Hi everybody,

I thought tonight I would write a note about some names that have caught my eye as we enter one of my favorite times of the year: tax-loss buying season. Or tax-loss selling season as some like to call it. For NCP, it’s almost always the time that Christmas comes early as year-end market dredges get sold off to charitable levels and low-risk entry points are provided to ambitious active investors such as ourselves, leading to New Year market alpha as tax loss dogs often get bid up in January. This year does not appear to be overly different, other then there may be less losers then before given the exceptional performance of the market.

Some names I had been hoping to add on further weakness seem to have recovered early which alludes me to believe we should act fast on existing opportunities. There are some notable outliers on the market which I wrote about before. In periods like this my preference is to gravitate into the highest quality market dredges which offer a clear rebound at a modest recovery into the new year rather then simply buy dogs with my fingers crossed, hoping for a turnaround. One of those examples would be a company like Bell, which I do not believe is a tax loss buying story but a dividend-cut in waiting story which will likely see further capitulation next year.

Things such as completed dividend cuts are something I like to look for, as often dividend cuts can leave a disproportional bone chilling response from investors which often leads to a great entry point for the more savvy investor buying after. Former renewable utility darling, now an ugly duckling, Algonquin Power is a name that I am currently researching in this regard as I believe the cut was obvious but the stock sold off aggressively regardless and may offer a turnaround story. One concern with a name like that is the potential of further selling pressure should it be deleted from the TSX Composite which is why I have not included it in my list today. Other things I look for are sectors that have been hit by broad-based macro issues, where headwinds may become a tailwind, some of the picks I write below are examples of that.

Overall into year-end, there is still a great amount of uncertainty in my view given the incoming shift towards the Trump administration, what his policies will look like, particularly with international trade and the revision of expectations with the interest rate trajectory as bond yields have once again spiked which may have adversarial impacts on some sectors more then others. I was hoping for more year-end weakness but given the dissipated views on an incoming recession and the shift towards a soft landing narrative with renewed economic strength and earnings season over, the risk of further downside catalysts seems rather limited into 2025.

Cenovus Energy (TSX: CVE / NYSE: CVE)

Cenovus Energy seems to give investors an annual opportunity at least once per year going back the past few years to make money on their stock. The oilsands major has been the worst performer of the Canadian majors, often in part due to their disappointing downstream results or in the past, including under the former operator, Huskey, refinery mishaps and sometimes explosions. While we are happy that the explosions have mostly come to an end, their margins have been suffering as crackspreads have been poor. Some of the fault is on Cenovus and others is more macro related, such as diesel demand in the US and globally has been quite poor. It didn’t help that the past year saw a historic amount of new downstream capacity added globally too, which seems to have adversely impacted North American downstream margins as there is now more supply sources on the refined product side.

Being a dog is not solely a reason to buy the stock as Cenovus has significantly underperformed the XEG index YTD. But Cenovus should not be seen as comparable to other high quality peers in terms of even downstream, as their operations are not truly as integrated as Suncor, which is able to capture better margins as their refineries are literally on-site with their upstream where they convert bitumen into high grade synthetic crude which sells often at a premium to WTI. Suncor refineries also have advanced characteristics which allows them to buy amongst the worst feedstock in Alberta on the market and run it thru their system, leaving Suncor with essentially next to a bare minimum exposure to WCS differentials. The only element of Cenovus’ business that has an advantage over oilsands peers is their Christina Lake bitumen operation, which is rated amongst the most competitive and lowest cost sources of supply in the oilsands industry.

Cenovus continues to struggle mainly in their US downstream business when it comes to profitability. Hypothetically, margins are likely to increase from here as product demand increases. Commodity prices seem like a safe bet at the current so in my view, it is more likely things get better then get worse from Q3. In a worst case scenario, Cenovus remains one of the lower cost operators in North America and has significantly deleveraged, little minimal risk relative to conventional E&P’s should oil price weakness persist. Multiple company insiders have been convincing buys including the CEO which seems to reflect the high level of confidence insiders with good operational knowledge have of Cenovus. The company is also buying back shares while paying a dividend which is on the low side and may see an increase in the coming quarters. In my view, the likelihood of a dividend hike is higher now given how positive the response has been to Suncor’s revitalization which has included multiple dividend hikes. Until Cenovus pays a higher dividend it seems the stock may struggle. But in the meantime, Cenovus seems to be a good trading stock between ranges until, if ever, it hits an inflection point and pulls out from the woodshed. NCP believes the risk-reward on Cenovus at the current valuation is extremely favorable.

Parkland Corporation (TSX: PKI)

Parkland Corporation like Cenovus offers investors in my opinion an opportunity to play the rebound in refining. Parkland is a unique company that operates Vancouver’s main refining asset in Burnaby, which in itself is a crown jewel on a normal day given that the Greater Vancouver area offers suffers from refined product shortages leading to very high product prices which often make national news. This year it was different as refining margins did very poor due to a global oversupply and macro weakness which put pressure on mainly diesel and jet fuel demand. This led to significant downside in Parkland share prices which was already out of favor.

Parkland’s initial weakness before the refining issues and EBITDA miss expectations grew from analysts was the rumor that the company’s board had rejected an M&A offer which would have seen the company acquired by a US peer for a significant premium valuation. The company’s largest shareholder, Simpson Oil with a 20% stake, has since taken Parkland’s executive to court accusing the management team of overlooking shareholder interests. In NCP’s view, there is a chance that Parkland becomes an activist target as there are now at least two large angry shareholders who are seeking a strategic review which may include a total corporate sale.

Ultimately, I think Parkland offers investors a good risk-reward entry point on multiple levels: potential activist, refining rebound, a consumer macro rebound which would bolster same store sales on their convenience stores. The valuation implied an opportunity meaningfully below the historical trading multiple which in itself presents a good risk-reward opportunity. The company is also investing significantly in upgrading their electric car charging infrastructure as the EV business in North American continues to evolve and operators strive for market share dominance and traditional gas stations retrofit their operations to accommodate a growing electric car industry which may offer a boon to their retail store sales. Insiders have made meaningful purchases in the past months and the company is buying back stock while investors collect a decent 4% yield as we wait. Tax loss selling may pose a final end-year risk but if the stock weakens further, I will consider adding to my position.

NCP is long.

Saputo (TSX: SAP)

Saputo is one of the largest dairy producers in North America. The stock is at cyclical troughs with milk and cheese being widely out of favor the last several years as inflationary pressure and supply chain challenges plagued the industry particularly since Covid. Other things such as restaurant sales weakness and labor shortages did not help. As headwinds now become tailwinds on some fronts, Saputo offers investors a compelling opportunity for establishing a new position into year-end tax loss selling.

Saputo is trading at a multiple trough of only 8x EBITDA with an estimated 26% EBITDA growth forecast in the pipeline for the next two years. Even more favorable is that Saputo’s recent hefty capital expenditures are expected to plunge over the next year which are expected to significantly reduce operating costs as much of the capex was dedicated to cost lowering enhancement. Regulatory changes in Canada have allowed for Saputo to purchase cheaper milk product beginning in 2026 which will also lead to higher cheese margins.

Some of the inflationary challenges that Saputo faced seem poised to become tailwinds. Things like a labor shortage in Canada have quickly turned into a worker surplus as the national employment rate now is in the mid $6s. With Canada and the United States in a rate cutting cycle, the prospect of more consumer demand at restaurants seems likely in the coming couple years. This should bolster demand for both milk and cheese, two products which have been out of favor as the fake milk and fake meat industry seemed to captivate the market with the now fading ESG bonanza.

Insiders, namely the Saputo family themselves who already have a massive stake in the company, have been buying the stock aggressively over the past two years and now there is now talk of a buyback which will further provide support for the share price. The company continues to pay a dividend with small raises annually since 1998. If Saputo shares continue to suffer into year-end tax loss selling, NCP sees it as a potential low risk buying opportunity of one of Canada’s most storied food companies.

NCP is long.

Minto Apartment REIT (TSX: MI)

Minto Apartment REIT is a name that NCP has followed for a number of years and I very surprised by how badly it has weakened. As I wrote in prior articles, the Canadian residential space as a whole offers investors a rare opportunity at a compelling and unusual valuation due to a number of factors: political risk, immigration changes, interest rates and especially narrative.

One thing that caught my eye on the Q3 call was when Minto’s CEO, a former M&A banker specializing in the REIT space, noted that he felt confident he could sell every property tomorrow at "full NAV” should he desire. Considering the internal NAV gap is approximately 40%, that comment excites me. He furthered by telling a questioning analyst that he would consider using the balance sheet for buybacks and seemed to express willingness to opt for the use of an NCIB route aggressively.

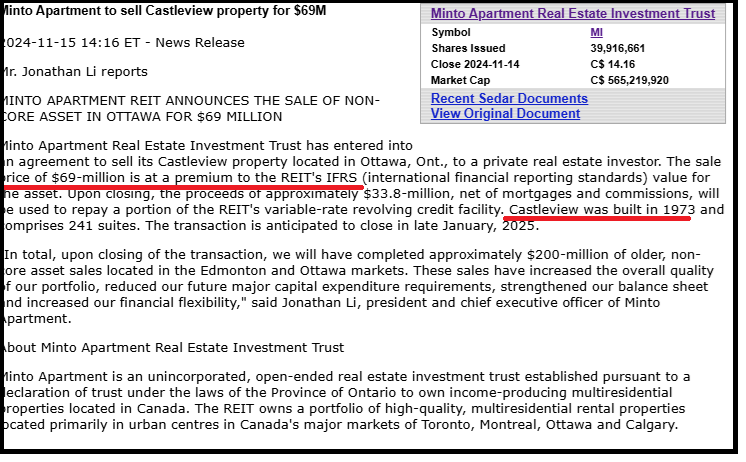

About a week later, Minto reported that they sold an apartment building in Ottawa for $69 million dollars. It was one of the worst in their portfolio and built in 1973. The sale was reported at full IFRS NAV. Now Minto is likely fully funded with some cash and may opt to use a portion of it to buyback heavily discounted units. Considering the parent company (Minto) owns around ~40% of Minto REIT, the illiquid nature of the unit structure means a buyback will have a significant impact at providing support should the REIT use it aggressively.

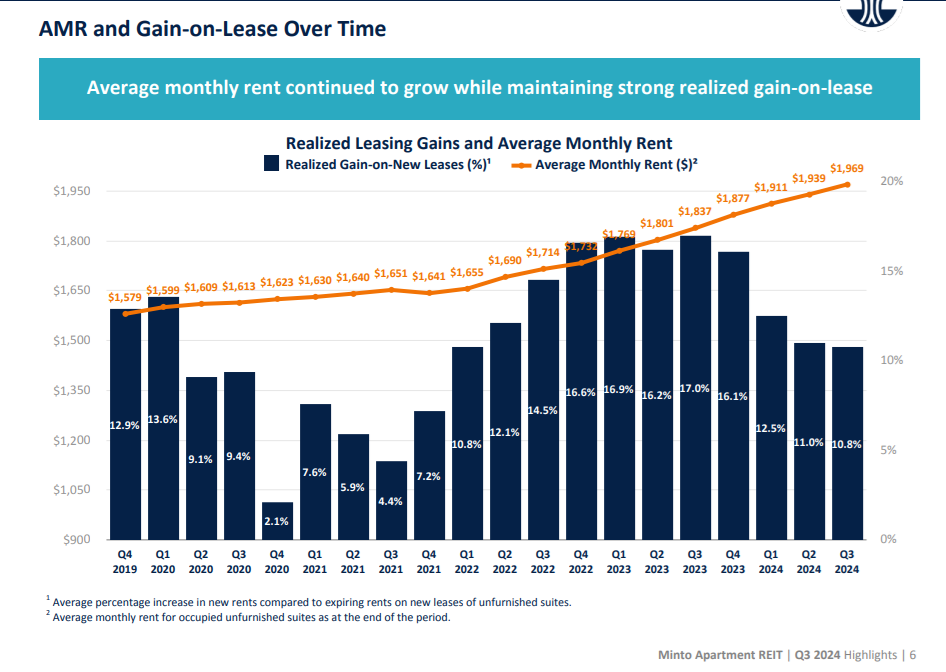

In the past couple years Minto insiders have added millions in units in the current range. The REIT is trading well below the IPO price despite the values of their apartments soaring over the same period. It now trades at a ~5.3% implied cap rate with in-place rents approximately ~27% below current market rents. Which means that even if the Canadian headline rent falls in certain markets, the leasing gains on any new established leases when a tenant moves out will be substantial. Minto is also in the business of upgrading older suites to capture higher market rents. I believe Minto offers one of the best opportunities in the Canadian REIT space at the moment.

NCP is long.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Thoughts on Superior (SPB) as a tax-loss buying candidate following recent dividend cut?

Thank you. Always enjoy your analysis.