As we close out 2024, it’s always fun to look back at our predictions and views from the year prior. Energy is such a dynamic industry that even the best of the most experienced forecasters look off by the year end as the industry always seems to throw those who know it best curve balls. In fact sometimes I wonder if the people who have made the most money know the sector the least, only being in the right place at the right time while the bulls tend to be too early or stay too late.

As for us, our view was that $80 oil was the likely bottom in 2023 on the oil side with $4 being the floor proven too optimistic. Had you told me the strip natural gas price in Canada would collapse below $2/gj on a 12-month basis even months ago I would not have believed it. We thought a price of $80 on WTI would be more than reasonable given what we thought was reasonable shale discipline and also geological constraints, and those views were in play with believing that Iran would or was coming online. In the end, we are quite surprised in multiple ways at output levels.

General reflections for O&G in 2024

American Shale grabbed the bull by the horns, for now at least.

By far, the biggest surprise to us and also the most bearish has been the resiliency of American shale producers to up output with all-time new highs in oil production. While there may be some debate about how the EIA classifies crude or what is a crude or what might be a condensate, we at NCP are not in the business of accusing the government of doing barrel fraud and will instead accept the numbers.

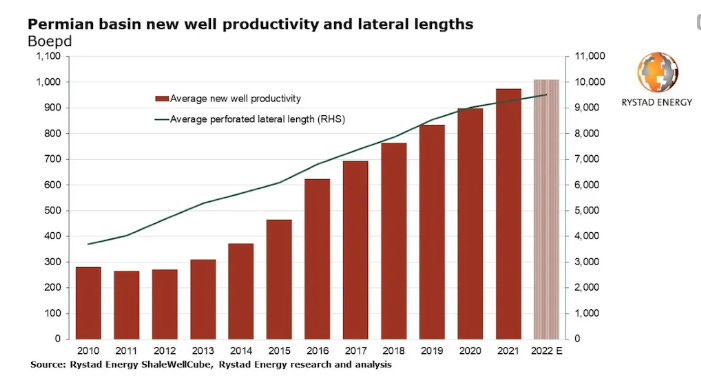

Longer laterals and better completion technology is causing higher output

Longer laterals (more meters drilled) and better completion technology is said to be the culprit in ever increasing shale output. As the shale industry is still new, efficiency gains are ever increasing with more knowledge as the shale patch grows. The pace of shale oil has been astonishing as well as a significant disruptor to global oil markets as the short cycle industry has acted heavily on higher prices and helped keep inflation at a much lower level than it likely would be otherwise. I might argue the growth of American shale output.

American shale oil is doing more with less rigs

Oil bulls overlook major gains in oilfield service industry as well, with more powerful drilling rigs, better downhole technology at the drillbit, advancements in hydraulic fracturing pumping and even gains on things like chemicals, engineering and geological knowledge, the end result has been significantly higher output in faster spud-production times than ever before. In the past year, recent M&A has helped spur ‘acreage synergies’ which is allowing US shale operators to apparently require even less rigs to maintain a certain level of production as travel times are reduced and laterals can cross from one acreage to the other. STEP Energy CEO noted on the Q3 conference call that the US shale rig count should not be considered a gauge for frac crew levels given the efficiency gains raised on the drilling side. Also to note, given low North American levels of oilfield service activity, we think it’s likely that E&P’s face another painful bout of OFS inflation should demand pick up as many OFS companies have had to stack equipment and even layoff workers.

US shale oil has also acted as a disruptor to natural gas markets

American shale oil continues to cause issue for global natural gas markets as a rapid rise in byproduct gas continues to weight heavily on Henry Hub pricing, for now at least. Better midstream buildout in the Permian basin has helped shale E&P’s capture more of this gas rather than having to flair it away. I would argue this is eerily also a problem in Canada’s Montney as a rise of associated gas from condensate rich liquids wells is helping keep AECO/Station 2 prices heavily suppressed.

Our view: US shale oil is particularly the story to watch in 2024

Given the global dependency on American shale oil and natural gas to keep prices subdued and respond to market signals, we think that any evidence of shale even topping out would be incredibly bullish. While shale bears have predicted the end of the industry almost since I knew it, the resiliency of shale keeps improving and defying its critics while leaving the bears in absolute ruin. If I might add the recent M&A towards larger companies with better capitalization structures may not be bullish as some think, as I do not believe these larger E&P’s are doing it with the intent of forming a mini-cartel. Companies like Exxon Mobil have been pioneers in the shale industry and continue to find ways to make gains. Earlier this year Exxon’s CEO Darren Woods indicated he thinks the company can develop technology to double output from existing shale wells, already drilled.

Crude quality? Ultimately, for us it feels a lot like 2017ish & that isn’t bullish

We hear a lot about “crude quality” and there used to be a big thing about it in the earlier shale days which seemed more like an issue at the time. NCP are not experts at downstream but we think US refineries have made configurations to process lighter shale oil in the Gulf Coast with Exxon even building a refinery to do so. The buildout in Asia’s petrochemical industry has helped end user demand and kept American shale exports high without any evidence to my knowledge of challenges. Most crude quality discussion seems to have dissipated for that reason. US shale differentials are rather tight and there is no evidence the physical market is hurting. In the past, US shale differentials really suffered as the output grew faster than accompanying midstream infrastructure, leading to controversial levels of flaring, inability to capture full margin of products and wider differentials, feeding the narrative that the issue was “crude quality” related rather than challenged infrastructure.

Then on top of actually building refineries to process lighter crude, you have the ability to blend down crude to get the desired crude slate. We think if this issue really came to surface American ingenuity would find a solution for it. U.S. refineries were built to process heavier grades because of the import markets - notably Canada to the Midwest (PADD II) & Venezuela/OPEC crude at the US Gulf Coast (PADD III). If the evidence changes, our views will as well, but we think this is something resolvable for the American oil and gas industry. It was only a couple years that Midwest refineries actually reduced processing of heavier sour crude from Canada as natural gas prices spiked, causing refinery margins to get crimped which put Bakken Clearbrook, a very light and sweeter crude at a significant premium while WCS blewout.

Buildout of international downstream could impact North America refining

Over the past year, North American refineries have enjoyed strong margins as distillate inventories were significantly low. In recent times, there has been growth in refinery additions in the Middle East such as the Al Zour refinery in Kuwait and also some add-ons in China and India. It should be worthwhile to note that all these countries have no issue processing Russian, Venezuelan or Iranian feedstock if given a chance. The end product will carry a different stamp, but sanctioned oil has already been able to access western markets by playing musical chairs on the downstream side. With much of the world’s spare capacity for refining in China, we think it’s important to watch China’s energy sector as they are now a major player in global crude markets for both demand also refining. They are also a buyer of the cheapest barrel and will disregard western sanctions where it benefits them. Also benefiting North American refineries over the past couple years has been issues in Europe with outages including due to striking workers, which led to a surge of demand. With these issues resolve, we think it’s important to watch how international downstream additions could threaten refinery runs in North American and reduce margins. Reduced margins could lead to reduced thruput which could lead to builds and ultimately impact differentials on certain grades of crude.

Buildout of LNG export is critical for North American natural gas

With 11 billion cubic feet of incremental LNG demand in U.S. between now and YE 2027, it’s yet to be seen how supply-demand dynamics will turnout. We think US shale producers are weary of allowing prices to go to high in the short-term as it may result in end users re-thinking the conversation of switching to natural gas away from cheaper energy sources such as coal or even renewables. The issue in the short-term seems to be that North American E&P’s are “ramping up” ahead of LNG buildout causing a short to medium term precarious supply-demand dynamic where the market could easily tilt into a state of oversupply on disappointing weather.

Global politics is changing, in favor of oil and gas putting green energy on the ropes

A notable event in our view is the rapidly changing status of governments around the world, where green leaning governments are facing crushing defeats. The latest being in the Netherlands where Geert Wilders, who wants to open up Europe and Netherlands to more domestic production was surprisingly elected. The trend is rather viral, with every election in Europe resulting in a conservative leaning government in the past two years. Even in the U.S., frontrunner appears to be Donald Trump who is extremely pro oil and gas, although in the past tenure that resulted in lower prices and higher production. In any case, we think the change of government and views of green energy is supportive for fossil fuel demand and may ultimately lead to higher multiples for fossil fuel stocks, including even coal.

Overhyped geopolitical risk

NCP were well known to take a short position when crude rallied on the Hamas-Israel conflict. The overhype of the Mideast conflict was the most ridiculous thing I’ve seen in many years for oil markets as this conflict had nothing to do with oil. While the recent conflict with the Houthis is a lot more of a threat, we still see the thawing of relations between Iran-Saudi as something notable in that conflict as it seems unlikely that Iran’s, the Houthis-backers would allow for them to disrupt oil ships even if they do have the ability. Also notable in my view is China’s intervention to push Iran-Saudi into peace as China is not a fan of higher oil prices and commends considerable clout over Iran and Russia given precarious nature of sanctions which often depends on a willing China to bypass western sanctions. Ultimately, I see oil as a commodity that should always carry geopolitical risk given the risks never dissipate and numerous sources are in regions prone to flairups, while perhaps the biggest risk is in western countries where domestic opposition under “ESG” remain strongest. Historically outages in the Mideast have been swift to resolve, with the recent major Ceyhan pipeline dispute between Kurdistan-Turkey being one of the longest ones I can remember yet even that was shrugged off by the market as incremental supply came online from other sources including U.S. shale.

Canada specific thoughts

Transmountain still faces uncertainties but making progress

Recent discussion about Transmountain being delayed by another 2-years took me by surprise as I was not aware of these risks. This week a CER regulator denied TMX’s application but there is apparently hope of approval for the second one, which would allow them to use a certain size pipe of a different diameter than the original plan. We won’t get into that as I haven’t followed the story closely. In any case, a 2-year delay of TMX-E would be an epic disaster and likely weigh negatively towards broader investor sentiment in Canada. However, with Trudeau polling so poorly and the more pro-oil Conservatives with a 99% chance of majority government (Source: 338 Canada), we think investors will build off this momentum regardless. With every producer in Canada ramping up, a delay on TMX-E could result in a painful blow to WCS differentials which were expected to tighten next year significantly. Given the expansion of multiples on key heavy oil names, it seems to be the favorable outcome is already priced in with this pipeline and I would not expect to see much on the valuation side for E&P’s should it be completed on time. More risk if it is delayed.

LNG Canada, still not approved & Blueberry/First Nations uncertainties remain

While there has been a number of LNG related projects approved in the past couple years, the biggest one which would be Shell’s next FID on LNG Canada has not been. With Coastal Gas Link being completed, one of the biggest risks to the project is in the rearview. However, my sources have informed me that Blueberry First Nation issue has resurfaced and we think that is a reason for caution. Should Shell FID the next wave of LNG development in Canada, we think it would act likely a significant momentum builder and lead to higher multiples, at least for the leaders such as Tourmaline and Arc Resources. While many investors think LNG is a game changer for North American natural gas prices, we are really not sure and generally do not share these views as a magic pill or guarantee of a better strip given the way midstream capabilities are designed in Canada. We think it’s possible that LNG actually even results in higher production which could risk excess gas being stranded in Canada and United States, causing pressure on local prices.

Trudeau being ousted will be a positive for the oilsands particularly

While NCP are not political, we are certain that the reprehensible government of Justin Trudeau being ousted will be a positive for Canadian energy. Although we are not expecting much in terms of impact, given all of our pipelines are approved are being finished, the obvious winner in my view would be the oilsands companies where carbon pricing has been particularly painful. For example Suncor was facing significant opposition from the Government of Canada on their base plant expansion, we think Suncor would be an obvious winner of change of government. However we should note that Justin’s government has lost multiple cases at the Supreme Court level in recent months so again, remind a change of government may be more symbolic for the time being than resulting in policy change (aside from the carbon tax) that would benefit the energy sector other than thru improved sentiment.

The Montney will continue to grow regardless of AECO pricing

Given natural gas producers are better diversified than ever, lower AECO strip pricing is unlikely to cause a major drop in activity levels as many E&P’s are accessing better markets including some of which are hedged. With the rise of liquids rich production in the Montney, natural gas like in the Permian is becoming a cost of doing business. Natural gas could literally become worthless and liquids rich wells could still be profitable, we’ve seen this before several years ago and in energy land, history tends to repeat itself, especially when you think it won’t. So we won’t be surprise to see this happen again. Low natural gas prices stimulates condensate-liquids activity as E&P’s tend to shift towards liquids during these periods and vice versa, low oil prices are good typically for natural gas prices as they reduce associated gas activity.

Canadian industry becoming more consolidated but it’s not over yet

2023 was a relatively busy year for Canadian M&A with a number of smaller companies disappearing. There are very few small publicly traded companies left on the market with Crew, Kelt, Advantage, Coleacath perhaps being the most obvious. On the oilfield service side, there was also M&A transactions which resulted in a smaller number of companies standing and I think it will continue next year with Calfrac & Western Energy Group being the next two to disappear. More consolidated oilfield services may result in higher E&P inflation when the pendulum tilts again.

Things look good for Canadian energy into 2024 but low commodity prices should remain

Next year looks promising for Canadian energy in our view. With Trudeau on the ropes, TMX-E likely almost online, LNG era getting closer, there is a lot to look forward to when it comes to Canada. However, NCP expects next year to be disappointing for commodity bulls on the oil and natural gas side, with $80 & $3 our base case for commodity prices. We think shale will probably flatline on the liquids side while growing modest on the natural gas side, while international growth - including Iran, Venezuela, Latin America plus Canada should TMX-E come online, outperforms, helping keep prices in-check along with inflation.

Well, there you have it! Some of our energy thoughts heading into 2024.

Thank you for reading our latest piece. We hope you enjoyed it and welcome your comments as we start a new phase in the economic cycle.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Hi,

I just received an email to become a paid subscriber. But i don’t see that there is paid-only posts. Is that going to change in 2024 ?