Greetings friends,

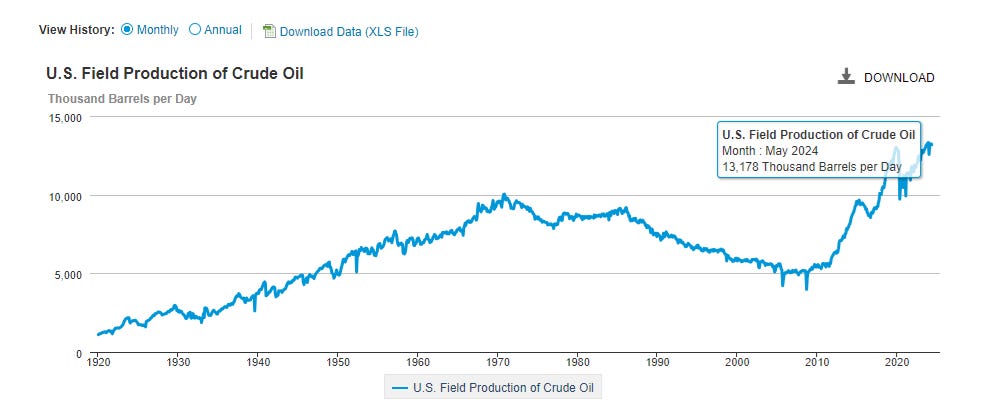

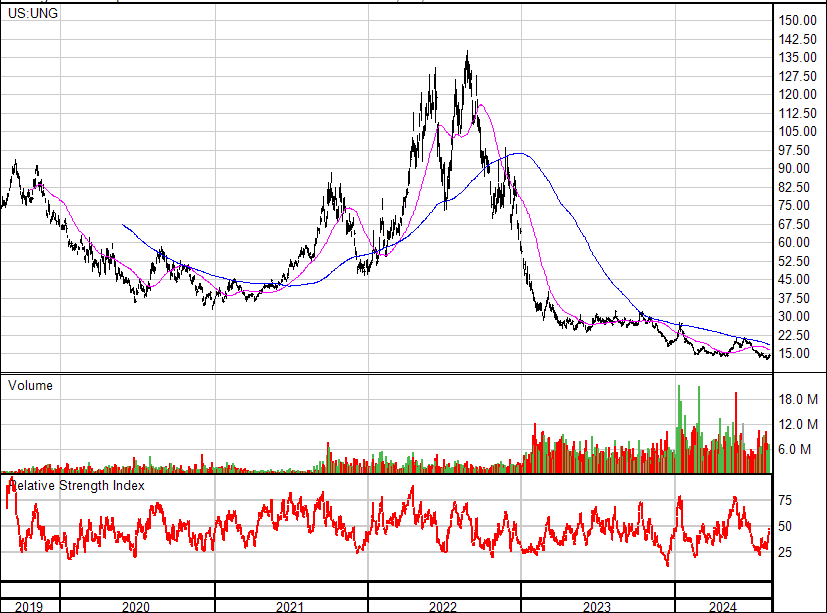

The past week or so has been quite fun with the Japan shakeout almost entirely reversing with most markets recovering. One market that continues to suffer is one that I have began to re-warm to after exiting most of my exposure near the Russia-Ukraine peek in mid 2022: the American oilfield service industry, which remains near a cycle low doldrum despite all time high production if you believe the EIA numbers.

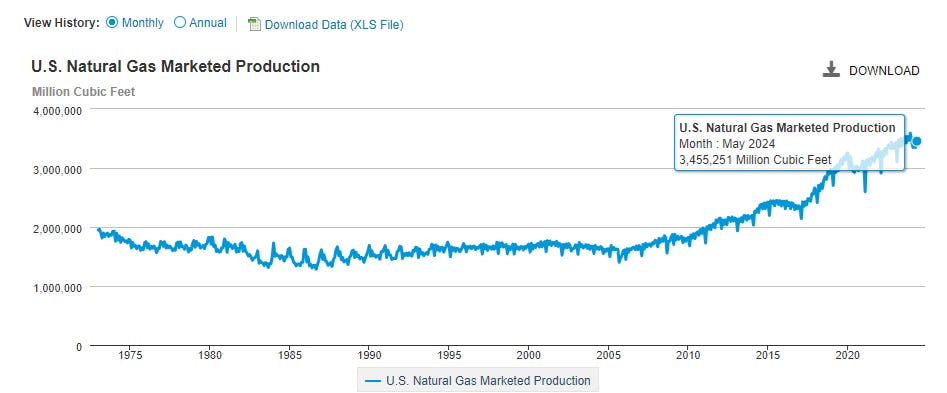

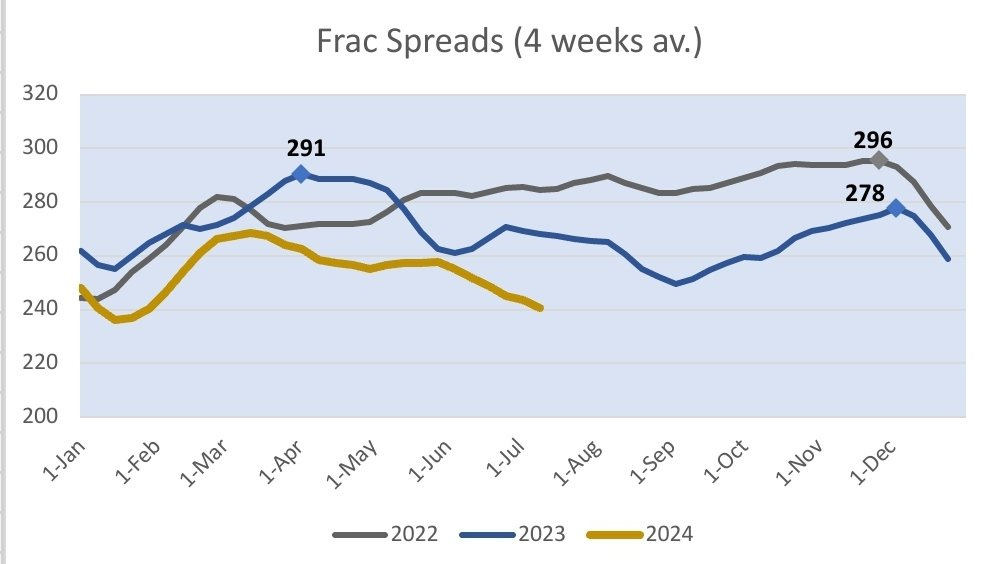

With US oilfield service activity near cycle lows, I continue to be quite amazed at how much the sector has been able to maintain production as both drilling and completions (frac count) numbers are near cycle lows while American shale production is near all or at all-time highs on both the liquids and natural gas side. One thing is clear, efficiencies on both the E&P and OFS side are genuine.

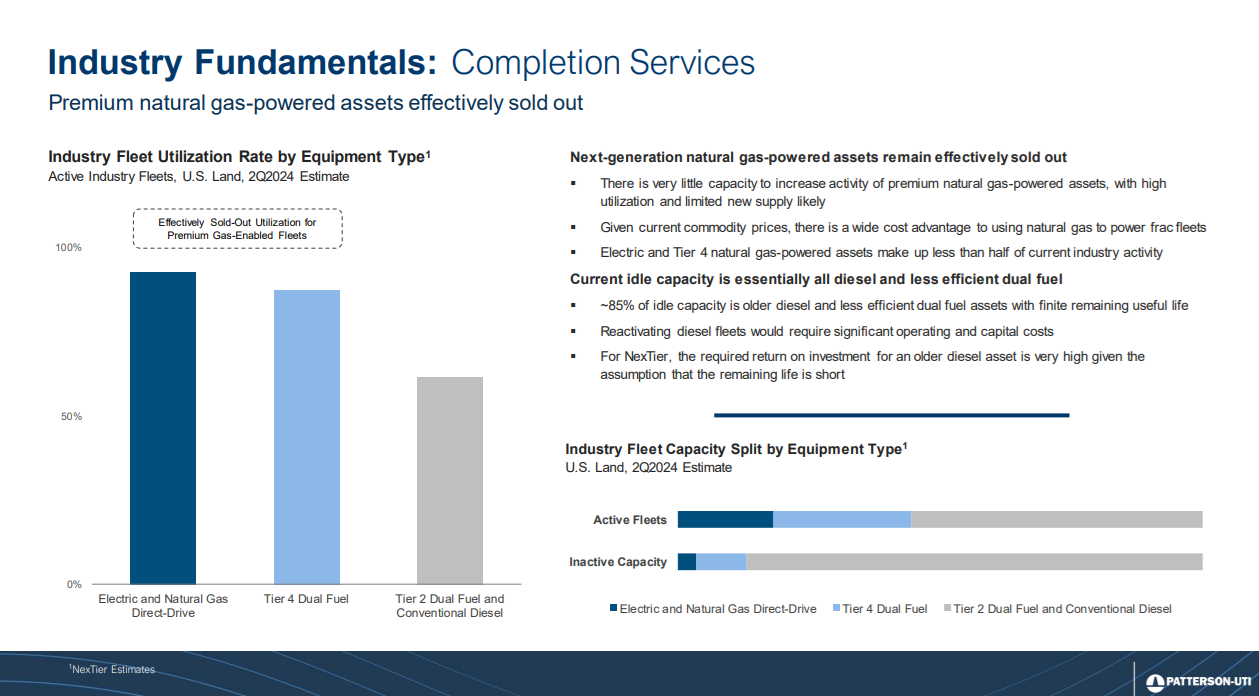

Given the wave of recent E&P consolidations, I find it hard to get a full read thru as to how much activity is required to support the status quo. It’s also noteworthy that there has been serious consolidations on the OFS side as well, particularly amongst the US frackers which is leading to a tighter market then most realize. Some of these companies have been quick to retire old equipment, in a process known as attrition, which is basically deleting excess horsepower leading to a tighter supply situation.

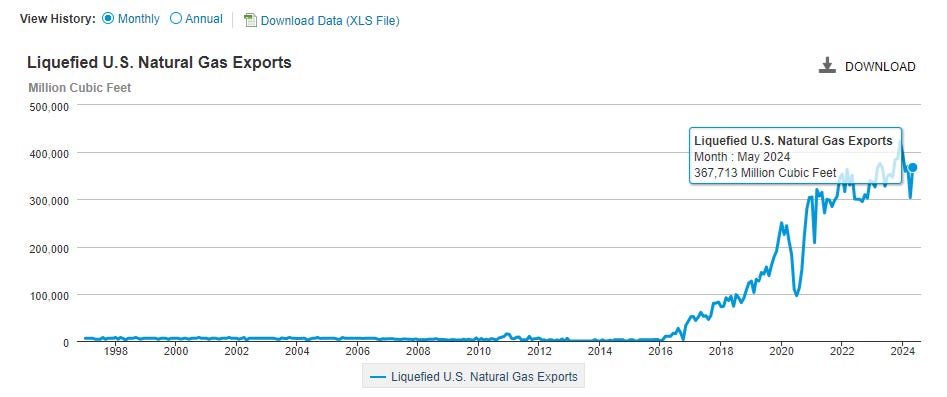

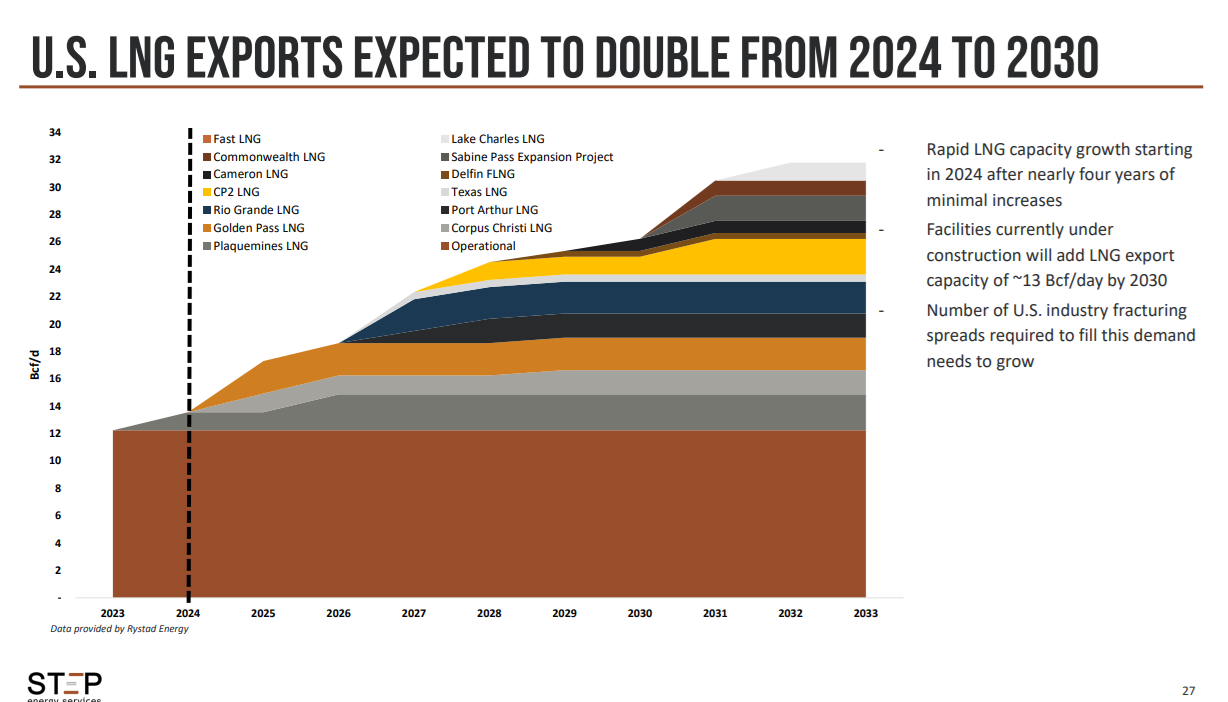

However, one thing is certain: listening to the oilfield service conference calls, the consensus is that the status quo if unlikely sufficient to maintain current production numbers on the natural gas side while at best, sufficient to support current liquids activity on the oilier side. In a nutshell, the fracturing count is likely at a cycle low, both in numbers and also margins and will have to increase in the coming year to meet domestic baseload requirements and any further buildout of US LNG. Completion services are going to have major torque to rising US natural gas demand requirements, likely leading to good pricing power margins upon recovery.

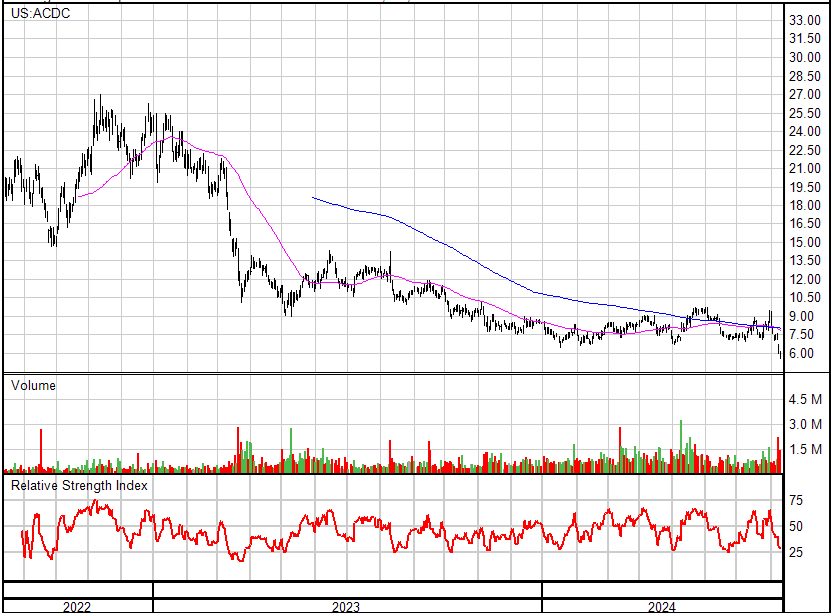

US-exposed fracturing companies are significantly off 52-week high:

- Profrac (NYSE: ACDC) -51%|

- Pattterson UTI (NYSE: PTEN) -45%

- Calfrac Well Service (TSX: CFW) -36%

- Halliburton (NYSE: HAL) -28%

- ProPetro (NYSE: PUMP) -23%

- STEP Energy Services (TSX: STEP) -15%

On Thursday the results of Profrac Holdings (NYSE: ACDC) caught my eye as I noticed the stock which has been on my watch list for the past couple years plummet by ~15% off an EBITDA miss. Overall on the week it was -23% off its highs and is now down ~77% off the current cycles highs. I found it surprising that the market was surprised the pricing was weak given the drop in US service activity.

Profrac came out public several years ago as an IPO. The name led to some excitement as the ‘legendary’ Wilks family was behind it, the American brothers who became billionaires from hydraulic fracturing. While much has changed since they entered the business given the transition towards nextgen equipment, the Wilks clan

know the fracturing industry better than anybody else in the US, possibly the world. Fortunately for the Wilks clan and Profrac, the company’s IPO came out during a period of hotness, given the Russian-Ukraine situation and tighter natural gas market while the D&C activity in the US was still recovering off Covid lows which led to the stock being overvalued at or near the current cycles highest point.

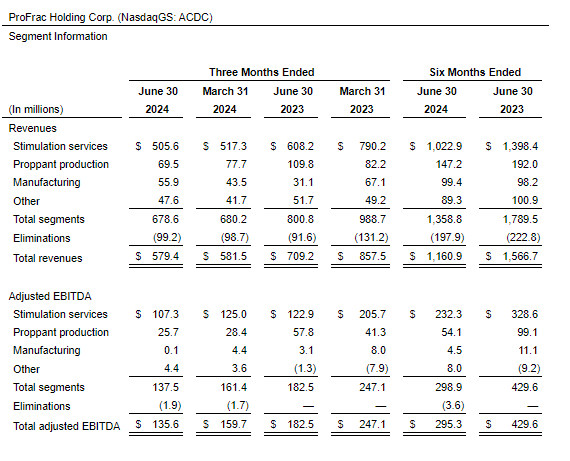

Profrac’s EBITDA on a continued down path along with US natural gas prices

Assuming Profrac is able to repeat comparable results in the 2H and as they were in the 1H, the stock is trading around ~3.5x EV/EBITDA near cycle lows for both service pricing and natural gas. That is a relatively low multiple for an industry leader with the most modern equipment and a multiple normally associated with a smaller cap producer that doesn’t have an industry leading presence. It also doesn’t assign any value to other lines of Profrac’s business such as manufacturing or sand mining. Typically North American natural gas activity rises with seasonal strength which may be approaching with US natural gas demand heating up during the winter months.

Given recent Golden Pass LNG delays, the current demand ramp in the near-term will have to be domestic related, whether on the power consumption side or if we get a decent winter with some cold heating demand. Into late 2025, it feels like a reasonable expectations to expect more US LNG natural gas activity. Further, rising US LNG exports may influence NYMEX pricing leading to strength in US domestic natural gas prices int he coming 12 to 18 months which would be supportive of fracturing as well as advancement into lower tier play which could be extra bullish for hydraulic fracturing given higher pumping requirements.|

Ultimately, Profrac is currently getting “mid teens” for each frac fleet with a target range of $20-25 million when market conditions improve. The impact could be ~$200-$400 million of extra EBITDA should service pricing normalize at some point only on the frac side, let alone the potential of other Profrac service lines which may begin to contribute at a higher level leading to margin enhancement. The opportunity to buy into a high quality US OFS company at cycle low margins with cycle low commodity prices ahead of an improving domestic natural gas market is compelling.

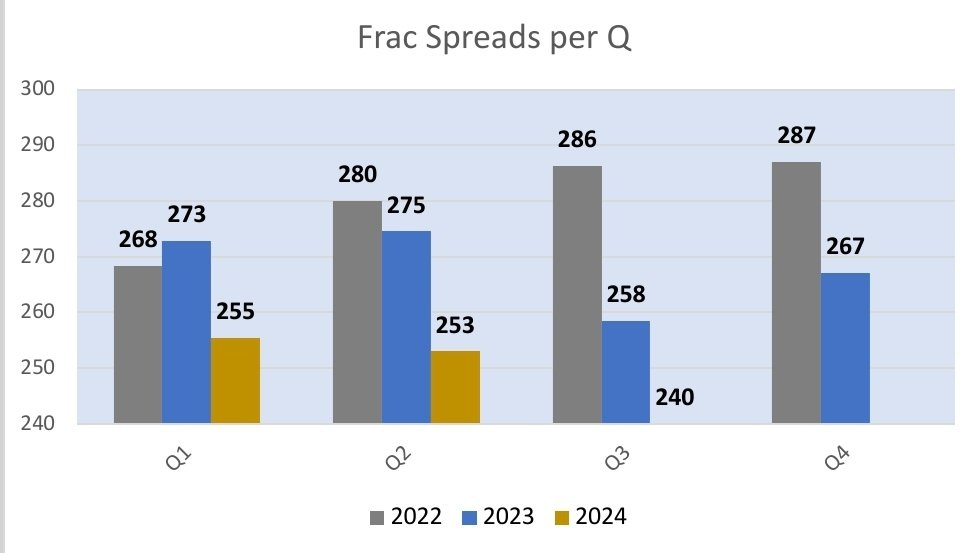

US fracturing spreads are hovering at cycle lows

US frac spreads are further expected to soften in 2H before ramping up in 1H 2025

With US fracturing at cyclical lows, it’s expected that the current numbers can only sustain shale oil production while being insufficient to maintain current natural gas production according to Chris Wright, CEO at Liberty per the Q2 conference call. On the STEP Energy Q2 conference call, Daniels Energy Partners’ John Daniels noted that he thought the US fracturing industry situation today was comparable to where it was coming out of Covid when numbers plummeted and demand ramped up given the high decline nature of the US shale industry. This led to record pricing power on the service side as natural gas prices ended up mooning while service fleets were hard to come by, both due to lack of skilled professionals and shelved equipment.

Competitive US frac equipment is mostly sold out, with more attrition to come

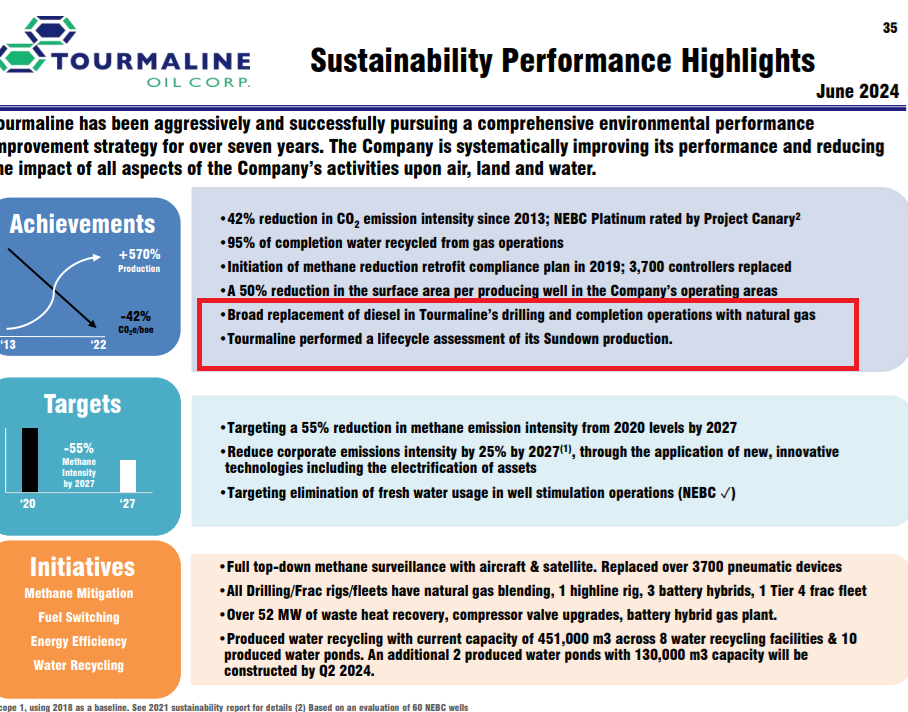

While D&C activities are really low in the United States, it’s important to note that the market is tighter then it appears given the transition to nextgen equipment which is known as Tier 4 duel fuel and e-frac. Most of the spare capacity on the market is Tier 2 Diesel which is not expected to make a meaningful resurgence given the cost savings involved in using Tier 4 Duel Fuel and e-Fracs, which are a much bigger thing in the United States then they are in Canada.

Tier 4 Duel Fuel allows for full methane capture and allows the E&P operator to use ‘pad gas’ from their own source as feedstock, rather then consume diesel which leads to a significant cost saving as well as a massive drop in emissions produced which gives operators ESG bragging rights which are in fact quite important to maintain optics in certain US dry gas regions. The cost savings to an E&P customer from an OFS provider by swinging to Tier 4 from Tier 2 diesel is around ~$10m/fleet on an annualized basis. With the majority of US production pads producing meaningful amounts of associated gas, it makes a lot of sense for E&P to want to use their own pad gas for both environmental and cost savings purposes. It’s safe to say that diesel will increasingly become niché, especially if fuel prices ramp up again.

This is comparable on the drilling side where super spec rigs for example are still commending stronger premiums while the lower spec rigs are becoming more obsolete. The utilization rig number may be higher then what is really viable in the market, given the shift over the past years into deeper plays with very long laterals which renders lower spec drilling rigs far less desirable and even obsolete in certain plays like the Permian Basin or the Canadian Montney. The current lower margin service pricing discourages new builds and is leading to only upgrades mostly of existing fleets, which is preventing incremental supply from coming onto the market. For incremental supply, it’s expected that both on the drilling and completion side, service rates are going to have to move significantly higher and on contract.

US LNG exports to see rapid growth, doubling by 2030 which will require more fracking

Natural gas is near all time lows in both Canada and the United States

Natural gas prices in both Canada and the United States are near all-time lows. The rise in production, the increase in efficiencies, the growth in North American liquids, unfavorable weather and LNG delays have likely all contributed to a miserable situation. Current hedging in place is supporting production in the US but that is expected to subside next year, putting US E&P’s to the brunt of feeling the pain. O

f course there has now been some curtailments, the most notable catch for me came from Canada when Arc Resources noted they were shutting in around 250,000 mcf/d of natural gas in the British Columbian Montney. Normally curtailments offer a good entry in commodities. Natural gas is a lot shorter cycle than something like uranium which took much longer to feel the impact when Cameco and Kazatoprom shutdown their mines given the high decline nature of shale wells.

Ultimately, given the cyclical low in natural gas which lines up with the cycle low numbers on the completion side, I feel very comfortable re-starting my position in American oilfield services. While there goes a saying never say it can’t get worse in natural gas, it’s really hard to imagine how it can, especially with the extreme low activity levels and now curtailed production into a ramp of LNG plus hopefully a modestly cold winter which will help bring inventories well within averages.

The risk-reward here is better then it has been since 2021 in my view.

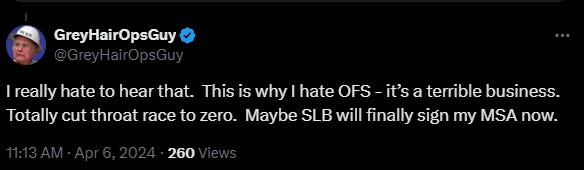

And perhaps most importantly, the OFS skeptics are in full force

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Good post. I like how you take a look at what consensus is.

Thanks Roger, looks like another good contrarian bet, on the heels of your gold and REIT calls.

In the bear case scenario, how much downside do you see in ACDC? How string is the balance sheet, and is there a plausible negative bad where it can get impaired?