Red alert: the signs were there!

Rarely do we see such a bright right red flag as we did today in energy fintwit

Friends,

It’s been a pretty good month for oil as well as other commodity stocks including precious metals. While we think the precious metals rally likely has a lot more room to run as producers correct to the commodity price and see multiple reversions, we think the mighty oil rally is likely coming to an end as OPEC nears the unwinding of their cuts, higher oil prices start impairing product cracks and large buyers like China and India start pushing their weight which may include curtailing purchases. It won’t take much from peak euphoria to send E&P stocks back into corrective territory. On the natural gas side, we continue to be amazed at how well the companies have performed despite little to no improvement in the commodity price and only hopes and prayers that current curtailments in the U.S. will have a larger impact later.

Today I have to admit that I have not seen so many ‘red flags’ in a single day for energy investing on X in quite some time, perhaps not since 2022. While I won’t share all of them, I wanted to highlight a few notable posts that caught my eye and also include some technical reasoning as to why I think certain oil stocks, particularly the high beta flyers and even Canadian Natural Resources has become a hard sell. While we think there is still upside in a number of names and would be comfortable holding them despite outperformance, particularly those that are likely to see equity appreciation as debt goes down such as our top 2024 pick, Strathcona Resources, we think the high beta flyers that trade with sentiment and better known oilsands names favored by generalists such as CNRL and Suncor are likely at a near term peak.

Global macro conditions continue to show signs of weakness as the world prepares for what is expected to be an interest rate cut cycle. Gold hitting $2300 sure does seem like a red flag to me for a number of reasons which I will discuss in another blog. Interest rates are taking a toll with one of the highest weeks of bankruptcies on record in the U.S while much of Asian PMI’s continue to be in contraction. China’s better than expected PMI reading seemed to charge the inflation crowd this week but overall the country still appears weak and does not benefit from higher oil prices. With a 1 billion barrel SPR in China and ample refining spare capacity they can make their presence felt and rattle global oil markets quickly in either direction. Meanwhile better than expected inflation data in European Union and Canada is leading to June rate cut hopes while Jerome Powell today reaffirmed the Fed’s interest rate outlook hasn’t changed despite a couple ‘hotter’ than expected macro readings.

On the flip side, it does feel that the energy complex (crude oil, natural gas, uranium) may be undergoing a paradigm shift. As the green energy narrative continues to implode, it seems there is a growing consensus globally, particularly amongst some western countries that pushed for green energy transitions, that there is no reprieve to the inflationary cycle without investment in fossil fuels. While not all are willing to embrace this, we are seeing major political shifting of those who refuse to buck and incoming governments are willing to invest in fossil fuels or find solutions to the current cost of living crisis. With valuations in energy, we think it’s important to note that one size does not fit all and multiple expectations should not be applied uniformly. “FCF yield” must be analyzed on a case-case basis while the quality of management can make a profound impact. Multiples matter and it’s very hard to find a '“never-sell” stock in the commodity space unless it involves an M&A exit.

Red flags that caught my eye today

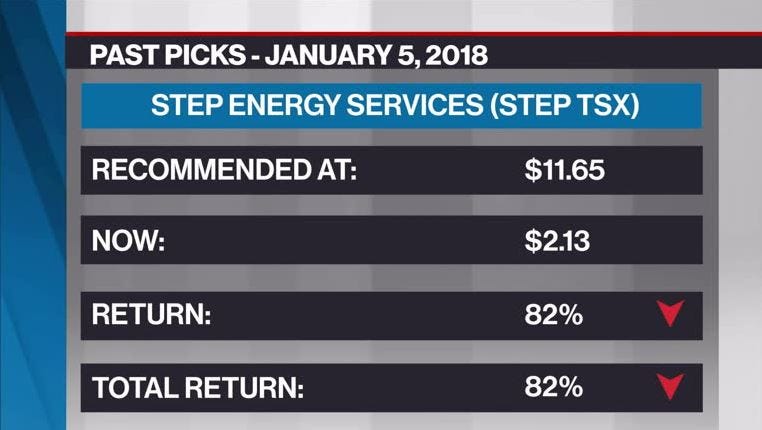

Baskin Wealth Management goes bull on Canadian OFS

We admire the views of Baskin often and enjoy the team’s posts, but we have to call a spade a spade without being a bully: their announcement on X today that Canadian oilfield services is attractive, while true, is likely going to be incredibly bearish. Need I recall that only several years ago, Baskin’s then CEO, David Baskin noted on Marketcall to “kiss it goodbye” when asked about Trican Well Services. He then went onto elaborate that his views extended to the Canadian oilpatch. While we agree the sector has significantly improved since then, most of the big gains were made including on Trican that since went from $1 to as high as $5.

See link: Kiss it good-bye [Trican] by David Baskin (source: BNN Bloomberg)

Burnsco “can’t wait” for his Baytex bonus from the company

Burnsco is one of the most popular #COM accounts and one I would consider is a leader. He’s been bullish on Baytex since at least 2019 according to X records and without a doubt, if he got in where he claims to have, he likely did okay on Baytex and made some big bucks over that period for duking it out. But his post today caught our eye as he implies that he’s waiting on a “bonus” from Baytex after boasting he received a substantial amount of corporate swag from the company, which I presume is for being a fantastic cheerleader thru its ups and downs on his X accounts. Sending swag to everyday investors is hallmark of an equity top. It reminds us a lot of AMC Entertainment’s CEO who was handing out coins a couple years ago. We need to remind Mr. Burnsco that Baytex is down substantially from 2022 peak and unless one sold, your life has been full of more downs than ups since. Another company that caught my eye sending swag is none other than Paul Coulbourne’s Surge Energy, another company this account is groovy on and one I’d feel comfortable comparing Baytex to in terms of bad corporate behavior over the past decade.

See link: Burnsco got the swag (source: X)

Eric Nuttall moves into OFS, admits his job is harder now

Eric Nuttall was on BNN Bloomberg’s Marketcall for the first time in a while this week and we enjoyed the episode a lot. It’s pretty clear that Mr. Nuttall has refined his bullishness and taken a more responsible stance as opposed to betting the farm on low quality crapola companies as he used to. We think it is probably because the opportunity Covid provided the sector and his fund, by making massive amounts of recovery/multi-baggers which resulted in a very high AUM around $2 billion now. Nuttall’s announcement that his job became “harder” when it comes to finding winners, even huddling up around elevated amounts of cash waiting to pounce on looming opportunities should not be seen lightly. It’s unusual for Nuttall to hide in cash so it’s pretty clear that he thinks better entry points are looming.

His other notable comments were on oilfield services in which he made Precision Drilling yet again a top pick. While we agree with Nuttall that the opportunity is in oil drilling for now, we still think that’s a sign of an equity top on the E&P side as Nuttall typically has used OFS as last in line in terms of an energy cycle to scalp alpha. We won’t be surprised to see Mr. Nuttall to gravitate towards more natural gas and Montney-focused oilfield service names in the coming months.

See link: Eric Nuttall’s Market Oulook, “job is tougher now.” (source: BNN Bloomberg)

Amrita Sen is back on Bloomberg live and is feeling bullish

For whatever reason, Energy Aspect’s Amrita Sen dominates the mainstream media’s airwaves when it comes to oil opinion. We find this awkward given the firm’s extremely poor track record at projecting oil price movements.

A bullish Amrita Sen is often the dagger in the back of the oil rally. We don’t’ think time is different although she seemed more composed with her bullishness, only projecting $90 oil when Brent was trading at a meager $88

See link: Amrita Sen is feeling bullish, predicts $90 oil (source: Bloomberg Live)

Often peak pessimist, peak optimist “Tradeoilstocks” says 2-3x baggers likely coming

We are big fans of TradeOilStocks and unquestionably think he’s a smart guy, but for whatever reason it’s pretty clear that he likes pain trades. Often TradeOilStocks well publicized posts tend to mark bottoms and tops. In this case, he’s hit the jackpot on Cenovus and Crescent Point but appears unwilling to cease profits and instead, opt for what appears to be a quest of multi-baggers. While we think this is possible, I find it extremely hard to imagine either of these stocks being doubles anytime soon. In fact, I think Crescent Point is probably a better short than long and discussed some of the reason’s with “WTI Bull” on Twitter Spaces yesterday (see link for recording). The time to buy oil stocks is when TradeOilStocks is not overtly bullish.

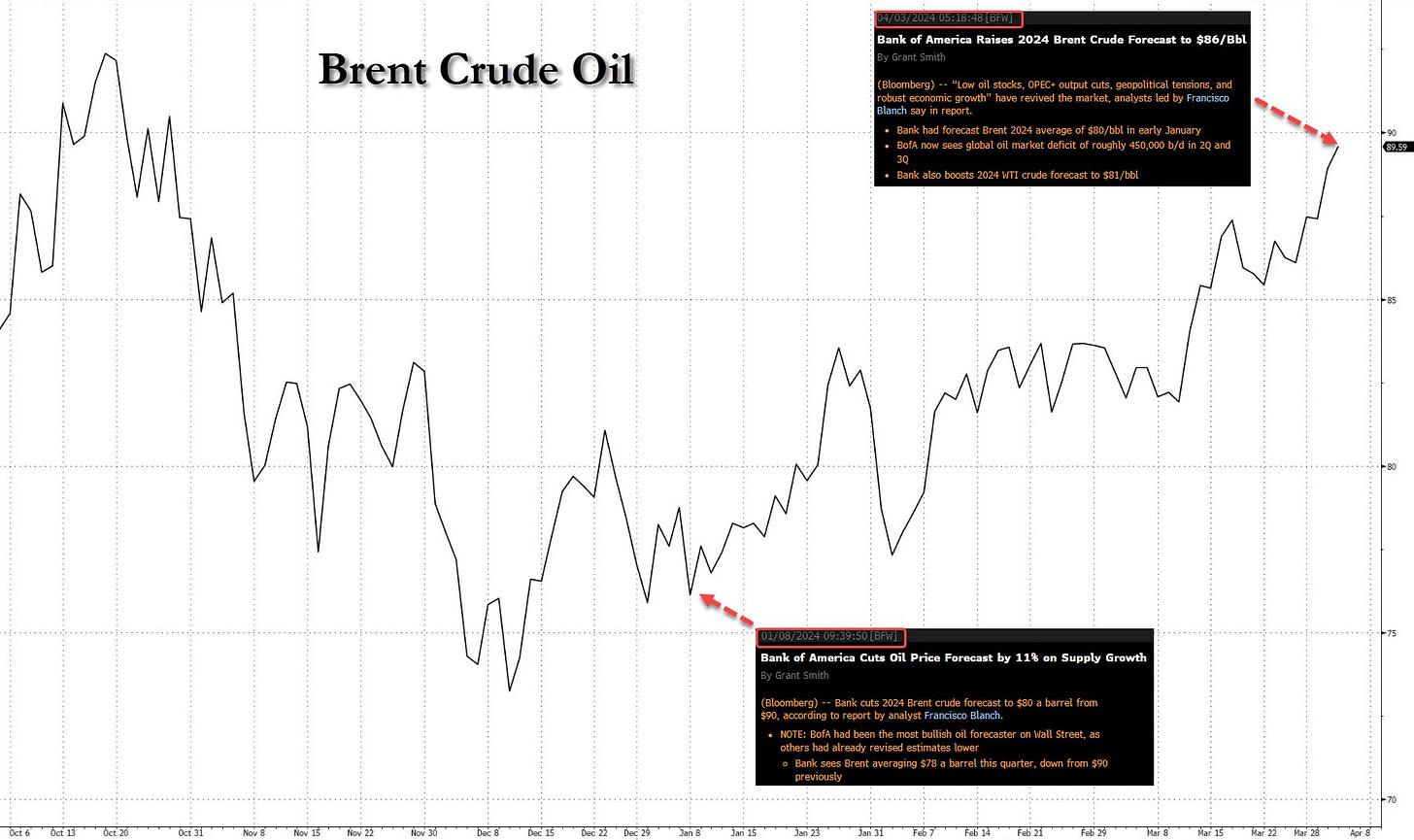

Bank of America upgrades oil price outlook, bulls rejoice when they should mourn

At Nugget Capital Partners, our firm believes that downgrades offer more opportunity than upgrades. Oil price outlook is no different as reflected in the above post which is getting oil permabulls excited. The fact that BoA upgraded oil prices in response to being wrong on last years’ outlook is not bullish but bearish. The move has been made and like any bad analyst trying to save their reputation they frantically move their target where the puck has gone rather than where the puck is went. Oil should be bought when hedge funds are bearish, analysts are mostly negative and sentiment is poor, which clearly has become the opposite of today after a big rally.

See link: Bank of America upgrades oil (source: ZeroHedge, Bank of America)

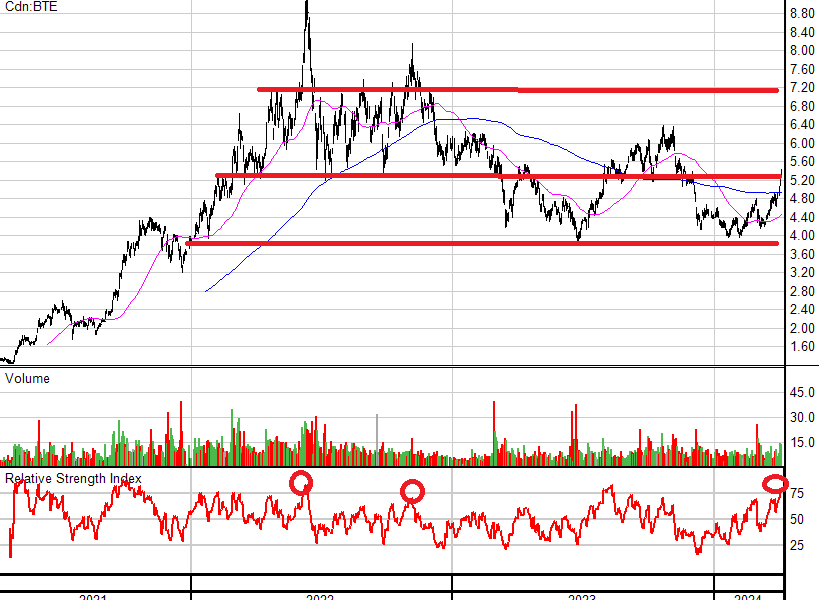

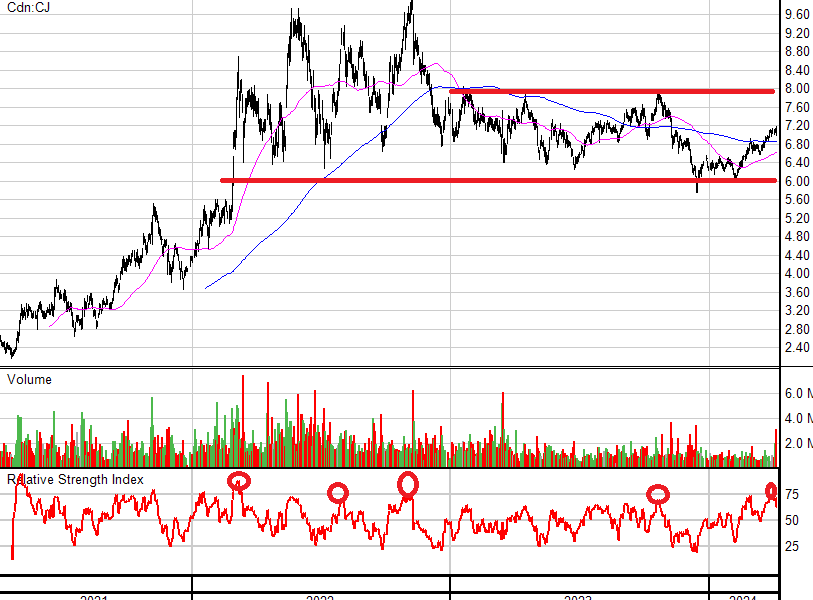

Technically in trouble: many Canadian E&P’s are flashing red alert in our view

While NCP are not solely technical traders, we do think that in modern trading and investing, technicals play an important role into the psychology of many investors, from retail to even institutional. Often we see stocks, especially in the commodity space, trade tightly within ranges while moving averages often tell an important story. In a world where algo trading is an important driver of price movement, we think it is unwise to ignore technicals on entry and exit points. Right now in oil, while we have seen a number of meaningful breakouts - notably on Canadian Natural Resources, the lower quality names appear to mostly be rangebound. Adhering to sharp sell-offs at resistance points while powerful buying opportunities at support points. The risk-reward on a technical basis is far better to buy on a support point as fundamentals shift and sentiment is negative than buy at a technical resistance points when sentiment is positive while fundamentals have been absorbed. While we can’t rule out more break-outs can occur, we’ll be very surprised if they do given the current state of controlled-oil markets with the current hype being driven by OPEC cuts rather than a structural undersupplied bull market which would have sustainable legs.

Crescent Point Energy (TSX: CPG, NYSE: CPG)

Baytex Energy (TSX: BTE, NYSE: BTE)

Surge Energy (TSX: SGY)

Cardinal Energy (TSX: CJ)

Precision Drilling (TSX: PD, NYSE: PDS)

Canadian Natural Resources (TSX: CNQ, NYSE: CNQ)

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Time will tell. I do enjoy your more contrarian cautious stance to bring me back to earth. It’s hard to sell at the top.

All of those range-bound charts make me feel smart for hiding out in $ENCC (Horizon's Cdn energy covered-call ETF). It's NAV has tracked the rise in WTI while fleecing a tidy 15% yield off the bulls while they restlessly jostle around, waiting for...well, whatever they're all still waiting for.