Hi everybody,

I thought I would make a quick write-up about some changes in the past week since NCP put out an article announcing we upped our energy positions. You can read it here if you missed it. Happy to report our adds were largely successful, with Paramount Resources (TSX: POU) up around 10% since and our US oilfield service positions in Profrac (NYSE: ACDC) up 26% since the time of add only earlier last month. You can read the rationale behind adding US oilfield service exposure here if you missed it. While we still kept our core positions and used the opportunity to add to Strathcona (TSX: SCR) which initially didn’t move much for the first two days of the crude rally, NCP did decide to sell Paramount while which was a large position we felt had exceptional risk-reward at the time of writing only a week ago before a significant rally. NCP still thinks Paramount is a great name to own and natural gas can outperform in 2025, but we are going to go back to the sidelines until the current Iranian noise subsides and crude has a clean slate again.

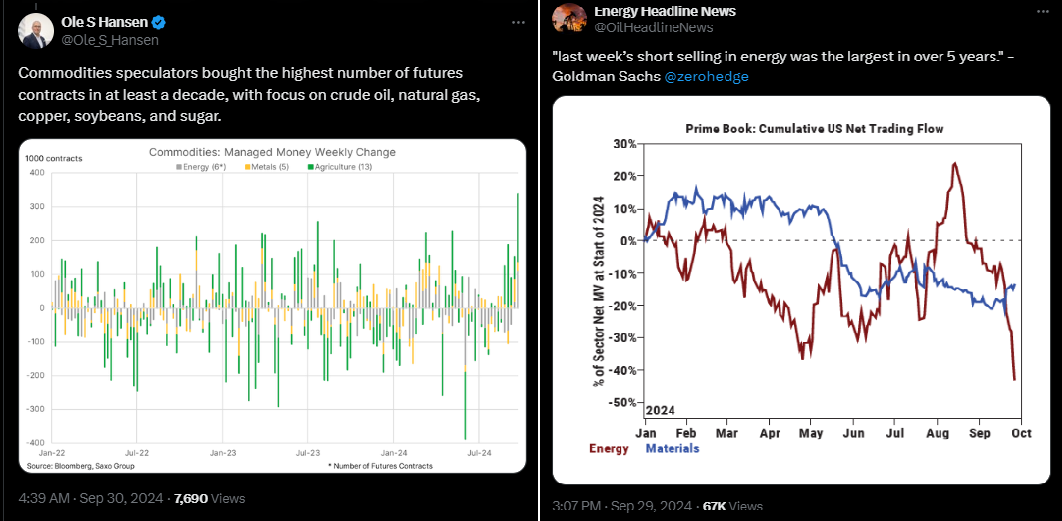

FUNDAMENTALLY WTI HAS SUPPORT AT $70 BUT DUMB MONEY IS BACK

In NCP’s initial rationale, we felt that crude at $67 was simply too low of a price fundamentally to justify and sentiment was overwhelmingly negative. Our thesis had nothing to do with Iranian tensions with Israel, a move that seems to be adding torque to the current rally which we thought had macro merits. Ultimately, while NCP thinks crude priced at $70 is a reasonably safe level and should be able to hold throughout the rest of the year based on fundamentals, the Iranian-Israeli tensions has brought murk to the waters and the dumb money has returned after mostly folding in the past month at peak market despair or close to it. Whenever the dumb money bid returns to oil, even if fundamentals justify a move, the downside can be meaningful on any de-escalation headlines, something that NCP believes is more likely then not as we don’t believe Iran’s regime has an appetite to engage Israel-USA nor do we think that the USA or the higher powers wants to see an extension of conflict. Israel’s hits on Hezbollah have been serious, savage and intense, but to us this feels more likely that Iran is quivering in fear then plotting meaningful revenge.

SENTIMENT CHECK, WHAT A DIFFERENCE A FEW WEEKS MAKES

OilStockBagholder returns, formerly known as TradeOilStocks, goes big into Athabasca, Cenovus and MEG Energy as crude rallies after recently throwing in the towel near cycle lows, likely selling to the algos at technical resistance. TradeOilStocks also has stated he is bullish on geopolitics in recent posts which means the sentiment bid is about Iran currently.

Nine Point Energy Fund Investor Facebook Group leader Warren Fine seems suddenly wildly bullish on oil due to geopolitics, after only recently announcing he was closing up shop after having sold 85% of his oil stocks a couple weeks prior.

Correlation Economics was wildly bearish only a week ago on oil, suggesting to avoid oil until crude goes negatives, but now is considering loading up on low quality risk cos. The difference between posts (and sentiment) is literally only days apart but complete extremes:

Self identified #COM member, fund manager, Cole Smead who had not Tweeted about oil stocks for several months prior to being loudly bullish suddenly is making TV appearances with BNN’s host Andrew Bell. Other commentators are on the airwaves warning about critical supply shocks and $100 crude all over the place:

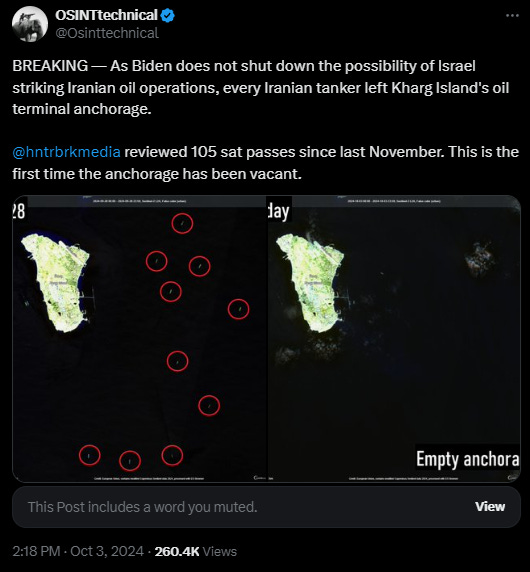

IRAN HEADLINES ABOUT OIL APPEAR TO HAVE DRIVEN RALLY TODAY

Oil prices really spiked today off news rotating X that Israel was considering hitting Iranian oil infrastructure based on comments that Joe Biden made. The comments were taken out of proportion. You can watch his comments here as Javier Blas of Bloomberg uploaded the clip. It seems pretty obvious that Biden has not committed nor was overtly interested in attacking facilities. We know that the Biden administration has been rather religious about keeping prices low. Considering the move was quite substantial in equities based off the news floating around, we think the downside in higher beta names could be as torquey as the outcome does not materialize and there is potential for de-escalation in the coming days.

NCP DOES NOT THINK IRANIAN TENSIONS RESULT IN WAR

The hits by Israel have been substantial, precise and literally devastating to Hezbollah in Lebanon as well as Hamas in Palestine, Syria and Tehran. These hits have literally exposed these Iranian proxy units as totally infiltrated if not outright spied upon. There has been estimates that the majority of Hezbollah’s senior leadership has been destroyed. Keep in mind in recent months, Israel has also killed Hamas’ political leader in the heart of security controlled Tehran only hours after he met with the Grand Ayatollah. NCP does not believe that Iran’s new President has ambition for war, nor do the majority of Iranians who are battling domestic economic turmoil. While there is a likelihood that hardline Khoeminists would like an escalation, it seems unlikely at this point. We think the recent Iranian missile strike in Iran was to save face with hardliners, very reminiscent of the last time Israel attacked Tehran to kill Ismail Haniyeh. Iran understands well that their back in China does not want higher oil prices and they have a limited buyers pool for crude. They also understand, now likely more then ever, that Israel and United States have overwhelmingly greater firepower which would likely bring ruin very quickly to Iran’s regime should things escalate. Lastly, Iran’s neighbors are not allies but adversaries, with the Gulf states strongly in the corner of the United States. Consider Qatar’s Emir warmly hosts the largest US offshore military base in the world - only minutes from Iran.

BOND YIELDS UP OFF THE OIL MOVE, IGNITING THE REFLATION TRADE

Bond yields have had a strong correlation in recent times to rising oil prices. Today rate sensitive names had some weakness as oil prices caught a bid. Inflation however appears to be falling below the Fed’s target which is also the case elsewhere in the world such as China and Europe where deflation is now a larger concern. Given the macro flows, NCP thinks it is prudent to maintain energy exposure as we think macro tailwinds are still likely from China in the more medium term. The short-term move is likely being driven by speculation and short covering, which is also something to be mindful of as the revival of Chinese economy is not conclusive by decree. At $73 WTI and still low gasoline and diesel prices thanks to global downstream production adds in the past year, NCP thinks it is likely that inflation stays subdued. If we start seeing soaring refining cracks or product shortages, or oil crossing the mid $80s, it is more likely to make an impact on the longer term inflation expectations which we would expect to have a larger market impact beyond short term moves.

ONE CANADIAN REIT NAME NCP ADDED TODAY

NCP took the opportunity to add to InterRent today, a name that has been significantly underperforming the market of late. At a 5% implied cap rate with a meaningful NAV discount, the risk-reward is very good. Inter Rent is one of the sector leaders, second only to CAPREIT which has been outperforming in the Canadian residential space. They enjoy steady SPNOI growth and a continued tight rental market across various cities in Canada which is unlikely to change in the coming years. In our view, the current weakness is being driven by modest immigration changes with students and having a lower distribution yield then other higher yielding REIT peers which are favorable given rates are still relatively high.

As bond yields in Canada continue to fall, NCP thinks that it favors particularly the residential names which have been trading at lower implied cap rates with lower distribution yields. Inter Rent is as low risk as you can find for the REIT space given the sound nature of Canada’s apartment shortage with a structural shortage that housing experts do not believe can be resolve over the next decade. Into 2025, NCP believes that a coupe of the residential laggards can catch a bid and we are now long both Minto REIT (TSX: MI.UN) and InterRent (TSX: IIP.UN) as we believe new entrants, particularly those with a hunch for lower risk, lower beta, will prefer to chose names that have sound fundamentals and lagging charts rather then bid up the better known, more popular names like CAPREIT which have bene outperforming.

IN CONCLUSION

NCP is watching energy to see if demand picks up. While it’s possible the geopolitical risk premium being embedded can hold, it can also flip very quickly, especially in higher beta names. The current trends seem to favor natural gas into 2025 given low drilling and completion activity in US shale basins as well as normalizing inventories and NCP remains cautiously optimistic for the aforementioned reasons. Meanwhile, Russia’s Novak recently stated that OPEC+ intends to resume barrels to the market in December, potentially putting pressure on crude prices. While we take things Russia says with a grain of salt, the threat is there and NCP thinks macro strength in China and elsewhere will determine crudes fate next year. As rising energy prices has implications on sentiment and flows elsewhere, it’s imperative that one never loses focus on the trajectory of the crude and refined product market given it often drives inflationary expectations. For the moment, NCP has left with slightly upped energy exposure even after profit taking on recent tactical adds, which got wildly oversold but remain favorable to rate sensitive sectors such as Canadian real estate. We have also began to research tax loss opportunities, something NCP plans to write about more thoroughly in the coming weeks.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Roger, do you have ideas for any refineries that stand to benefit from Israel hitting Iran's refining operations?

Great results on POU. Did you exit anything else? Dumb question, what is #COM - I see it everywhere, and googling doesn't yield results.