Hi everybody,

Tonight I decided to write about Morguard REIT, a name that has intrigued me for the past year or so but one that I finally built a position in. Morguard is a name that is not well-liked and not well known and even less understood, including with most REIT investors in Canada. The two parties who know it best have been buying hands over fist for the past year and have recently ramped up purchases which seem to have set a higher floor price. Those two parties are amongst the best known names in the Canadian commercial real estate space: Rai Sahi & George Armoyan.

HEAVY INSIDER OWNERSHIP FAVORS PRIVITIZATION

Between Sahi as an individual, Sahi as CEO of Morguard Corporation - which is a different entity and acts as a holding company, a similar relationship to what Dream Unlimited has Dream Office, Impact, Residential, and which holds stakes in other Morguard REITs (MRG, MRT), the collective ownership between Kuldeep Rai Sahi and G2S2’s George Armoyan is around 83%. If you factor in the 2026 debentures which are convertible from $7.80, Rai Sahi owns 40% of those while G2S2’s George Armoyan has disposed of his stake in recent months which he has been swapping out with an increased stake in the equity, perhaps in a rush to buy the remaining units at a slightly higher price then Rai Sahi’s bid with Morguard Corporation which seems to be static. It may also be an effort from George to expedite the privation process as he is now less then 1 million units away from controlling ‘the majority of minority’ of units. Both men have carved out immensely successful real estate careers as value investors and I believe it would be wise to follow their moves in Morguard.

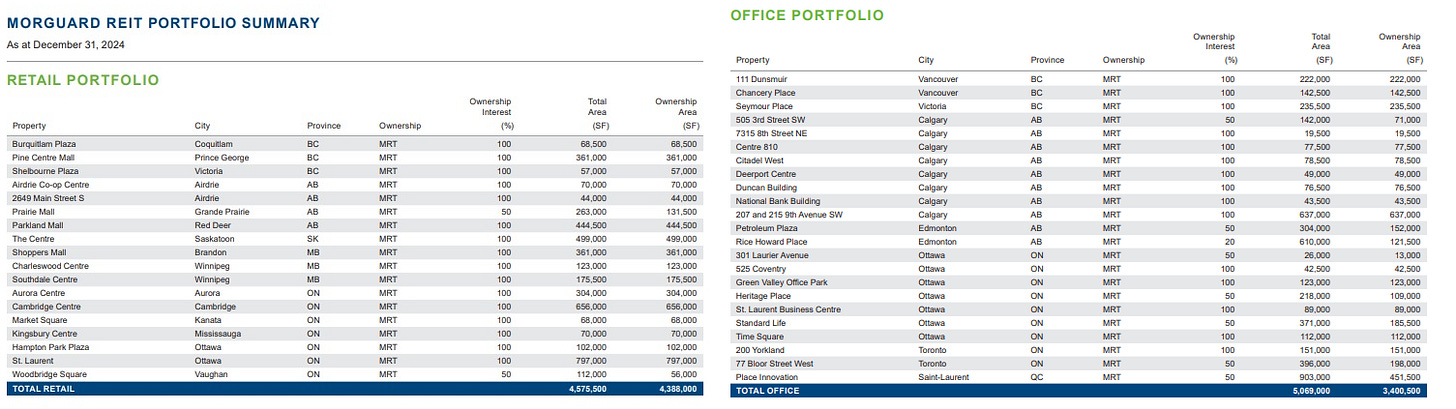

THE PORTFOLIO

Morguard’s portfolio is a mix of mainly retail and office assets, with a small portion of Toronto based industrial assets. Morguard also has a couple important rezoning opportunities, the most important of which is Burquitlam Plaza in Coquitlam British Columbia, an asset that could feature 2,200 new residential condominiums over an aging retail complex built in the 1970s. The project has immense value to Morguard if they are able to get it past the finish line. Morguard are also owners of the St. Laurent Shopping Center in Ottawa, a 797,000 square foot complex which Morguard is considering even expanding. It has significant redevelopment potential and is connected as a major hub to Ottawa’s light rail transit system. Canadian retail assets are exceptionally strong right now and most assets are liquid. Recent asset sales from peer REITs show that the ability to sell assets at or above IFRS valuations is well-supported, including “Tire 2” strip mall-like assets. Simply put, there is little for construction in the retail space and most Canadian cities have seen significant population growth. Sales per square foot at most retail assets has been on the rise and there is a sudden interest in the asset class that has not been seen in years. Office is more of a case-by-case opportunity. In the case of Morguard, they have some offices in British Columbia which likely could fetch ~$400 per square foot while some in Alberta may be challenged to fetch much bid at all. For my own thesis on Morguard, I nearly $0 their Alberta office exposure and still get a very compelling investment case.

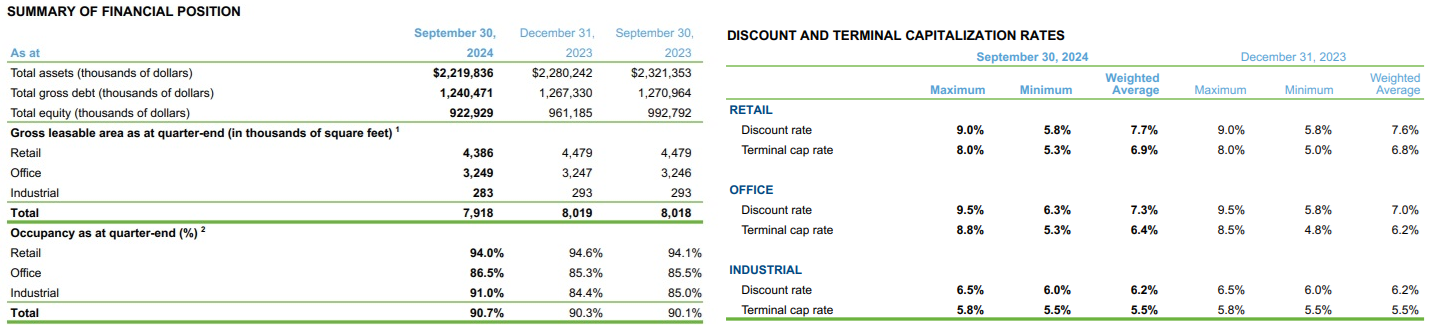

THE VALUATION

For the record, NCP are not “NAV” investors but if we were, Morguard REIT would be on the top of our list as to which REIT to buy as it trades at around ~40% of IFRS NAV based on the latest information. I am comfortable using Morguard’s capitalization rate and I believe the industrial and retail values are well supported. Office as noted above, is a case-by-case study and each asset has different degrees of marketability and some may struggle to be marketed at all. In the case of Morguard, I believe that most of their office properties with the exception of a few in Alberta have marketing potential should Morguard ever wish to sell them. There is no indication that is the path they are planning to travel however. In my view it is important to always consider transaction liquidity for a REIT rather then blindly claim a NAV discount. A NAV discount does not mean much if the discount gap cannot be closed, be it by inability to sell assets or managements decision to not sell any.

Morguard is trading at around ~$209 per square foot and nearly a 10% implied cap rate. In most of Morguard’s markets for retail, a ~$300-400 per square foot sale assumption if very likely, in some cases more, perhaps in a couple cases slightly less. It’s impossible to make a firm assumption because there are so few examples in some of Morguard’s markets of sales and of even more so, no comparable assets such as closed malls. In the past year there has however been a number of closed dome malls in Canada which have been sold in both primary and secondary markets. Morguard’s most prized retail asset is likely the St. Laurent shopping center in Ottawa, a 797,000 square foot facility. Using recent sales trends for Canadian malls, it is likely that this asset alone is worth at least $325-350 million using lower end assumptions. The unknown hidden value attributes of an asset like this are plentiful, as Morguard also is purposing an expansion of the property on both the retail and office side as well as contemplating residential developments. It is likely that Morguard can create significant value off existing retail asset bases overtime which does not currently generate net income at all, an opportunity overlooked by most analysts and investors.

Suffice to say, there are plenty of strong recent examples in Canada that demonstrate the value of retail assets, including indoor shopping malls which are seeing a major comeback. If we take Morguard’s 4.3 million square feet of retail and consider it at a value of ~$350 per square foot, the sum comes out to ~$1.5 billion which is enough to cover all of Morguard’s current liabilities and also the market cap. This would leave investors with the entire office portfolio and the remaining industrial assets. Office is a more challenged asset class but Morguard has various good properties which could still fetch decent prices. But for the sake of simplicity and to leave myself with a wide margin of error, I am comfortable with making an assumption of ‘distressed’ valuations in which I hypothetically assume Morguard could sell their entire office portfolio. In this case I use a ~$100 square foot price assumption on Morguard’s 3.4 million square feet which brings me up to $340,000,000. Lastly we have 283,000 square feet of Toronto industrial to consider. Latest CBRE trends show an average asking price of $340 per square foot but for the sake of simplicity, I will assume a ~$250 selling price and end up with $70,750,000 million. In total, under my assumptions that are attainable in today’s market an investor could receive $1.91 billion dollars from asset proceeds should Morguard wish to engage in a sales process in today’s less then stellar real estate environment. An amount which is below the $2.12 billion that Morguard claims internally and leaves an investor with a wide margin of error.

THE CATALYST

Morguard’s units have traded in nearly a straight line for the past several years. Since the Covid crash, the REIT has cut the distribution twice and the current 4.25% yield is not very compelling relative to peers. Morguard has instead reallocated a lot of capital into upgraded their retail properties which has began to pay off as they have been able to bolster occupancy and also increase rent. Kuldeep Rai Sahi is a value creator and a self-made billionaire, an immigrant from India who came to Montreal at a young age and built his own fortune. Although much of the success has been his own rather then those retail investors who chose to invest in his publicly traded entities such as Morguard Corporation or Morguard REIT, I believe the time is coming where retail investors can benefit off riding with Mr. Sahi who is approaching 80-years old and appears close to handing over the keys to his daughter Angela, recently appointed as President and Chief Operating Officer, who may take a different strategy to what Rai Sahi pursued over the many years, be it from increasing public participation and raising interest in Morguard entities or selling it all entirely.

Neither Morguard Corporation or Morguard REIT seem to have much appeal as a publicly traded entity and I am of the view that Morguard REIT is nearing a privatization opportunity as less then ~10% of all units outstanding remain available for public trading. Liquidity is thin and the asset class is out of favor, which makes it difficult if not nearly impossible for Morguard to use the REIT to raise capital thru public issuances given the significant discount the units are trading at to intrinsic value. Morguard’s best option seems to wrap up the remaining amount of units of the REIT into Morguard Corporation, an event that I believe is coming. However while this is perhaps the most exciting outcome for a retail investor taking a position in the REIT, it is not the only outcome that may provide value. With George Armoyan now involved in the story, it is possible that Mr. Armoyan can push Morguard into selling assets and returning capital to investors thru special distributions. An outcome that seems less likely then privatization but certainly possible.

Morguard has some property specific catalysts, the most notable in 2025 would be the Burquitlam Plaza (link) in Coquitlam British Columbia, one of the fastest growing neighborhoods in the Vancouver region which would bring 2200 new residential condominiums to the site and may be worth over $100 million to the REIT if the final approval can be obtained. Morguard currently has a significant project tabled off an existing retail asset base which is decades old. The project has strong support from the municipality but is currently slowed down by a new Transit Oriented Development (Bill 47) which has added new layers of bureaucracy to the Master Planned Community. According to Morguard’s Geoff Nagle, the target for the first reading is Spring 2025 but there is no guarantee but the timing is still subject to discussion with various officials. Aside from the potential for news on the Burquitlam Plaza, I believe that any day Morguard could dispose of various retail or office properties which could be meaningful to an investor at the current distraught valuation where almost any sale would likely lead to unitholder value creation. A sale of one of Morguard’s various malls could lead to significant unit price upside, particularly if special distributions were paid out with some of the profits.

Asset sale potential off a very low implied valuation would be the most exciting catalyst to me if I believed Morguard’s Sahi was going to do everything he could to close the NAV gap, perhaps in a way that Samir Manji at Artis is attempting, but since I don’t, the next best thing for a Morguard investor would be privatization. As some may remember, Morguard’s Sahi and G2S2’s Armoyan made a deal in 2019 to take Temple Hotels private after Morguard made a deal with Armoyan to buy out his stake in Temple Hotels. The premium was relatively modest at 18% but the fundamentals at the time of Temple Hotels was not on par with Morguard REIT which is in a much better financial position with more desirable assets. I don’t believe George Armoyan would accept such a small premium nor would it be ethical to the remainder of the minority unitholders to attempt one. I believe the upside thru privatization of Morguard REIT from the current valuation is likely closer to 50% which would still represent a bargain for Rai Sahi who has been buying shares under Morguard Corporation aggressively at a significant discount. The impact to Sahi is smaller then it was at Temple Hotels given the small amount of public float outstanding. The risk that George Armoyan would accept a smaller premium then he would otherwise is that he is also a large shareholder in Morguard Corporation, which I presume would be the likely acquisition vehicle to Morguard REIT. If Morguard Corporation can purchase the remainder of the units on the cheap from Morguard REIT, they could ultimately sell them over time or use them to create better value at Morguard Corporation where Armoyan would have his bases covered and profit indirectly from a smaller then could-have-been takeover offer. While these are all hypothetical assumptions, the bottom line is that investors purchasing units today likely come out significantly ahead given wide margin of error - the biggest question is when.

Conclusion

Morguard REIT units are cheap and are trading at one of the largest discount gaps in the space using a wide margin of error based on recent examples of dispositions in the Canadian real estate space. Morguard REIT has been dead money for years but Sahi is a patient value creator, as is George Armoyan who has taken a significant stake. Between the two men, the remainder of the public float is increasingly slim as both men sense a significant opportunity in the REIT at the current trading price. The apathy for the space and this name continue to slide under the radar, which has in my view allowed for meaningful opportunity here that may otherwise have captivated investors in a more ‘en vogue’ time. The risk-reward in this name is exceptional and I believe the financial position is strong. The biggest risk I see is that NCP’s views on privation are wrong and Mr. Sahi does not take George Armoyan’s “nudge” to close the massive NAV gap, often does thru dispositions of assets to private market buyers which allows for a public issuer trading at a significant discount to public market valuations to use the proceeds to buyback units or pay special distributions. In this case, Morguard REIT could be dead money for another year or longer, just as it has been for the past 5-years. Sahi is a billionaire and may not need the money. The REIT trades like a private company with thin liquidity much like Morguard Corporation. But at some point pay day will come, I am going to bet that day is going to happen this year as Sahi nears retirement, Armoyan takes a significant stake and the public float has shrunk to a point where it no longer makes sense to remain public. Interest rates are falling and transaction liquidity for commercial real estate has improved. Morguard has a major residential development project in Coquitlam which could see a break thru in 2025 and offer investors significant upside. Overall I like my odds and have taken a meaningful stake over the past month in Morguard REIT.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Thanks for the article and share, very good as usual. Loved this quote:

"A NAV discount does not mean much if the discount gap cannot be closed, be it by inability to sell assets or managements decision to not sell any."

So true.

So the safe bet as a minority shareholder is to buy both the REIT and Morguard Corp, would you agree?

If not, then I am not really sure the incentives are in place to close the NAV gap any time soon.