Some updated energy thoughts

Hi everyone,

This morning I thought I’d write a bit about updated energy views. As I mentioned on Twitter, I do not expect oil to fall further from here. It could happen but it then becomes at a point where a threshold of pain is met (see: Diamondback Energy warns that US output could plunge) from lost production capacity which ends up being most likely medium term bullish. On Friday, OPEC had a meeting in which they agreed to add barrels onto the market. There were even some stories that OPEC was contemplating going above and beyond that number which seemed to further put pressure on crude prices. So the status quo decision of an incremental 411,000 barrels per day was the final number. These unwind some of the 2.2 million barrels of voluntary cuts. Ultimately, I do not put much thought into these numbers at all unless there is evidence of compliance and also true output lift. There have long been reports that OPEC members were cheating or in some cases, even using other OPEC members output to mask the true origin of barrels (Iraq-Iran, Kazakhstan-Russia) so the data has always been murky, at least to me.

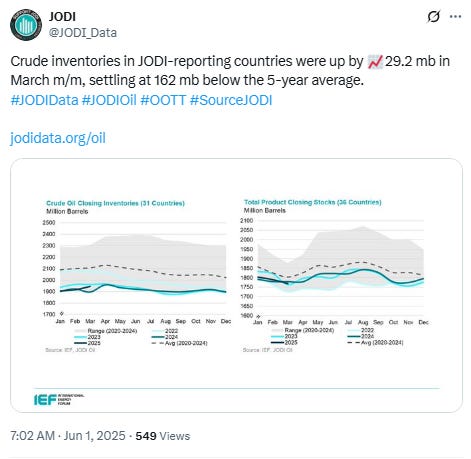

Now don’t get me wrong, I am not a big oil bull, just not as bearish as some of the crazier views that came out, including from fallen oil bulls like Amrita Sen of Energy Aspects who recently noted that oil could fall into the $40s, after only bragging about being a bull above bank estimates in March with a $75 estimate! NCP just does not expect things to get worse, and if they do, it’s hard to see them get much worse. If it does get worse I would anticipate it comes with a significant macro event, perhaps a global recession, which is not my thought as some of the world like China is already in economic troughs and an emergence seems more likely then further declines. I do not think that it is far-fetched to see $70s again this year if macro sentiment improves, as the entire sell-off in oil began with Trump’s “liberation day” noticed coupled with OPEC’s ‘shock’ announcement about lifting output cuts. Unlike the broader market, oil has not recovered the losses, but other sectors have. Perhaps the most interesting news to oil to play the ‘contra’ thinker is that KPLER, the world’s leading oil inventory tracker, has reported that barrels from OPEC remain essentially unchanged.

NO SIGNS YET OF INCREASED OPEC BARRELS PER KPLER

In my article in April (see: Oil bulls have completely capitulated) NCP wrote that it is important to note whether the OPEC adds are ‘real barrels’ or just verbal barrels, essentially to get the monkey off their backs from Donald Trump, who may be applying political pressure. In past years, OPEC has faced significant pressure from various US governments for price collusion. Now with the formal release of cuts, that pressure is likely dissipated. There have been long reports that OPEC members were cheating to begin with while others, like the United Arab Emirates, have been rather feisty about increasing their crude quotas. So without genuine crude additions from OPEC on the export side, this is nothing but an announcement and no behavioral changes. NCP believes it is important to watch if OPEC actually ramps up exports or increases production. Based on recent drilling reports, it seems that Saudi Arabia is actually scaling back drilling activity this year so it seems unlikely organic growth is coming out of OPEC’s largest producer and defacto leader.

GEOPOLITICAK RISK NOW NEARLY COMPLETELY EXTINGUISHED

Geopolitical risk factors that we thought were unwarranted was another reason that NCP generally stayed away from the oil market over the past couple years. Things like Hamas’ invasion of Israel and the subsequent reprisal from Israel into Gaza just did not strike us as ‘bullish oil’ by any means. The so-called Iranian sanctions was only pushing barrels into China, the only buyer of Iranian crude, at a discount which put pressure on crude prices. Until recently, Russian barrels seemed to have a very limited home between India and China, again, putting pressure on crude as Russia was forced to sell a significant portion of production at a discount. Then came the Houthis, mostly a rank of tough tribal rank-and-file types who were getting malicious with cargo ships in the Red Sea off the coast of Yemen. Whatever Trump did to them seems to have silenced them. Lastly, the Iranian situation with Israel, which was very bearish. The most latest reports suggest that Trump is looking forward to an Iranian peace deal and that Iran has expressed potential willingness to accept US inspectors. It appears a deal is coming, further squashing out remaining geopolitical risk in crude.

HARD TO BE BEARISH NATURAL GAS AND OIL AT THE SAME TIME

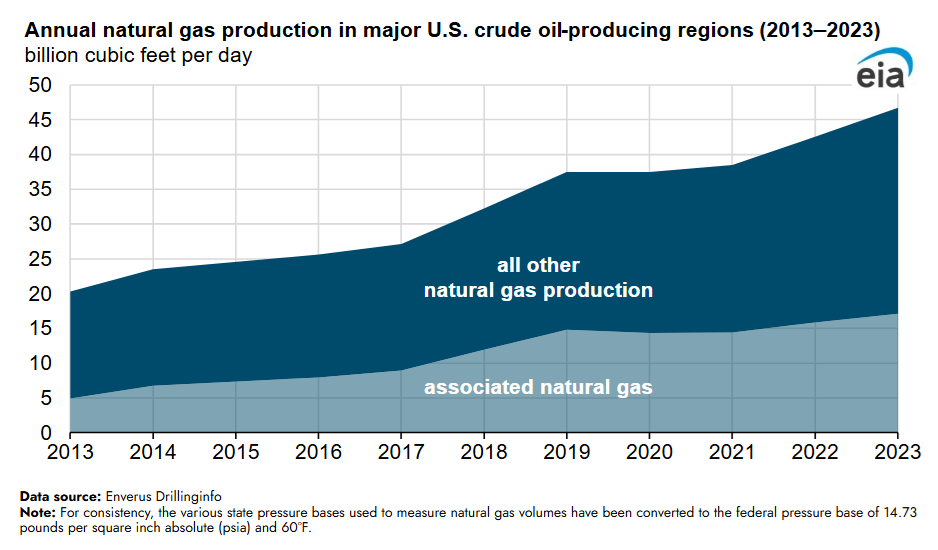

NCP’s first reactional thought when OPEC decided to crash the prices on Trump’s so-called Liberation Day announcement was “this is very bullish for natural gas.” NYMEX prices going up was my very first instinct and if I recall, EQT was the only energy stock that day of significant market bloodbath that finished green. A perfectly fundamental outcome in my mind, even though I have no interest in investing in EQT as some of the “former” oil permabulls are now opting to chase. United States rig count is the lowest since 2022 and is now in a multi-year decline. The declines in rig count have been offset by increased drilling efficacy and higher horsepower per frac fleet, which has allowed for more pumping capacity amidst falling frac fleet numbers, a widely watched indicator of some of the permabulls. However, at the current low prices, it seems to be really weighing on US shale production sentiment and it is possible that we see declines. Any blip in recent acreage synergies from largescale operators may result in unforeseen weaknesses, an outcome that NCP does expect to materialize inevitably as the higher tier locations are brought online. Given that the United States shale producers targeting oil are in fact natural gas producers by virtu of associated gas (natural gas that is produced as a byproduct of oil targets) it seems likely that we could see natural gas production under threat into the face of a historic US LNG surge, with 11 bcf/d of demand expected into 2028. Therefore, it is NCP’s view that NYMEX prices have to rise or US shale oil production might rise to produce incremental associated gas. The second idea seems more challenged, so at the moment, NCP is more in the shale oil stays flat and NYMEX prices must rise.

WHERE IS THE PREFERRED ‘LNG’ OPPORTUNITY?

NCP are not LNG specialists but we pay attention to the domestic markets. There are countless LNG opportunities in various areas of the energy market, be it midstream, E&P but at the moment, NCP prefers to play it with American energy services. Over the years my favorite component of the space to make money has often been in the much hated energy service space, a very overlooked area of the market and one that is continuously written off, even when times are good. But the time to add oilfield service is often when times are not good, but a recovery is in sight. In April during the big sell-off, NCP got brazen and wrote that we added Precision Drilling (call me crazy, but I added a drilling stock), a name I am still long and believe is one of the best opportunities on the market as Canadian drilling schedules appear little changed, if at all, for 2H despite a meaningful pullback in oil prices. The bifurfurcation of the Canadian market ensures that there remains a high demand for Precision’s Montney-centric superspec rigs. Tighter then historical norm differentials of Western-Canadian-Select ensure that drilling activity in plays like the oily Clearwater remain ‘robust’ with no changes to E&P drilling schedules. However, the brunt of the recent sell-off in US oilfield service stocks has been even more compelling and NCP has decided to add a significant position in Patterson UTI (NYSE: PTEN). We sold our Profrac (NYSE: ACDC) after a significant rally as the name is up over 100% from the bottom only last month. Needless to say, we are enormously excited about the space.

Patterson-UTI is one of the largest drilling and completion companies in the United States. Since the Nextier acquisition in 2023, they have the largest pressure pumping fleets in the United States which has given them vertical integration, meaning an E&P can use the company to drill and complete the well without having to source different contractors. This is a distinguishing feature that may go along way when the market further tightens as finding labor and equipment has been a challenge. NCP believes in the next upturn that the US oilfield service market is likely to be tight, given the recent wave of largescale consolidations and continued equipment attrition which is reducing the available capacity of service fleets. Over recent years, there has been a continued transition to next-gen equipment where the bifurcation of the market means the best drilling rigs and pressure pumping fleets remain in high demand, while older equipment becomes obsolete or is forced to work at lower service rates, sometimes pricing itself out of the market as the economics do not work.

On the recent conference call, Patterson-UTI noted that margins were still being supported even amidst falling activity levels. This was something that was rather broad of the higher spec service companies and felt negatively at companies that have lower quality fleets, putting further evidence on the term ‘bifurcated’ market. It also tells NCP that the market of higher spec/next-gen equipment is likely tight and that is at or near a cyclical trough in the US oilfield service space. When demand for oilfield services increases, an outcome that NCP believes is likely to meet US LNG commitments, it could put a significant strain on the sector which will lead to a strong bout of pricing power, which is the time where oilfield service companies get ‘torque’ and outperform the market, an outcome that I believe is highly likely in the next 12-18 months. There is simply almost nobody bullish on US oilfield services in front of a historic LNG ramp up in the United States with all-time high production growth that requires a high service response simply to maintain short-cycle production levels. Without continued investment in the space at all-times, irrespective of commodity prices, shale production will fall.

With 15 billion cubic feet of LNG coming online in North America by 2028, it seems likely that drilling will have to pick up. For that to happen, commodity prices have to rise and likely so do service margins. The opportunity to buy the best oilfield service names in the United States right now at a cyclical trough where ethe shareprice decline has more then offset revenue lost while margins hold up seems like a compelling opportunity. For NCP, we entered the trade last week with high conviction and plan to write about company specifics in the future. Our biggest concern is broader macro concerns rather then commodity prices, as the cure for low prices is low prices and in a short cycle industry with high declines like US shale, low prices can be felt fast, as can the commodity response time. While it is possible that broader risks bring down the market in the shorter-term, it seems likely that energy is one of the safer sectors as it has yet to recover from the recent slump. Right now, there is almost nothing for investment in the oilfield service space, an outcome that likely bodes well eventually for oilfield service companies and perhaps not as good for E&P”s in the years ahead as service prices are likely to go up to support new builds. In the short-term it is is pain for longer-term gain. The outlook for United States oilfield services seems very strong for those who are able to service and fortify during the downturn which is more likely close to the end then the beginning.

CONCLUSION?

Energy is the one of the only areas of the market that really hasn’t recovered yet has significant importance. Much of the bearish catalysts have been realized and energy prices are likely at a trough. Natural gas prices will have to move higher to support US LNG production in the next couple years unless shale oil production moves higher and brings on more associated gas. The recent sell-off in oil appears to be the victim of Trump’s liberation day announcement and ‘would-be’ OPEC adds, that according to KPLER, have not actually at the moment added barrels to the market. With the US dollar weakening it may further put support on oil prices from further decline. The green energy movement has not been making good inroads outside of China where there has been a rapid growth of electrification of the automobile sector. NCP is still not convinced of a structural uptrend in oil but it seems almost certain that natural gas prices will have to move higher if oil prices do not. We think oil prices will not see further declines and there is not a will or desire from any market participants to have a significant inventory glut. As data changes, our views may change, but at the moment, we will step out of the bear camp and into the oil can hit $70s camp by year-end should broader macro concerns ease.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

NCP, what are your opinions on SLB as an oil upside name here? Is super beaten down, and looks like it is consolidating.

Greetings, NCP! New subscriber here. Been following your work on Twitter for a while. Long-time energy investor always looking for fresh insights. Recently followed you into PTEN with a new position. Let's make some $$$. :)