Happy Father’s Day friends,

This evening I thought I would write a bit about some thoughts on technical set-ups in Canadian oil and gas stocks. While we are not day traders or pureplay technical traders, it always amazes me how reliable these lines can be at times, particularly when it comes to violating or busting thru 200/50 moving averages. We are close to testing those magic lines again as O&G stocks are facing a technical support point.

As I wrote last month, Q1 data didn’t show much new money coming into the energy space which makes the sector open to volatility as institutional funds tend to be more passive and longer-term natured rather than shorter term orientated traders. Our view was that most midcap energy names were being recycled by the same group of buyers and sellers, rather then improving their shareholder base with new entrants.

One thing that makes a difference in our view are companies with strong NCIB and/or good shareholder bases which tend to be less volatile. Some examples of these names might be the likes of an IPCO, Arc Resources, Trican. Other examples which makes stocks more prone to less volatility are those with good dividend bases like Peyto or Freehold Royalty, names that investors hold for the payout.

Meanwhile names like Baytex and Veren, which are referred to as “higher beta” equities tend to be violent and choppy as neither has been successful in building up their shareholder bases much. Retail focused analysts tend to put high targets on these types of names because they fancy their dealmaking streams which are lucrative as business dries up. Retail investors who buy them tend to be short-term holders.

It’s also important to remember, I think, that after many years of suffering, Canadian energy stocks have been a top performing global asset class for years. Many of the long-awaited catalysts are now in place, with others in sight of being in place, which raises the question of how much more can it climb? We think there is more upside ahead but not without volatility, but not all names equal as shorter cycle asset bases tend to be prone to more violent swings than lower decline oilsands names.

Below you can find some of our thoughts on recent technical trends in the space:

Enjoy!

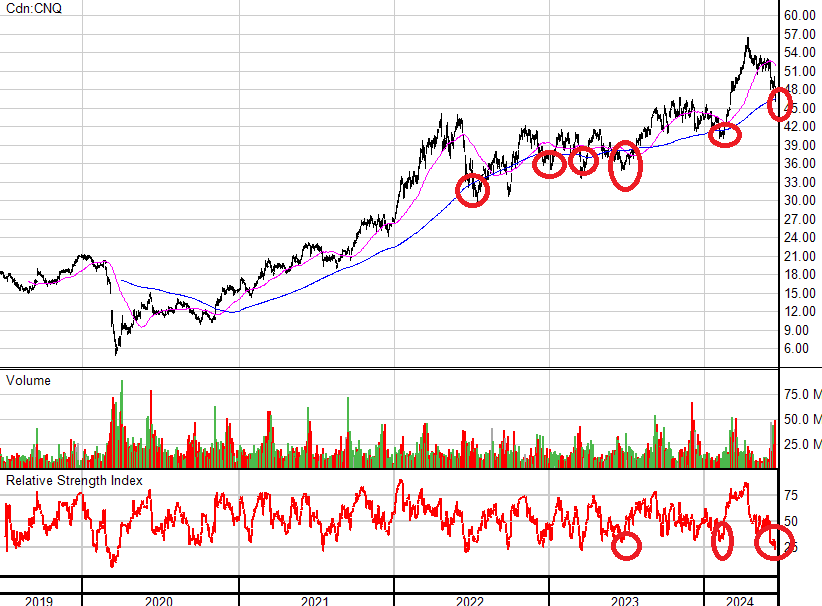

Canadian Natural Resources (TSX: CNQ | NYSE: CNQ)

Canadian Natural Resources is the sector leader for Canadian oil and gas and one of the biggest capitalized companies on the TSX. It has amongst the highest percentage of institutional ownership making it less volatile. If we use a 5-year chart, CNRL has proven to be a masterful buy every time during this cycle at the 200 day moving average, which the stock violated on Friday. The risk-reward to buying CNRL on a technical basis seems very strong in our view, even though we don’t have an overly constructive view near-term on oil prices to breach $80.

Tourmaline Oil (TSX: TOU)

Tourmaline has had a great run this cycle but not as impressive as CNRL. We think that has to do with the shorter cycle nature of their asset base and more volatile nature of the natural gas markets. Unlike CNRL, the case to buy Tourmaline as it melts thru the 200 day moving averages is not a good one as everytime this cycle it has violated these ranges it tends to dip much further. We would consider adding Tourmaline again in the mid $50 range and expect it to fall further.

Veren Energy (TSX: VRN | NYSE: VRN)

Veren Energy is one of the ‘hottest’ talked about stocks as they do a lot of deals and sell-side analysts all put out raving reviews about how great they are. In our view, we don’t think this company is great at all except at making wealthy insiders even richer as they shun the stock and never buy shares. After a brutal sell-off after their recent hung deal in 2H of last year, the stock recovered and began the year as one of the strongest performers. We expected that performance to melt away and thus it has. Veren is heavily exposed to natural gas markets now and even condensate differentials are widening which will have a financial impact. Technically speaking, when Veren violates critical moving averages, the stock tends to fall further. We don’t’ think Veren is a buy on a technical basis until the $8 range and that is where it could end up soon.

Trican Well Service (TSX: TCW)

Trican Well Service may not have been the name with the best returns of the current cycle but it has had one of the most impressive charts and performance on a volatility basis in our view. Trican has been in a steady uptrend basically since 2020’s downfall, something quite rare in the oilfield service space. With an aggressive buyback in place, the name has lost a lot of historic volatility. Trican is in a deep state of consolidation along the 200 day moving average and has so far been a strong buy at these levels. We are in the neutral camp on Trican and think the risk reward is decent here relative to other E&P names in the space given the tested consolidation band.

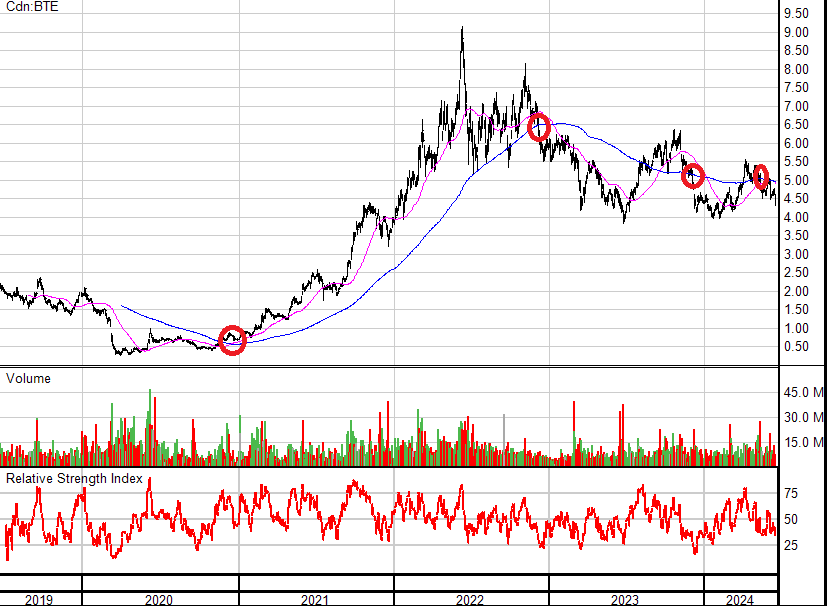

Baytex Energy (TSX: BTE | NYSE: BTE)

Baytex Energy has been a really poor outlier in the Canadian energy space, having been in a steady downtrend for the past couple years despite the asset class being a top performer enjoying a rather speculator bull market. The old red flag goes true that being a poor performer when an asset class is in a bull market should not be ignored. Baytex has proven this very true as it remains ‘heavily submerged’ under the 200 day moving averages without much reprieve in sight. Despite the company” buyback back” stock it remains a sector dog, as the company took on quite a bit of high interest debt in their recent Ranger Oil shale deal in Texas. Legacy institutional insiders were quick to sell while the stock is touted to predominantly retail investors thru several mediums: notably Eric Nutall’s BNN appearances and several sell-side analysts whose firms had a hand in Baytex’ deal making. While we are very bearish on Baytex, technical indicators tell us to stay away. If you really want a piece of this, we think you should wait to see the low $4 range before jumping in.

Nuvista Energy (TSX: NVA)

Nuvista Energy is in a league of its own. Trending well above the 200 day moving average which has held up even as their largest investor, Paramount, unloaded stock and the sector took a dive. The chart seems to be telling us something and we think Nuvista may be an acquisition target. The company’s land base is in the Alberta Montney which has seen quite a bit of M&A activity in the past couple years, with the latest deal being the Advantage Energy-Longshore Resources deal. Technically there isn’t much evidence of whether Nuvista is a buy this cycle below the 200 day moving average as it doesn’t seem to fall often. The company is also executing a relatively good NCIB which has removed over 10% of all shares outstanding in the past couple years without the temptation of issuing more. Nuvista remains high on our watch list.

Arc Resources (TSX: ARX)

Team Terry’s Arc Resources has been one of the cycle’s best performers and most impressive charts. Every time the stock has pulled back to the 200 day moving average this cycle the uptrend has been able to resume and anybody who bought came out ahead. We think Arc is a good name to add if it falls to the low $20s again. With a mix of condensate (oil) and natural gas with growing LNG exposure, we think Arc can continue to outperform. Recent comments suggest that Canada may be on the receiving end of more LNG headlines in the weeks/months ahead and anything favorable could further act as a catalyst for Arc. The company also has a growing dividend and relatively strong NCIB in place which helps volatility.

Whitecap Resources (TSX: WCP)

Whitecap Resources, like their twin sister, Veren, has a scary looking chat and we think it should be avoided at all costs currently. Despite nearly an 8% yield, the stock continues to suffer technically even in a decent oil price environment. We think this is attributable to continued never-ending M&A and the pick-up of high capex gassy assets in the Montney at a time commodity prices are at 5-year lows. The company also does not have a meaningful buyback in place which does not help with volatility, opting to dish out much of their free cash flow on dividends. When Whitecap violates the 200 day moving average, the name has typically fallen much further before recovering. We think Whitecap could be a buy around the $8 range.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section. We would love to hear your top 10 investing ideas in the comments if you care to share.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Thank you for the article. Do you ever listen to "Market Huddle"? The Canadian hosts tend to bring up Canada. :) They had a gentlemen on last week who was extremely bearish on the currency and the housing market (basically thought central bank would be forced to cut a lot and fast compared to US). The one play he liked was Canadian oil sands, producing with Cad and selling in USD. Curious if you agreed with the logic. I know you don't see a big drop in Cad, because Fed will also be cutting more aggressively than some think? I've dipped my toes in Canadian Reits, been selling calls against my CNQ. Just not ready to jump in on the Reits with size yet.

I saw you highlighted buys from management on OBE and JOY, is there a price on those where you become interested? Do you have any thoughts on JOY's utility efforts? I take it you still like Strathcona the best, out of the endless choices for oil and gas? I like that OBE has options (I'm from the states, so can't play with options in Toronto). Appreciate any feedback. Hope your week is off to a good start.