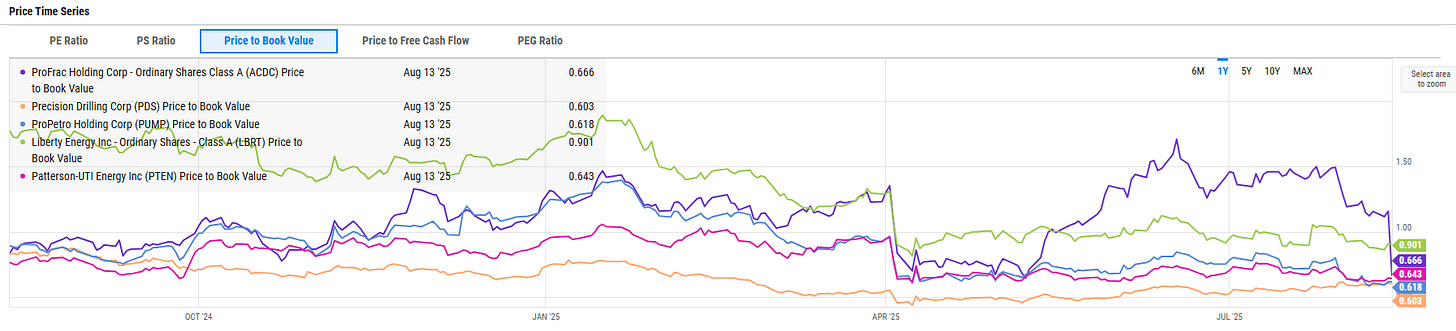

Profrac (NASDAQ: ACDC) was down -42% today after reporting an overnight equity raise for a relatively modest $75 million with an $11 million over allotment option. The sell-off was significantly disproportionate to the amount of the raise although the pricing was quite low, with shares available at $4. Reports suggest insiders, who already owned ~90% of the company were putting up their own capital in it. Aside from trading it after big sell-offs in the past year, I did not remain long this name but chose to re-enter the stock today given a return to a large discount as I feel the risk-reward is good, although the risk is higher with this name then peers due to debt.

Profrac is an interesting story in the sense of how much control the insiders have with commandeering positions in commons, debt and also the preferred shares which are collecting “payment-in-kind” with a conversion option at $20. It is also unique as a hold co rather then an oilfield service pureplay and serves the interests of the Wilk Family who are exceptionally respected in the oilfield service arena for prior success.

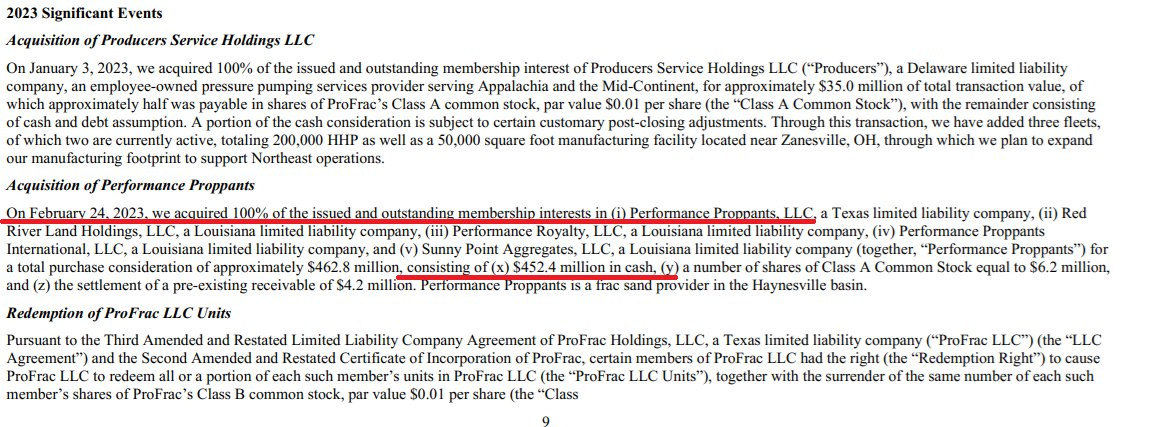

Last week I wrote about an oilfield service position that was new in ProPetro, a smaller competitor of Profrac that operates solely in the Permian. Profrac is a much bigger outfit and not only does frac but has a vertical integration set-up, meaning, they want to be a one-stop-shop for their needy E&P clients when it comes to well completion. Profrac is also one of the largest completion companies in the United States with at least 45 frac fleets available, with ~30 currently in service.

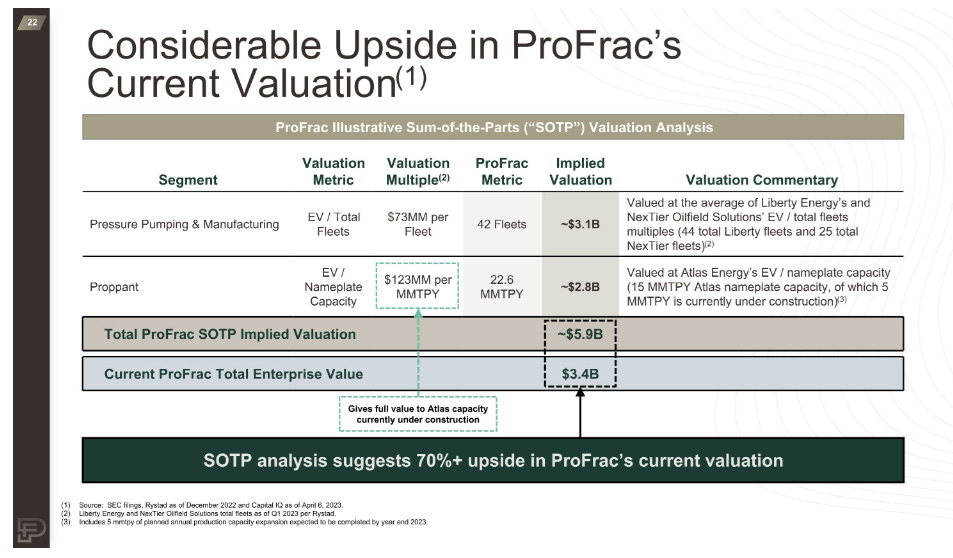

Profrac is also particularly unique in the sense there is ‘hidden value’ within the name unlike pure play oilfield service companies. The most obvious opportunity within the hold co that comes to mind is the potential monetization of of their frac sand company, Alpine Silica, which is the largest frac sand mining company in the United States. If you recall in April 2024, Apollo Asset Management purchased US Silica [link] for $1.85 billion which was an 18.5% premium to the days’ trading price.

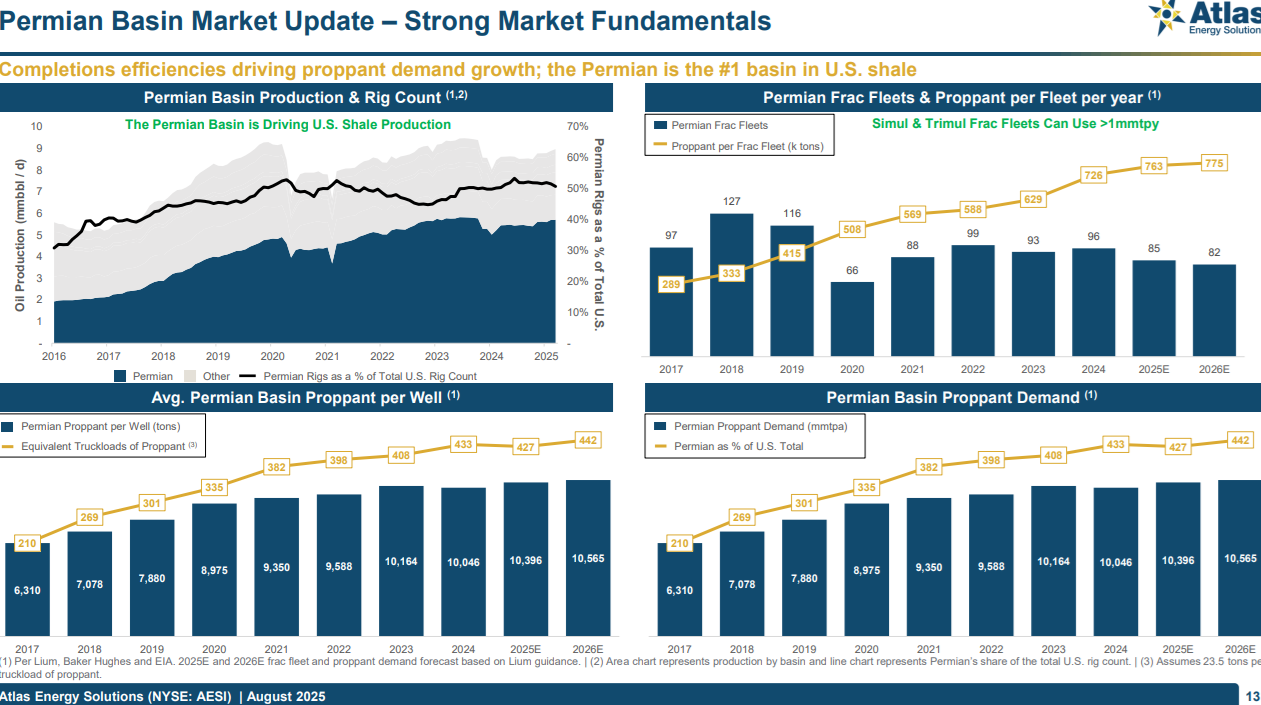

Although oilfield service activity levels are down by number, the amount of proppant being pumped by completion companies is more then ever and continues to grow as operators find ways to create efficiencies such as longer laterals, simul-fracs, trimul-fracs and even quad-fracs. This is a similar trend in Canada where the rig count appears to a blind eye as lower then it was many years ago but with production breaking records. Such basins like Duvernay and Montney are seeing increased proppant demand per well which is a similar trend in the United States shale basins.

It is my opinion that Profrac has not yet gone public with Alpine Silica because of poor market conditions. The Wilks Family made their fortune in US hydraulic fracturing and likely take the view, ‘buy low and sell high.’ Going forth with an IPO during a cyclical downturn seems unwise but I believe a turning point is nearing as sentiment could easily improve in the next year as US LNG continues to grow out and the D&C activity levels start to rise along with pricing. It seems very clear that drilling activity must increase in US natural gas basins to meet LNG export requirements. This will benefit Profrac the most as they have strategically positioned themselves to take advantage of these plays, particularly the Haynesville basin.

Keep reading with a 7-day free trial

Subscribe to Nugget Capital Partner's Substack to keep reading this post and get 7 days of free access to the full post archives.