As part of my investment work routine, I like to keep an eye on who is buying and who is selling in Canadian energy from an institutional angle. It’s useful to analyze the buying trends, especially given all the talk of “re-rate” potential as Transmountain Expansion comes online and LNG Canada grows closer by each passing day which should lead to further interest and confidence in Canada’s energy space.

Q1 didn’t really give me the warm and fuzzies that there were incremental buyers coming into the space. Some of the largest shareholders in certain names were active sellers and most of the activity looked like standard fund shuffling. The largest Canadian energy names such as CNRL, Suncor, Arc Resources, Tourmaline continue to see active inflows while midcaps continue to struggle to find institutional buyers.

The most interesting transactions I noticed was Hong Kong-based Assenagon Asset Management selling their entire Cenovus stake to swap it with more undervalued Suncor, which turned out to be a pretty good decision. Ninepoint caught my eye as large sellers of Tamarack Valley while totally cashing out overvalued Athabasca. Canoe’s big sale of Trican Well Service was interesting, it’s yet to be seen who the large buyers there there as it included several seven figure block trades.

Below you can find a select list of names to see who the largest buyers and sellers in Q1 were with institutional ownership breakdown. Enjoy!

Arc Resources (TSX: ARX)

Biggest Q1 buyer: RBC Asset Management (+1,003,000)

Bigger Q1 seller: Blackrock (-854,000)

Arc Resources has been one of North America’s most impressive stocks and surprisingly one of the least held institutionally. That has changed over the past year as larger buyers continuing moving in, in addition to the company’s strong normal course issuer bid, has helped propel it’s dominating performance. In Q1, there wasn’t much activity but the top holder RBC Global Asset Management continued to build their position with an addition of 1.03 million shares. Relative to other names, I’d be inclined to think Arc Resources could continue to see institutional ownership build.

Athabasca Oil Corp (TSX: ATH)

Biggest Q1 buyer: JP Morgan Chase (+2,870,000)

Biggest Q1 seller: Ninepoint Partners (-31,000,000)

Athabasca Oil Corp has been the marvel of Canadian retail energy investors since the Covid crash. If you got in mid 2020, you hit the jackpot; if you got in even in the past year, you still did pretty good. Overall, that surprised me greatly to see the continued outperformance but I suspect the party is over here. Ninepoint bailed and sold every one of their last shares and the CEO was a top seller as he cashed out bigly. The stock suffers from lack of institutional interest and remains amongst the least held despite its heightened outperformance. The company sports a buyback using proceeds from recent asset sales which is mitigating the volatility for now. At some point, we think the party will end here and the stock will re-rate downwards.

Baytex Energy (TSX: BTE, NYSE: BTE)

Biggest Q1 buyer: Atlantic Investors (+943,510)

Biggest Q1 seller: CI Global Asset Management (-2,180,000)

Baytex Energy has seen a bit of an uptick in institutional buying, probably related to the recent NYSE re-listing which forced some index funds to purchase it. Overall the ownership structure is one of the least impressive in Canadian energy, with the top shareholder being Juniper continuously unloading its position with #2 holder being Eric Nuttall’s Ninepoint Energy Fund. Absent of those two holders there isn’t anything really respectable for passive inflows. Baytex’s unimpressive normal course issuer bid seems to be unable to move the needle as the stock remains under pressure and amongst the poorest performers in the TSX energy group.

Canadian Natural Resources (TSX: CNQ, NYSE: CNQ)

Biggest Q1 buyer: Principal Global Investors (+409,930)

Biggest Q1 seller: UBS Asset Management (-625,270)

At 79% institutional ownership, Canadian Natural Resources ranks amongst the most desirable for passive fund ownership in North American energy. In Q1 there was little to change my view that will change anytime soon as the stock saw numerous large buyers and numerous large sellers, most of which appeared to be standard fund shuffling. Oh, and former anti-oil stock Baskin Wealth added another 13,800 bringing up their total to 478,080 according to the latest 13F filing. UBS was caught selling down other Canadian oil positions too so probably nothing personal against Murray.

Cenovus Energy (TSX: CVE, NYSE: CVE)

Biggest Q1 buyer: T. Rowe Price (+1,472,000)

Biggest Q1 seller: Assenagon Asset Management (-3,270,000)

Cenovus Energy has become an incredibly illiquid stock with 87% held between institutions and the top insiders. In Q1, Cenovus ranks amongst the top for institutional interest and saw some big buys and sells. Luxembourg-based Assengnon Asset Management sold their entire position of 3.27 million shares while U.S.-based T.Rowe Price made a couple large buys for a total of 1.472 million shares in Q1.

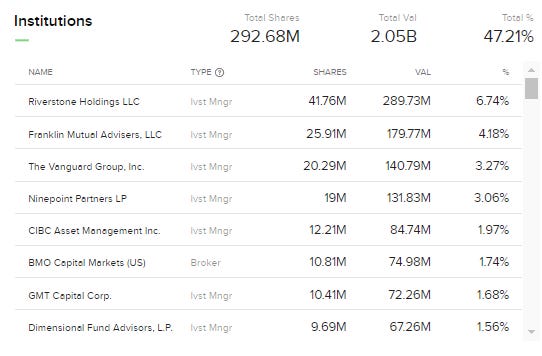

Crescent Point Energy (TSX: CPG, NYSE: CPG)

Biggest Q1 buyer: Atlantis Investors (+896,000)

Biggest Q1 seller: BNP Paradis (-469,000)

Crescent Point’s institutional ownership growth is surprising to me considering its brutal history of shareholder capital decimation. At 47.2%, it ranks pretty good and definitely above the average for Canadian energy midcaps. I saw some speculation that Riverstone had sold some shares in Q1 thru an internal offering but my records do not officially reflect that move yet, so I provided the data that I have certainty too showing Atlantis Investors as the top buyer and French bank BNP Paradis as the top seller. It appears that Atlantis has been adding a handful of Canadian energy names.

Imperial Oil (TSX: IMO, NYSE: IMO)

Biggest Q1 buyer: AustralianSuper

Biggest Q1 seller: Blackrock

At 69% ownership from the parent Exxon, there are very few shares available in Imperial for trading on any given day so if you are a big player, you take what you can get because you can’t get much without bidding up the price despite it being a massive multi-billion dollar company. In Q1, the largest buyer was an Australian-based outfit named AustralianSuper; the largest seller was Blackrock. The rest of the buys and sells were mostly small and scattered, insignificant to talk about frankly.

Peyto Exploration (TSX: PEY)

Biggest Q1 buyer: Ninepoint Partners LP (+961,300)

Biggest Q1 seller: Blackrock (-549,000)

Peyto has been one of the most impressive natural gas stories in North America this year, vastly outperforming the natural gas prices while sporting a double digit yield along the way as rivals were forced to cut. The stock saw net fund selling in Q1 but notably Ninepoint Partners LP increasing their stake by nearly a million shares. It seems that Eric Nuttall’s fund has been very active buying Canadian gas names.

Suncor Energy (TSX: SU, NYSE: SU)

Biggest Q1 buyer: Assenagnon Asset Management (+3,780,000)

Biggest Q1 seller: BNY Mellon Asset Management (-294,000)

Suncor has been huge improvements in luring new institutional owners into the stock over the past year as reflected in recent outperformance. In Q1 the largest buyer was Assenagnon Asset Management, who totally sold out of Canadian Natural Resources to add to the more undervalued and cheaper Suncor.

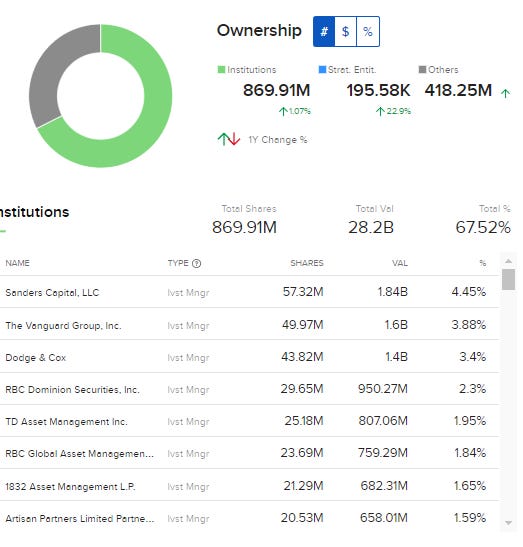

Tourmaline Oil (TSX: TOU)

Biggest Q1 buyer: Vanguard Group (+1,230,000)

Biggest Q1 seller: Fidelity Management (-1,200,000)

Tourmaline Oil has ever increasing institutional interest with California-based Capital World & Capital Research together amassing a 24% interest. In Q1 activity was relatively muted for the company with Ninepoint Energy also buying into the story. The largest buyer was Vanguard and the largest seller was Fidelity. Nothing overly interesting going on and the stock has sagged and underperformed with poor natural gas prices, something that seems unlikely to change in the months ahead.

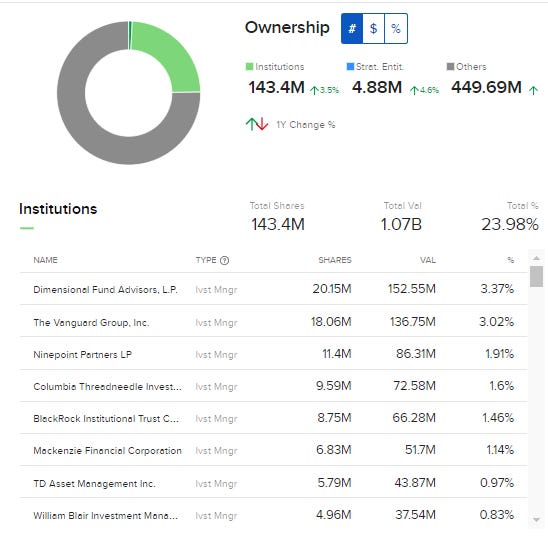

Tamarack Valley (TSX: TVE)

Biggest Q1 buyer: Dimensional Funds (+1,220,000)

Biggest Q1 seller: Ninepoint Partners LP (-11,000,000)

Tamarack Valley held up pretty well considering top touter and largest stock holder Eric Nuttall’s Ninepoint Energy Fund unloaded 11,000,000 shares. The company was very active during this period with their normal course issuer bid and insiders made a few purchases too. Like elsewhere, Atlantis Investors ranked amongst the top buyers but were outdone by Dimensional Funds

Topaz Energy (TSX: TPZ)

Biggest Q1 buyer: Nuveen LLP (+590,000)

Biggest Q1 seller: Franklin Templeton Advisors (-132,000)

Topaz is a new name and a royalty company just starting out which is linked to Tourmaline so expect it to continue to see growing interest. There was very little for fund selling in Q1 and much more activity for small amounts of fund buying, with the largest buyer being Nuveen which added 590,000 shares. Royalty names rank high on the ‘ESG’ scale with others like Prairiesky & Freehold all side by side so expect to see funds who are not kean on oil take interest in the space for exposure. Topaz has a lot of running room to build institutional interest and I expect it to grow.

Trican Well Services (TSX: TCW)

Biggest Q1 buyer: Atlantis Investors (+202,000)

Biggest Q1 seller: Canoe Financial LP (-5,330,000)

Trican Well Service saw some pretty big block trades in Q1 so I suspect there were other buys than the ones we know about on record as the volumes don’t match the filings. Officially the largest seller was Canoe, which held Trican in its energy funds while the largest buyer on record was Hong Kong-based Atlantis Investors, who added large stakes in numerous Canadian energy names during the first quarter.

Whitecap Resources (TSX: WCP)

Biggest Q1 buyer: Vanguard Group (+8,920,000)

Biggest Q1 seller: Blackrock (-685,000)

Whitecap Resources continues to lag Crescent Point not just in performance but fund buying interest. The stock saw a huge buyer in Vanguard in Q1 while most the other activity looks like fund shuffling and is rather insignificant. The main insiders continue to buy as they always do, mostly to an indifferent street which isn’t giving it much love despite the company flashing one of the higher dividends in the space.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Curious to know if you have any additional thoughts on why TVE has held in so well given the significant sales by Nine Point. I have been a buyer down here looking for a bounce back towards $4.

Thank you good stuff. I bought my arx in 2020. Never sold a share, holding tight.