Hi everybody,

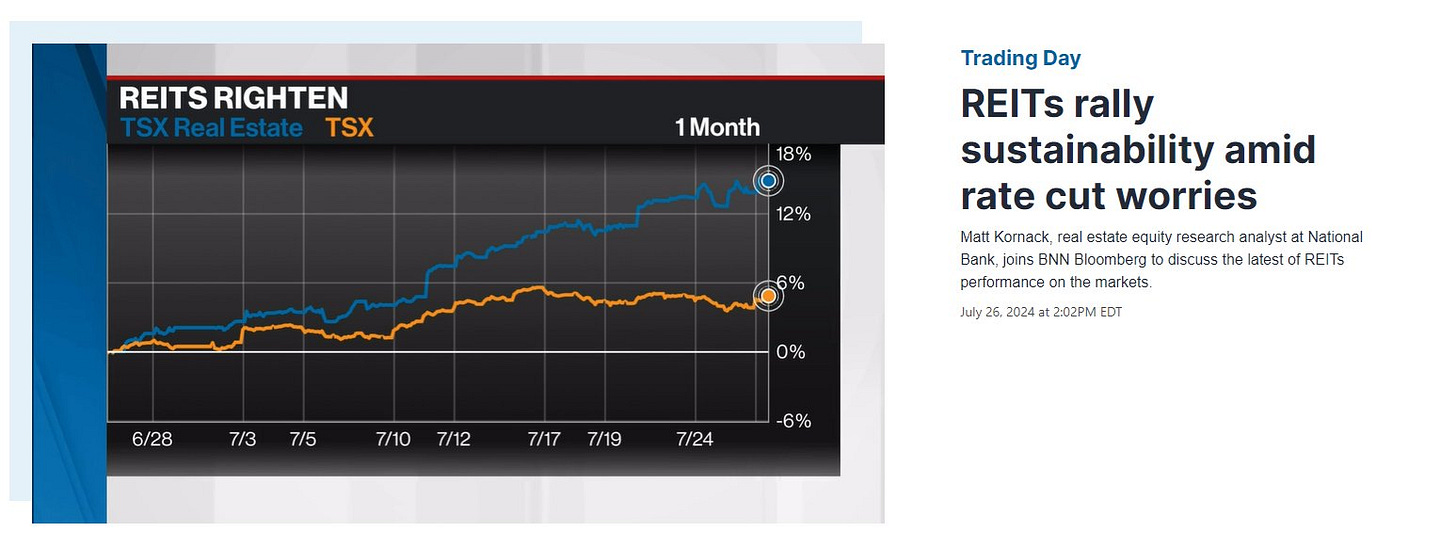

It’s been quite a good two weeks for investors as inflation in the US continues to come in soft and the Bank of Canada has now executed its second consecutive rate cut. If you remember our writings this year, we thought that gold and real estate could be top performers and so far that continues to work out on the gold stock side while real estate and home builders has been a top performer over the past month on the TSX but we think it has significant running room and stock pick selection is important.

Read: NCP’s “top 10 investment ideas” for 2H 2024 (May 19, 2024)

Next week the US Federal Reserve meets and is expected to signal that they will be cutting rates in September, although a July ‘surprise’ cut is unlikely, it cannot be ruled out and the bond market thinks it is possible as US unemployment now exceeds the Fed target of 4% and the inflation readings have been within line. The bond market seems to think that up to 3 rate cuts are possible and there are even talks that up to 50 basis points cuts may occur at once if labor market risks intensify.

Our view on real estate has only intensified, as US inflation data becomes better than expected and the call on Bank of Canada to further cut rates become more obvious. While a lot of sectors with debt are constantly thrown into the bath water as “bond proxies” we think real estate is truly the biggest benefactor given the relationship between cap rates and interest rates on both existing valuations of real estate and also the transaction liquidity which increases in a falling rate environment, which will likely lead to more respect given to real estate “NAVs” as evidence surfaces the sector is unsustainably discounted relative to the private market gap.

Some REITs in our portfolio like Artis will immediately see the impact of falling rates, given they had variable debt exposure. Overall the sector becomes more attractive to income seekers who will be forced to sell things like guaranteed income certificates to bolster their fixed income yield portfolios. This makes things like REITs and other higher dividend paying instruments more attractive as liquidity returns to the public markets. As rates go down, the chance that cap rates which have expanded over the past few years can compress which leads to higher valuations and higher NAVs, which ultimately leads to wider discounts and analyst upgrades.

The Bank of Canada made interesting remarks over the past several meetings on housing, that alluded me to believe they will oversee the cost of shelter inflation which is beyond their scope given government policy and how important it is to ultimately correct the problem which is recognized to be be not only related to interest rates (see Carolyn Rogers said interest rates alone can’t solve the problem.) Lower interests rates will stimulate new build construction, which is currently weak because of poor economics. There is record demand for new construction on the residential side in Canada but the price must be right to unleash it. Right now, in my view, there is increasing pressures across the board and all parties to stimulate developers to bring on new supply. Hence, I think Dream Unlimited is a great way to play the residential pipeline development story in Western Canada.

Overall I think it’s prudent to be invested in a historic supply shortage on the Canadian side, although I prefer to play it with the development angle over holding residential apartment operators where there is more political pressure and higher existing valuations, although still sizably opportunity. On the commercial real estate side, there is literally a construction freeze and aside from offices, the market remains extremely tight with record low vacancies in industrial and retail. We think this is an opportunity and a perfect set-up at cyclical troughs that will offer upside for years to come. Even in office, much like oil prior to 2020 with the green energy narrative, when something becomes so hated and out of favor while the narrative becomes so bad, existing supply disappears and new supply stops being built while the population surge in Canada and the United States continues, leaving even opportunity there.

Right now it seems all real estate asset classes are being grouped in with the poor office narrative, that largely stems from weak markets in the United States despite being only a small component of the overall “CRE” market. Despite the narrative, supply is as tight as it has ever been in residential and North American retail, while industrial remains near all-time lows on vacancy despite a surge in new supply while only office is weak although that seems to have stabilized. Record pricing power in some asset classes continues to be reported and expected. Meanwhile the narrative is the entire sector is going under, again, we see this as a meaningful opportunity that will likely be paying us oversized distributions for a number of years.

Below you can find NCP’s current weightings to real estate with a brief thesis attached as to why we are invested in each story.

Canadian-listed Real Estate Holdings

Dream Unlimited (TSX: DRM)

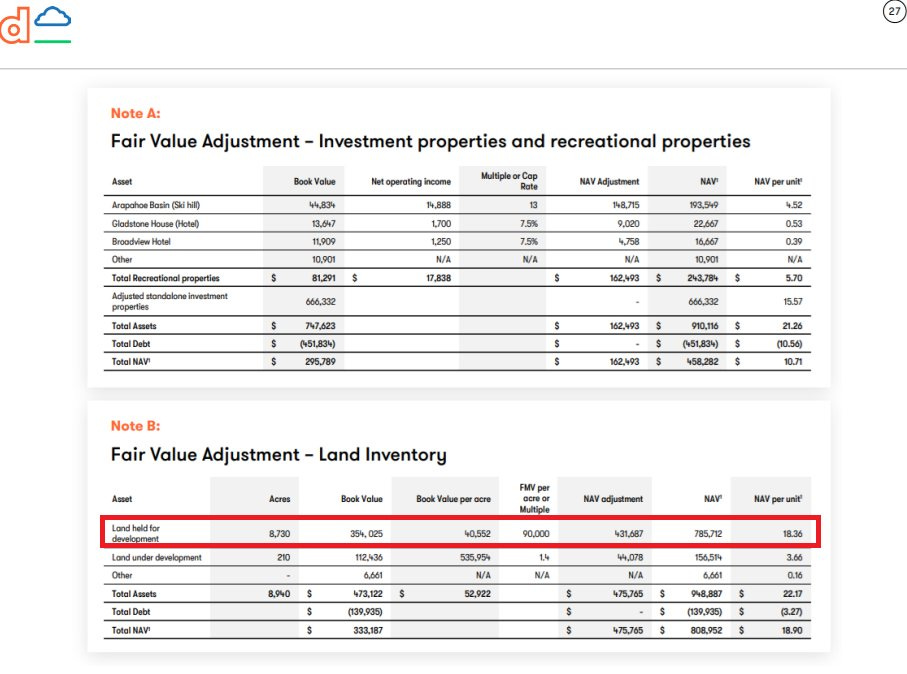

Dream is a TSX-listed real estate holding company. I added to this name over the past couple weeks as clarity on rates became more visible. The current NAV is $58 and before you tell me the NAV is fake, I actually think the NAV is likely understated. Dream Unlimited holds around ~9000 acres of master planned residential acres in western Canada, predominantly in the Calgary, Edmonton, Saskatoon and Regina areas. Over the past quarters they have sold land magnitudes of where IFRS values hold them (between $40k and $90k). I believe Dream Unlimited’s residential land should be valued in excess of $200,000 or more per acre given the surge in valuation over the prior years and strong demand in Alberta. As the communities get built off on Dream’s land, the adjacent lots go up in value. They noted record land sales for this year and into next year as new communities get built out in Saskatoon. They recently sold a Denver-based ski resort called Araphoe Basin and made $110 million in profits in doing so. The deal has yet to close but will give Dream records amount of liquidity. The company also has numerous other rental properties, apartments, retail sites and land i prized downtown Toronto locations plus holdings in several other Dream entities which are only a small insignificant portion of their NAV. Dream is also building their asset management business significantly on top of it. Overall, I expect Dream Unlimited to be a top winner in the coming real estate build cycle.

Plaza REIT (TSX: PLZ.UN)

Plaza REIT is a pureplay Canadian retail opportunity that often gets left off the radar of better known and far more expensive entities like Riocan, Smartcenters or Choice. It’s a small cap name led by prominent Canadian real estate developer Michael Zakuta who has ran the operation since 1984. Their focus is on Atlantic Canada and smaller but growing Quebec & Ontario markets. Atlantic Canada has led the coutnry in population growth over the past few years and real estate values have since soared. Meanwhile, Plaza REIT value has fallen along with other names in the space as the sentiment around real estate investing is extremely poor and at a cycle low. Mostly all their properties are anchored by grocery store chains or such as Shopper’s Drug Marts. In 2024 alone they have already brought on several new properties which will begin contributing income. They have the strongest FFO growth in the Canadian retail space and offer nearly an 8% yield. Plaza REIT NAV is around $5.50 so the opportunity to get in at a near historic discount gap is very compelling. Canadian retail fundamentals are the strongest in history with only 1.7% vacancy rate being reported. Michael Zakuta has noted on the last call the demand for their properties is at a historical high with only a smallscale pet store reporting sales weakness.

Artis REIT (TSX: AX.UN)

Artis is a diversified REIT that does business in both Canada and the United States with their operations nearly evenly split. Artis also has a large weighting to industrial yet trades alongside pureplay office names which we think is largely unjustified given Artis’ demonstrated ability to sell assets at low cap rates even during periods of cyclical weakness. The US exposure may have benefits in a weak Canadian dollar environment as Artis has successfully pulled off some impressive sales this year, including a $220 US million dollar Houston industrial sale at a low cap rate which recently closed giving the REIT a strong amount of liquidity. With USD-denominated sales and also cash flows from strong USD-paying assets bases, Artis will be able to pay off cheaper Canadian debt tactically. Artis trades at one of the highest discounts to NAV ($14.30) in the Canadian real estate space which is factored in after cap rates already expanded and non-cash losses (write downs) have already occurred. that leaves massive opportunity if cap rates compress once again as interest rates fall. In any case, the biggest overhang on Artis was their poor debt structure, which featured a lot of short duration and variable rate debt during a period of real estate weakness on the office side and high interest rates which pushed their distribution to the limit. Fast forward to July 2024 and they continue to sell assets, with around $700 million assets sold in 2024 alone including weak Winnipeg office properties recently announced to the Metis Federation of Manitoba. This puts Artis in a position of strength as they will be able to tackle their near term maturities. Artis has the most exposure to floating rate debt so will see a FFO boost as rates fall. Since 2020, Artis has bought back ~25% of the common units and a significant portion of the preferred shares which has meaningfully reduced the distribution payout ratio and had an accretive impact on their NAV, which went up in Q1 2024 due to buybacks. Artis has some of the highest insider ownership in the space and is led by notable activist investor Samir Manji, who has a dedicated mission to restore the unit price to NAV.

European Residential REIT (TSX: ERE.UN)

European Residential REIT is a small cap opportunity that is majority owned by the more well known CAPREIT (TSX: CAR.UN) and shares the same CEO in Mark Kenney. Earlier this month they announced they sold around ~15% of all their units “at or above” IFRS value ($2.70 today v. $4.30 IFRS NAV). Costar recently reported that Alternative Wealth Manager Angelo Gordon wanted a “slice” in European Residential REIT and the REIT has re-launched the sales process with Colliers. European Residential traded above $5 for some time and seemed to have sunk with the space and higher interest rates. As rates went up, cap rate expansion occurred causing the debt ratios to expand without actual increases to debt load. That seems to have reversed as the last quarter showed cap rate compression on certain assets. In any case, the strong liquidity generated from the recent asset sales puts European Residential into a position of strength. We think there is more sales to come as CAPREIT has been seeking to exit international plays and focus on Canada, with a recent largescale disposition in Ireland. Netherlands, where ERES does 100% of its business is one of the best housing markets in the world, with an acute shortage even worse than what we have in Canada. Each July 1 the country allows for operators to increase rent, this year it is expected to be a boost of minimum of ~5%. ERES targets between 4-7% annually, which will be an FFO boost even with higher rates. As we wait for Mark Kenney and his team to make their next move, we collect a 6.4% yield.

H&R REIT (TSX: HR.UN)

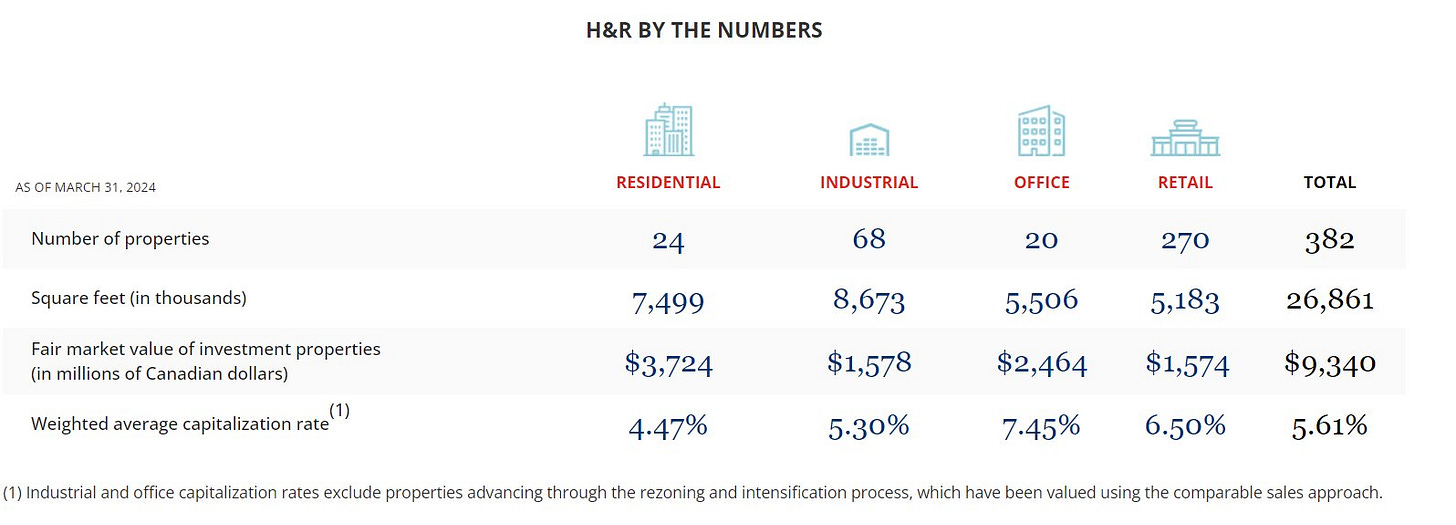

H&R REIT is one of Canada’s largest and most discounted names. In my view, like Artis, it is widely misunderstood and out of favor. With around a 9% implied cap rate and over 50% discount to IFRS NAV of $21, it’s safe to say that H&R is out of favor. Despite such a discount, the opportunity is very compelling. With majority of H&R exposure weighted to very nice US residential and industrial, the name trades alongside weaker office names with less good properties. H&R offices are mostly quite compelling, including higher end properties in New York City which are strong markets. In Canada, over the past two years they completed two 9 figure office sale property sales in Ottawa and Toronto for very strong prices at low cap rates. Their spin out plans seeks to exit retail and office altogether while focusing strictly on residential and industrial, which may ultimately lead to a re-rate as both asset classes are far more in favor with investors. Given the interest in M&A of both industrial and residential names over the past several years, it would not surprise me to see H&R ultimate spin off both asset classes to private or public market acquirors at a large premium if the discount persists. H&R also offers significant redevelopment potential off prized asset bases in downtown Toronto where currently, new build economics are out of favor due to high interest rates. As rates tumble these projects may become viable quickly and sought after by other developers who can buy the opportunities outright, form joint ventures (like Dream Office is doing with partners) or even build the projects themselves. This is only a bonus part of the story. I see H&R as a low risk opportunity to collect strong yield with some of the highest upside potential in the space and have added to my already large position in the past week.

Nexus Industrial (TSX: NXR.UN)

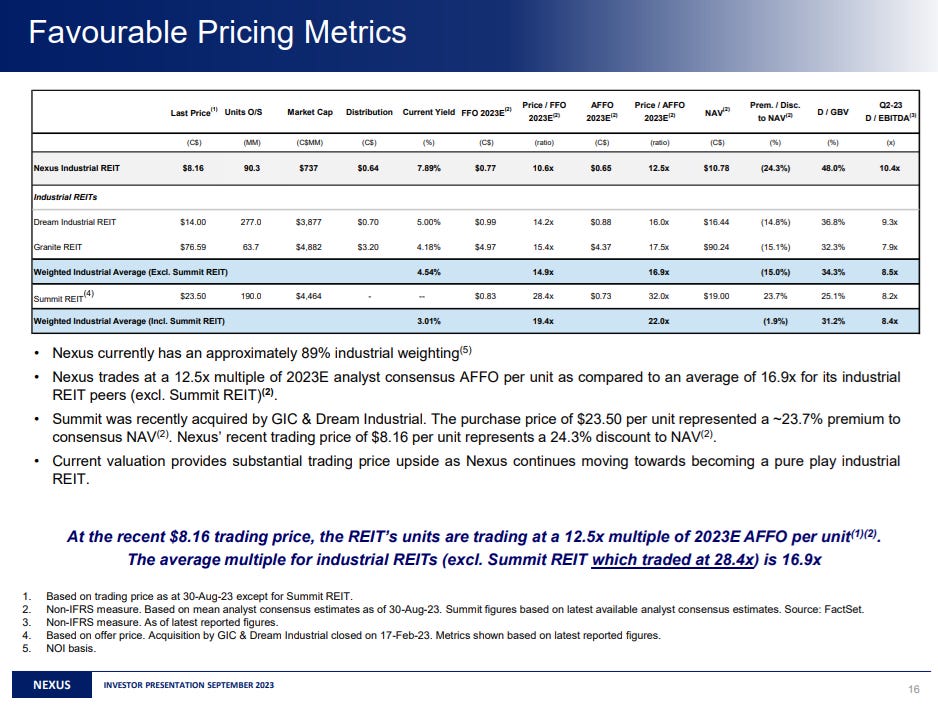

Nexus Industrial is a small cap industrial REIT that has almost completed its transformation to becoming a pureplay. I started adding this recently in the past month below $7 as it sold off on fears that the distribution which was yielding over 9% would be imminently cut due to high payout. However, after a large million dollar buy from one of the key insiders who himself is a commercial real estate developer, I took a closer look. On the Q1 call the CEO noted that the REIT had completed several asset sales to spin off remaining offices in Montreal, which were located in the prestigious old port and had some plans to sell retail assets, for a total of $200 million dollars which would bolster liquidity, reduce debt and improve the payout ratio. The CEO also noted that some of the vacancies they experienced would be backfilled in the 2H, leading to higher occupancy. It was also noted that some of their construction projects that were organic were closing in on completion and would further boost the REITs FFO and lower the payout ratio. Nexus already trades at a very large discount relative to cap rates, which are much wider than peer group, leaving new investors a comfortable margin of safety. Even if they were to cut the distribution, that wouldn’t change and Nexus would still be a table pounding buy. In their old presentation, they note the discount and how much peers were acquired for. Industrial remains an in favor asset class and M&A is strong potential with a small cap name like this. In any case, getting just a hair under 9% yield on my cost average at nearly a 50% IFRS NAV discount provides me with a compelling opportunity regardless.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Great write-up. Institutional REIT ownership is near all time lows and REIT’s have returned poorly the last decade. The better REITs should move significantly when institutional flows start again, I’ve been buying most of these names and a few others for a while and it is getting more difficult to find volume without moving the price, noticed this especially with Dream Unlimited and Plaza Retail the last few weeks.

More early than clever at this stage…😂😂