It’s donned on me that I have been following oil and gas stocks for quite some time. I also have to admit that over the years of following oil and gas stocks, I have developed strong views and even vendettas on certain names which I consider bad actors. Thru thick and thin, thru good times and bad. Times are much better now but some of the bad actors seem unable to capitalize off improving conditions yet have glorified outlooks by their promoters who often have vested self-serving interests. However, contrary to the narrative, you may not realize it unless you look under the hood as the promotional element behind some names is incredibly strong.

This is in part due to sellside analysts who work for financial institutions/investment banks which take part in lucrative deal streams which seem to be never ending. You might scratch your head and ask yourself why a company like Strathcona, this years’ top energy performer merely had “sector perform” ratings on it relative to a poorly run underperforming dog like Baytex Energy which had a series of raving reviews from institutions that had a had in their deal streams. Analysts seem to put juciy targets on names that they do business with. Smaller companies can often recruit firms to write favourably about their stock. Nothing shady, it’s all part of the business.

Aside from sell-side analysts, there are merely a couple oil and gas fund managers who dominate the scene: Eric Nuttall and Rafi Tahmazian. With Canoe’s Rafi Tahmazian now stepping away from running the energy fund, the defacto “go-to” cheerleader in oil likely remains Eric Nuttall. Unless of course, Baskin’s newfound love of oil and gas picks up steam and perhaps they can front Ernest Wong. Eric Nuttall’s had a hunch for names like Baytex and Tamarack Valley for years. His view on Crescent Point in prior years was wavering, with some wildly lovey dovey years and other times total disdain. As the most influential person in Canadian energy investing, Nuttall’s views likely are behind the widescale fanbase of Baytex, Tamarack Valley and Crescent Point along with a few others.

In this article I wanted to discuss a few of the highly touted companies that are often touted as buyback machines, but in fact are rather the contrary as sharecounts have instead grow substantially. I would be comfortable in writing off Crescent Point and Baytex Eneryg as more of the same while taking a soften approach on Tamarack Valley which seems to have more of a focus than the other two bad actors who seem to keep going thru transformative maneveurs, only to end up further behind the 8-ball then when the intiatives started. In a nutshell, there is more debt, more shares outstanding, capex tends to be higher and in some cases much gassier.

Baytex Energy (TSX: BTE, NYSE: BTE)

Baytex Energy is Canada’s premier dumpster fires of an E&P in my opinion. Still down ~92% off last cycles’ highs, the stock had a nice run in 2022 off the Clearwater bonanza before fading back to the doghouse. I have to admit that I was pretty impressed with the Baytex Clearwater performance and thought I might have to eat crow. Ed Lahehr with the help of the Raging River team (Neil Roszell & co) likely had a helping hand in their discoveries as the team since left Baytex after the merger with Raging River at bear market lows to form Headwater Exploration, another Clearwater player.

It wasn’t long before Lahehr resigned and Baytex picked up a new CEO in Eric Greager. While I have no view of Greager, one of his first moves was to acquire an Eagleford shale producer called Ranger Oil which was highly unpopular with their revitalized shareholder base which caused a mass sell-off. Shortly after the sell-off, Eric Nuttall had to go on BNN and calm down everybody’s nerves suggesting that his analyst had gone to Texas and determined the company’s projections were reliable.

In any case, without making a judgement, I would say that if Baytex is what winning looks like, I would be terrified to lose. As seen below, the company added 290,838,852 million shares and has a staggering amount of debt at $2.487 billion, some of it at an extremely high coupon rate (~10%) on a US issued bond. Their capex soared in Q1 which led to another sell-off which the CEO says will bear fruits in the coming quarters. Their largest shareholder Juniper who inherited Baytex shares via the recent Ranger deal continues to sell and with 12.3% ownership, more ‘overhang’ is expected.

Baytex probably shouldn’t be buying any shares at all in my view which is a thought I share with a few other names engaging in the NCIBs. It seems like a desperate attempt to appease certain touters and bring in a false sense of balance sheet strength. Reasonable companies in the energy space do not buyback shares while they have tons of debt, quite a bit of it high yielding, in a short-cycle commodity environment into worsening macro outlook which impact crude oil prices while natural gas remains in the dumpsters. This is just a crazy capital allocation policy which is why the stock is down ~92% from last cycle to begin with. With OPEC propping up the oil market in the near-term, it’s not far-fetched to expect prices to come down. If they do, expect Baytex to get themselves in trouble once again and shareholders to hold bags.

Crescent Point Energy (TSX: CPG, NYSE: CPG)

Crescent Point Energy is one of Canada’s premier treadmill stocks if not the elite. Like Baytex, the stock is down a staggering amount from the last cycle, around ~82% which is slightly better than Baytex at ~91%. The company has also been a long time retail favorite and was at one point Canada’s largest light oil company as they had dominated Southeast Saskatchewan’s Bakken zone in an era when that was hot. Somehow, the company has re-invented its image with a string of recent deals and is once again one of the most talked about midcaps in the space.

In 2018, the founder and CEO Scott Saxberg was pushed aside after a failed activist coup led by a featherweight frontman named Sandy Edmonstone of the now defunct Cation Capital. In retrospect, I still wonder if this was all a show or Edmonstone himself was bagholding. Saxberg had been brewing in unpopularity for quite some time. At this time, Craig Bryska took the helm having long served the company as executive although he was completely unknown to the street which was a good thing considering how unpopular and unliked the former was.

Initially I was impressed by Crescent Point’s maneuvers under Craig Bryska, as they begin to deleverage the balance sheet with a series of dispositions in Saskatchewan and were able to pawn off the dreadful Uitina Basin yellow wax assets in Utah for $700 million to a private buyer which Saxberg thought was a good idea. At the time the Utah assets lacked egress as their sole client was a Salt Lake refinery accessible by railroad car which required constant heat coils in to prevent the oil from turning to wax, much like Canadian bitumen would without costly diluent.

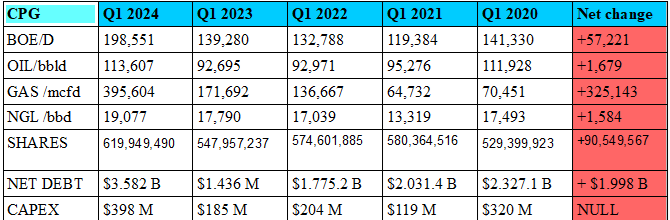

It didn’t take long for Crescent Point to go back on the acquisition binge. The company started expanding in the Duvernay and then started acquiring in the Alberta Montney, picking up Spartan Delta followed by the much larger and recent Hammerhead Resources transaction. At the same time, they spun off their North Dakota Bakken assets at dreadfully low prices while their recent largescale Saskatchewan dispositions saw 13,000 barrels per day of low cost light oil at their former core plays pawned off to a rapidly growing Saturn Oil & Gas,

The end result of Crescent Point does not look good to me despite the hot start to the year which put the shares back to around where they were in 2022. The company has slightly more boe/d of production but got significantly more gassy. That isn’t good in our view as the natural gas in Alberta is not linked to LNG but AECO so considering boe/d for Crescent Point is simply not effective. Oil production is almost flat, with a lot of that now condensate which brings on associated gas. Their sharecount is higher, although not by much. However, the more concerning issue is the large amount of debt which is nearly $2 billion higher than 2020 while their capex is soaring.

It truly baffles me that a new wave of investors are getting excited by Crescent Point. The misallocation to buybacks in light of significative debt and exposure to a short cycle asset base in a volatile commodity price environment is truly bewildering. It isn’t a surprise to me this company remains down ~82% off last cycles high and we could easily envision this happening again given their poor priority towards ‘shareholder returns’ over debt paydown. For a rationale investor, debt paydown is a form of return as an equity holder as the shareprice tends to rise as the company pays down debt and balance sheet is derisked.

Tamarack Valley (TSX: TVE)

Tamarack Valley has been the talk of a lot of “Canadian Oil Mafia” members as the stock picked up a substantial following since 2020, much in part due to Eric Nuttall who has consistently made it a top pick. Others carried it further as the CEO became very receptive to the COM, willing to take part in lengthy interviews and even hosting parties for Twitter’s investor base in Calgary. Truthfully, as nice as it may seem, I find CEO’s willingness to participate on Twitter and Spaces as a bearish indicator.

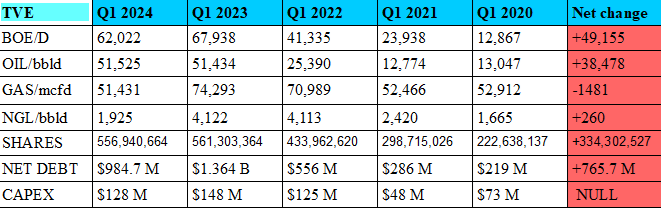

The stock has not performed well. That may be in part due to very high expectations put in place by the touters but relative to Crescent Point and Baytex, I would rank the stock in a much higher regard given the company has become a Clearwater force with much larger scale than where they started as they rolled up a number of private players in the highly regarded Clearwater heavy oil play. Tamarack also saw one of their largest private equity holders, Arc Financial, begin to unwind their stake which may have placed overhang on the equity.

According to Q1 filings, even Ninepoint Partners began to unwind their large Tamarack Valley position in which they appear to remain the largest shareholder. Eric Nuttall had noted on BNN that he was not happy with the story as the name embarassed him due to its underperformacne and constant dealmaking. He claimed that nobody in the world has made money on Tamarack which is leading to increased negativity. Meanwhile, as seen above, other large retail investors have begun to capitulate and sentiment is extremely negative, leading to a possible opportunity.

Like the two other names, Tamarack Valley has not made a dent in their sharecount, rather, they have seen their sharecount skyrocket. But to be fair, the company has made significant gains in oil per day production and their net debt while significantly higher, isn’t too obscene for a company with that much production. Much of the story playout will depend on how well their Clearwater plays evolve. On paper, this story has tons of potential but it really depends on how good the reserves turn on. If you were to ask me between the 3 touted buyback names which one I would be comfortable with, I would unquestionably go with Tamarack Valley.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

"Baytex Energy is Canada’s premier dumpster fires of an E&P in my opinion."

lol