which seems illogical, unplanned.

The prospect of the 25% tariff was probably partially priced in. Likely not fully as many people like myself did not think it was realistic, nor do we continue to. This likely results in some weakness on Monday which could provide for some big buying opportunities in high quality names which do not usually go on sale. My plan is to stay relatively defensive. I believe lower bond yields are coming in Canada which will benefit interest rate sensitive sectors like real estate. Some sectors like energy and certain manufacturing have likely been unjustly clobbered by the tariff prospects and could rally significantly should a notion of a deal appear possible.

The risk-reward seems far less good on the US side where a lot of positively is priced into the market and valuations relative to elsewhere are historically high. The trade that most interests me on the American side is with bonds and some US energy names as I believe that Trump will succeed in driving down yields and that growth is likely to face set-backs, particularly with a new added round of uncertainty coming from a massive tariff war with a number of critical trading partners simultaneously. If he is successful in the short-term driving down energy prices it will further cause pain in the US shale patch but that sets us up for significant opportunity.

Trump’s move is historic and never has been done before. I have always seen him as a reality TV star but without question he has heart and conviction. The coming days will be interesting and likely provide for good opportunities for daring investors.

I will do my best to write about those opportunities to come

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

What are your thoughts on Martinrea and other auto part manufacturers? Any that you like?

Please share your thoughts on Gold and mid-tier Canadian Gold stocks like Equinox and B2Gold in this scenario.