Hi everybody,

Tonight I wanted to write a bit about some observable trends in the oil market and ideas of how NCP is playing it and what we are watching for. While a downtrend is not fun at all for anybody already long oil stocks ahead of the sell-off, it opens up opportunities for those who wish to add to their position or open new ones. It is important to exercise added degrees of caution in a declining price environment, particularly with those heavily indebted names or those who have to invest considerable sums of capital expenditures and pay only be breaking even, such as NCP warned about last year with short-cycle names, often the first to suffer in such a scenario. The most obvious trend that I see in the oil market today is sudden ‘hardcore’ bearishness, something NCP wrote about last year. All but a very small handful of the most ardent oil bulls have thrown in the towel in recent months which is improving the margin of error in a number of energy names.

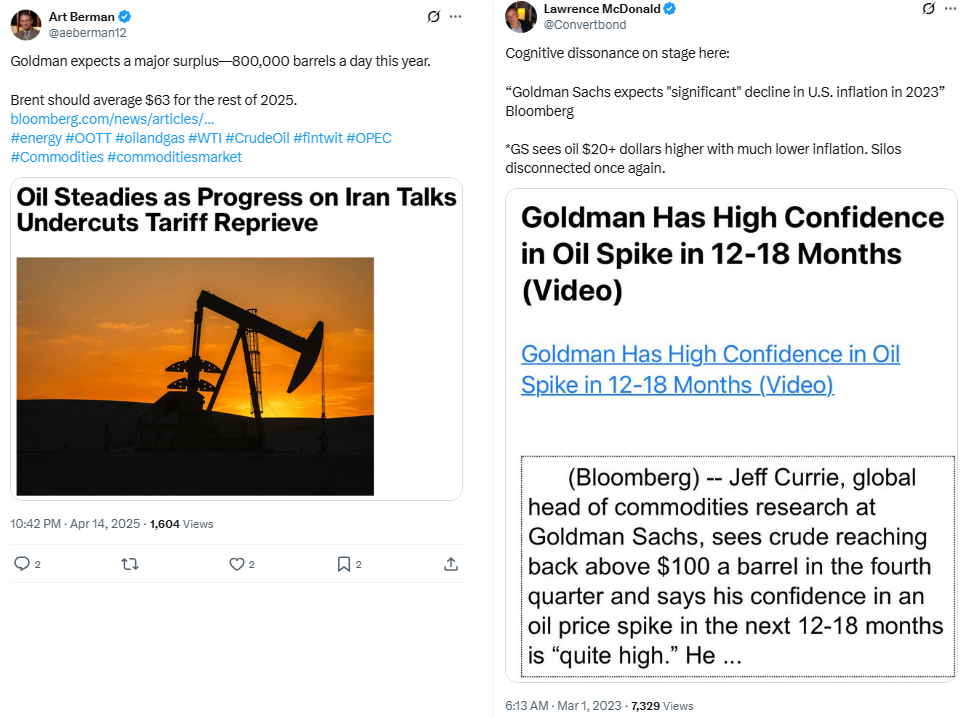

Loudmouth oil bulls who have put outlandishly bullish forecasts for the past several years have begun to fold en-masse. Most notably, even noted pureplay energy portfolio manager Eric Nuttall noted in one of his recent posts that he is not ‘necessary bullish.’ Jeff Currie, the former Goldman Sachs ‘star’ commodity analyst who assured his clients of a supercycle in the space before he was terminated has in recent weeks thrown in the towel on oil. Frequently featured Bloomberg favorite Amrita Sen of Energy Aspects has gone full oil bear, warning that oil prices could plummet into the $40s this year, barely over a month ago she was a self-proclaimed contrarian suggesting oil would be in a band of $75-80 and that the banks were wrong. While Goldman has been tapering down its bullishness since Currie left, they were still generally in the bull camp but recently threw in the towel as well with a $63 BRENT call for 2025. JP Morgan followed suit. Needless to say, the list could go on for a while but I provided my readers with a number of ‘before’ and ‘after’ posts which reflect the sentiment in the space from those who have been most bullish below.

Why did oil sell-off?

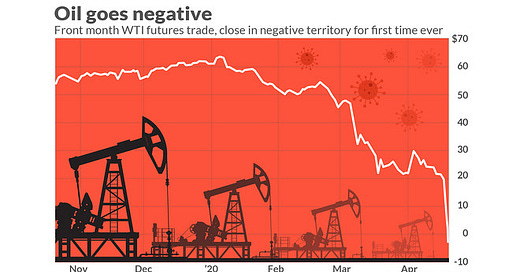

Oil began to sell-off aggressively on the day of Donald Trump’s trade war announcement. As mentioned in my prior report, it seemed to be amplified by the OPEC announcement about adding 400,000 incremental barrels which shocked the market and even took me by surprise as I had no idea it was coming. All of a sudden I began to notice oil names with ‘Covid-like’ drops. It wasn’t immediately able to be pinpointed because the entire market was in decline. NCP will attribute the decline to oil more to the OPEC announcement then the Trump announcement. Put them together and you have a double whammy in the space.

Is the sell-off justified?

This is the more interesting part to me and perhaps the million dollar question. Unlike in prior times where we may have seen such a crash, this crash seems to be one of forward looking expectations rather then inventory builds. There is an anticipation from the market that the OPEC cartel will flood the market, something they have been rather cautious about not doing for the past number of years. There is also increasingly an expectation that we may encounter a global recession, something that seems probable, at least to a degree, given current trade issues with the world’s largest economies and increasing uncertainty which is reducing capital spending and surely will reduce business activity and consumer confidence levels which could impair oil demand in the short-term. Given oil’s decline began to happen the day of broader market declines, it is hard to feel comfortable that oil is going to stay in the doghouse as low as the bearish forecasts are projecting it, as these projections have followed the price action from shops and individuals who were bullish in the past couple months.

What variables should we watch?

There are a number of important factors to watch going forward in the near-term. The first one is whether there is actual evidence that OPEC is adding barrels. It may be political pressure to lift the monkey off their back - with the monkey being Trump - which may have led to an announcement about adding more barrels. It has been a widely accepted conclusion that OPEC has been cheating which likely means they were already above their quotas. In the past couple days, OPEC put out a list of ‘compensation cuts’ required by each member state which must be met by a certain timeline. If the incremental adds do not materialize and the barrels are already on the market, perhaps the market reaction is unsubstantial. NCP is by no means ‘bullish’ but we are reserved in our bearishness until there is evidence of a global glut brewing. This should be reflected in global crude inventories in due course, or not.

US shale is another factor to watch given how aggressive the new US administration has been in regards to oil prices. The latest EIA 914 (monthly data) which is released on the last day of each month showing official American oil production numbers showed a decline. The latest Baker Hughes rotary rig count data from the US showed a major decline in rigs. Primary Vision continues to show a decline in frac spreads. Liberty Oilfield Services however reported a sequential activity boost in their Q1 which was released today, they are one of the largest service providers in the Untied States. It is important to note that frac spreads only tell one tale of the story as the shale industry moves towards simulfrac, quadfracs, etc. For the past several years NCP advocated that the biggest risk to oil markets this time around was not shale but low decline and long cycle supply growth, something we still cling to. Nevertheless, a decline in shale activity could result in falling American oil production which may spark a change within the Trump administration’s quest for such low oil prices. While declining shale is probably not going to save the oil market or boost prices much in the short-term, NCP thinks it could alter the narrative. Of course, depending on the ferocity of the drop, should it materialize at all. NCP will be watching guidance from American shale E&P’s and OFS companies in the coming weeks.

Global demand is another one to watch. Given in NCP’s view that oil sold off at least partially on broader macro issues, the bear case for oil could be upended by an economic recovery or perhaps even the impeding of further economic decline. There is a wide expectation of a recession, even in the United States now, which clearly investors expect to impair global oil demand. Historically oil demand does not weaken that much during a recession and recessions tend to be short-lived. NCP has warned against using China’s economic activity as a barometer for crude given electric car and CNG truck ramp up but should Chinese economic activity pick up, it surely won’t hurt crude prices. NCP of the view is that oil could see material upside should the narrative improve on the global economy as we perceive this sell-off to be macro driven in addition to the OPEC news.

Declining US dollar has historically benefited commodities as it lowers the cost for importing countries around the world which have a higher sensitivity to oil prices. The US dollar (DXY) has seen a major drop in the past few weeks and is now at a multi-year low. With declining interest rates in many parts of the western world plus China, the probable likelihood of further interest rate cuts, the macro economics from a monetary front is increasingly being swayed in favor of commodities. I would not buy oil simply because the US dollar is in decline but it creates a tailwind for oil demand and has historically helped bolster demand which will eventually help raise prices. This is not something I would expect to happen overnight but perhaps over the period of 1-2 years.

Where are the opportunities?

In NCP’s view, when everything gets whacked, it offers opportunity to ‘high grade’ ones portfolio. Many of the best names in the space got hit with the bad. Even natural gas names which have little exposure to oil other then some liquidates production sank. In NCP’s case, we added a couple oilfield service names. Last week I wrote about Precision Drilling, which I initiated a position in. In the past couple days, I added a second oilfield service name in Profrac (NYSE: ACDC), a name I have written about in the past and has a significant weighting to US natural gas activity with a number of service lines not confined to oil. OFS stocks are not for everybody and I take a traders approach to them. Unlike E&P’s, OFS companies are not getting paid by commodity prices and much of their equipment is contracted so cashflows may not change as much as one expects. While declining commodity prices is likely to put a dent in spending, it may not be as intense as the permabulls are hoping for. Especially for ‘next generation’ equipment which is still a relatively tight market given a recent wave of consolidations and retirements in the space over the past several years.

Other areas of the market that attract me right now are elements of refining. Low oil prices can stimulate demand and lead to wider product cracks. While NCP has not yet added refineries, one name that comes to mind is the very hated Cenovus which happens to have amongst the best upstream assets in North America. They have several refineries in the United States which have done poorly for a number of reasons including very poor product cracks. With two more refineries in the United States going down in 2025 it seems likely that we will see an improvement in the space in the next year or so. While a recession may crimp refined product demand in the short-term, when the storm clears it seems likely that this space should outperform. In the coming months NCP expects to pursue refining opportunities more carefully but does not have much to add here.

Canadian oilsands names are amongst the lowest cost of supply in the world and can whether a storm. With a relatively low Canadian dollar, even after a modest rally, historically tight WCS spreads (latest data shows under $10), all of the oilsands names should be able to sustain themselves comfortably in this environment. NCP would feel comfortable adding them. Last year NCP had Strathcona Resources as a top pick and still feel good about it. Any of the oilsands majors should continue to excel here and are likely good buys on market overreactions with extreme cases of pessimism, even if looking for a shorter trade idea. CNRL for example has a 6% yield which is likely to capture some attention from the dividend crowd. It is still covered but otherwise ‘not exciting.’ My way of looking at CNRL here is that if they cannot pay their dividends, it is unlikely any other producer in North American will be able to which is bullish.

Natural gas seems to be the biggest likely winner of an oil market decline for the simple reason that declining oil production in North American can be bullish for natural gas. The problem I see is that many investors were already bullish given ‘A.I and data centers’ which makes it less appealing as a direct trade unless we see further sell-offs which would most certainly be a buy. US shale production creates a massive amount of byproduct natural gas which is known as ‘associated gas.’ This gas comes out of liquids wells where liquids is the primary target. It has been a huge problem in places like the Permian basin which although are liquids rich, produce significant amounts of natural gas. The latest Matterhorn pipeline has added a significant amount of gas capture in the Permian and brought it to the markets. With more US LNG capacity coming online, it seems likely that American producers will have to ramp up growth on the natural gas side. While much of that growth was likely to be ‘dry gas’ it sure will not be helpful if liquids production does end up falling which may reduce the amount of associated gas. This is also an issue in the Alberta Montney which is liquids rich but very gassy and often results in devastating AECO natural gas prices. If I had to wager on any outcome in this scenario it would be that natural gas comes out ahead from an oil market decline for the aforementioned reasons with a ‘high’ level of confidence.

Mistakes not to make for oil investors who don’t want to get hosed?Geopolitical risk is omni present, but there is still a number of oil permabulls surfing the idea that Iran is going to get bombed and their oil will be taken off the market. It seems pretty clear this option is not the preferred option. NCP wrote about the Iranian and Mideast issue, pouring water on the oil bull case for the past couple years with a high degree of precision. Iran has been hit clandestinely so many times including on their nuclear program which has resulted in significant causalities of top level officials. In the past few months we have seen Iran helplessly watch their clutch proxies in Lebanon and Syria face complete annahilation without a whisper from the regime. It seems likely that Iran has accepted their fate, the only option is a deal. If they are dumb enough to act bad here it is possible we see further crimping of sanctions or even an Israeli military attack but if it happens and oil prices spike, it will be a selling opportunity.

Oil bulls are still constantly raving about US shale activity being at risk. They scoff at ‘drill baby drill’ while the US rig count is constantly in decline. NCP agrees this is more like ‘schill baby schill’ and a political rallying cry, but its importance is overrated and nobody in the energy space with knowledge really expected this to materialize. If anything, the saying was catered to Bubba Gump in Alabama, not sophisticated crude traders around the world who know that shale is not going to grow at $60 or even $70 oil. While this is undoubtedly true, the main risk for oil markets has not been shale for a number of years. Production is back near all-time highs and is no longer growing, but US offshore will be growing this year by approximately ~300,000 barrels per day. US shale is the higher cost producer and the reason their production may fall is because oil markets may prove to be oversupplied. It isn’t immediately bullish but will likely have a more medium-term impact if production falls.

Oil bulls love to flaunt the lower US inventories or the drainage of the SPR. It is important for anybody who doesn’t know, the SPR does not need to be re-filled at all. It is not a security risk to leave it as it stands by any means. The SPR was created decades ago when US production was not as it was today and there was nowhere near the import capacity from Canadian oilsands to the US PADD system. Today the world has changed and so has US energy security. The US is not dependent on the OPEC nations or hostile states for their energy supply. They do not ever have to re-fill the SPR and if they do, it may be done tactically. On the other hand, low US inventories are most certainly a real thing but investors have cued on that OPEC can game the US inventories as they known they are transparent forms of data which have been used to manipulate markets and prices in the past. NCP would be more bullish on inventories if refined products showed a significant pull as it would likely be prelude to a legitimate case of crude imbalance within the American crude processing complex.

Conclusion?

Oil has undoubtedly been hammered to a point of capitulation along with energy stocks. Normally I would be excited and want to take significant exposure, but this time around I only added modest positioning. It feels different because of broader macro risks. The reasons outlined in my post are scenarios in which NCP would be willing to significant up the ante in the energy trade. The sell-off provides opportunity and makes the space more interesting. Timing is important.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Nice pick Roger - bought ACDC last week, great minds think alike! LBRT ER was very encouraging.

Long time SCR holder. Not everyone has capitulated . Mike Rothman is extremely bullish gives little heed to any “official numbers” spewed forth by the agencies .

Go Jets!