Hi everybody,

I thought I would write tonight and share some updated views on the Canadian public real estate names NCP has discussed in recent months. Some of which have done well and some of which have not, albeit, market performance wise. The fundamentals of all names continues to generally be exceptional. Trade wars becoming the prevailing headline haven’t been overly helpful for the asset class although it seems to have sparked a flight to the most defensive areas of the space like residential while most other asset classes including the dreaded office asset class appear to have bottomed with 52-week lows no longer appearing since the end of last year’s tax loss selling. Ultimately, NCP continues to add to the best ideas and opportunistically ‘pounce’ on opportunities as they arise tactically as we did last week with Riocan.

BOND YIELDS PLUNGE

Falling interests rates is bullish for public real estate because it opens up the door to transaction liquidity, cap rate compression which causes NAVs to rise instead of fall (cap rate expansion) and makes the asset class more desirable hypothetically to income seekers as the risk free bond rate falls. It is the ‘ideal’ set-up. Although rates have plunged in Canada, REITs have not yet moved as a broad index as they typically would have in prior times. In NCP’s view, a lot of this may be due to Trump’s tariff overhang which is impacting broader markets, including his own markets such as the S&P 500 and NASDAQ. In Canada, we have faced more uncertainty with Trudeau proroguing parliament (who knew what that meant prior to him doing it - not us!) with a Canadian election now held within one month. Ultimately NCP does not see the outcome of the election material to the REIT space but less uncertainty in any case should provide more clarity for Canadian investors which should help the investment scene, especially as more policies such as immigration are clarified.

Into this year, I continue to expect to see further privatizations of some names, outright sales of others and continued single asset dispositions to private market buyers - aka “non-core” asset sales which will be used to fund buybacks or reduce debt on an opportunistic basis. For the moment, NCP is sticking with REITs that have what we believe are catalysts to an upward re-rating rather then buy popular names with ‘hope and prayer’ in mind that the asset class becomes in favor again and re-rates are achieved as they have been every other time in history. When NCP says re-rate, we are talking about selling assets to private market buyers, whether individual or outright sales as was the case last year with European Residential REIT - a top pick of NCP which has nearly doubled due to willingness to dispose of assets to private market buyers. This year the most obvious opportunity in that regard seems to be Dream Residential or Morguard REIT - two names we are also long. But the opportunity for capital gains and yield exists too in name like Riocan, something that is rather unusual for a high quality name. Overall opportunities are abundant and NCP is legitimately excited to be part of an otherwise normally ‘boring’ asset class.

Dream Residential REIT (TSX: DRR.U / DRR.UN)

Dream Residential is by far my best performing holding year-to-date. Initially I began to accumulate it last year because of the extreme discount gap with a favourable taxation structure (return of capital) and thought that the management team may disembark into a joint venture with a US-listed REIT which could have helped close the extreme multiple gap narrow. Instead, on the Q4 call earlier this month the management team noted they were pursuing a strategic review. It sounds relatively clear that Dream Residential is putting itself up for sale. On the conference call, the management team led by CEO Brian Pauls, a reputable second generation career real estate insider stated that Dream believes in the NAV of the REIT which is is ~$13.39 USD. It was also noted on the call that a significant portion of the assets had recently been audited which should help corroborate the “NAV” based on recent market trends. By law, REITs must be audited once every several years. After an audit, it is not unusual to see either writeups or write-downs based on current cap rate trends which are to my knowledge based on regional and comparable asset sales.

More encouraging were some of the developments of fellow Canadian listed US-focused entity, BSR REIT which is listed as HOM.U / HOM.UN on the TSX. They recently completed two meaningful residential apartment sales, interestingly enough in two markets that Dream Residential has nearby assets. The first sale took place in Dallas Fort-Worth and the second earlier this month took place in Oklahoma City. In the case of the Dallas sale, BSR noted they sold the residential portfolio at 5.05% cap rate and in the Oklahoma City deal it was noted the apartments were sold at an 8% premium to IFRS NAV value. Currently, Dream Residential still trades at a mid 8% implied cap rate with a 37% discount to IFRS NAV. I continued to believe that Dream Residential is one of the best risk-reward opportunities on the market and would consider adding to my already large position should liquidity open up. My target for Dream Residential is $12-$13 which based on recent market trends and publicly disclosed sales, including those of BSR in the past months, appears to be likely. The biggest risk to this thesis is that management puts its own interests above unitholders by virtue of some kind of asset management contract. This seems less likely given how much ownership they own from the initial $13 IPO as well as other reputable players involved such as Edgepoint and Middlefield. It seems more in the interests of all parties involved that Dream Residential sells itself for the best outright price possible.

Nexus Industrial REIT (TSX: NXR.UN)

Several months ago I wrote an article about Nexus Industrial. I also wrote about it last year when it was in the $6'‘s and ended up as a top performer before the Trump tariff wars spooked investors from the industrial asset class overall. Fortunately, not much has changed fundamentally. The worst known news is that Peaveymart (3.8% OF GLA) filed for credit protection. They lease two properties from Nexus, one in London, Ontario and one in Grande Prairie, Alberta. On the recent conference call it was noted they think they have a tenant for the London property and both properties were ‘well below’ current market rents so a new tenant will be paying a higher price which creates opportunity. The next thing is that the distribution which is ~9% is now fully covered. For the longest time Nexus had an elevated payout but organic growth coming online and year-over-year rent resets has helped drive NOI which was up ~12% year-over-year including same property NOI which was up 4.7%. Net asset value continued to grow despite the impact of higher interest rate and modest cap rate expansion. It is hard to believe a high quality industrial REIT can be trading at nearly a 50% discount to IFRS NAV after factoring in the impact of multiple years of interest rate hikes but the current cycle has created some extreme discounts in the space which reminds me so much of where Canadian energy stocks were in 2020 when nobody would touch the asset class.

Nexus Industrial insiders continue to accumulate shares with 10% “insider” Edwin McLaughlin adding another $400,000 worth in the past couple weeks. In the past year McLaughlin’s purchases at Nexus REIT are close to $4 million worth. I view his purchases as constructive given he is a landlord of his own private industrial assets with a focus on the London, Ontario region. It’s likely that he and his brother, both large holders in Nexus by choice, are aware of the depth of the market and recognize that Nexus is deeply undervalued. Nexus’ extreme discount gap is attractive to the people who know the asset class best. Nexus currently has the last of their remaining retail assets nearing a sale in the Montreal area which will help the REIT further deleverage and invest in potentially organic growth. In recent months they have sold several non-core industrial and office assets with the goal of becoming Canada’s first 100% pureplay industrial REIT. Within the next year they hope to obtain a credit grade investment rating which will further reduce the cost of capital.

Nexus has been weakening along with other high quality industrial peers like Dream Industrial, Granite Industrial and even Prologis likely because of tariff overhang. While industrial was a darling asset class for the longest time, it seems that a trade war can upend those vibes. I went thru all of Nexus’ properties and believe the biggest risk is in the Windsor, Ontario area where they have a company called Plasman which leases three buildings from Nexus. While not material overall to the health of the REIT, it may be consequential for the distribution if hypothetically they lost all three leases - an outcome which seems very unlikely, particularly since the autoparts such as plastics were not a part of Trump’s initial tariff wave and also for the reason these parts are complaint under the existing USMCA trade agreement. From the sellside analyst reports I have read, they indicate that ~85% of Nexus’ business is related to inter-Canadian trade with minimal tariff risk. In the even that tariff overhang subsides in the coming weeks, I believe that Nexus could see the strongest rally of any name in the space as the fundamentals of the REIT have improved year-over-year and the sell-off seems strictly related to the tariff overhang and uncertainty.

European Residential REIT (TSX: ERE.UN)

NCP wrote about European Residential well over a year ago numerous times. Since that period the REIT has been the best performer in the asset class in 2024 finishing upwards of 64% and now up close to 100% since NCP first mentioned it. Our thesis on this name played out as CAPREIT succeeded in selling a great chunk of their portfolio to the private market in Netherlands. The REIT still exists, albeit under a custodian which is now managing their assets while they pursue a liquidation strategy. We are out of this name but still think it offers upside in the range of anywhere from 10-25% depending on the end fees. Perhaps the recent upward move in European bond yields will hinder their process in the near-term.

+European Residential still offers good risk-reward for a lower risk investor, especially in an uncertain macro environment in my view. According to the latest Netherlands data, real estate valuations continue to rise and the housing crisis is amongst the worst in the world which creates good demand for ERES’s apartments. While it is unclear what is remaining in the portfolio, in prior calls, Mark Kenney the CEO of ERES and also CAPREIT noted that he was able to sell the ‘worst properties well well well above NAV’ which should imply that any existing sales take place above NAV. If you believe this is possible ERE still could offer ~20% upside potential.

Morguard REIT (TSX: MRT.UN)

I wrote a bit about Morguard months back and not much has changed other then both Morguard Corporation and George Armoyan have scooped up significant portion of units in the past month and change. Morguard Corporation (TSX: MRC) has ramped up purchases heavily and actually added millions worth this year alone. While I haven’t done a recent calculation, before the latest rash of insider buying the free float was only 7.94% and that has gotten much narrower since.

NCP is long Morguard REIT and is of the view that is could be privatized at a significant premium to the current trading price. George Armoyan and Rai Sahi have completed such an outcome before with the former publicly traded entity Temple Hotels. In the case of Morguard I believe the discount is far more extreme with significant better fundamentals than Temple Hotels. Anything less then a 40% premium for the remaining minority unitholders would seem unethical in my view based on recent transaction trends in the retail space. Morguard is close to ~50/~50 office with a small portion of Toronto industrial assets, which are worth well above the current implied public market valuation.

If we go back to only last year, Melcor Developments made an M&A bid on Melcor REIT at a 46% premium which was opposed by some unitholders. The deal surprised me because the discount wasn’t as extreme by my math as it is at other REITs but it goes to show the folks who know the asset class best have a lot of confident and are not afraid to bite where it is in their interest. By using Melcor as an example, I am of the view that Morguard should receive an even better premium. The only risk to that is that both Sahi-Armoyan are onboard Morguard Corporation and a lower M&A price paid at Morguard REIT could benefit them over the longer-term at Morguard Corporation which would hypothetically inherit the assets under such an outcome. In any case I believe the risk-reward to buying Morguard REIT is exceptional for a patient investor who gets paid a modest distribution to wait until it happens or not.

Northview REIT (TSX: NRR.UN)

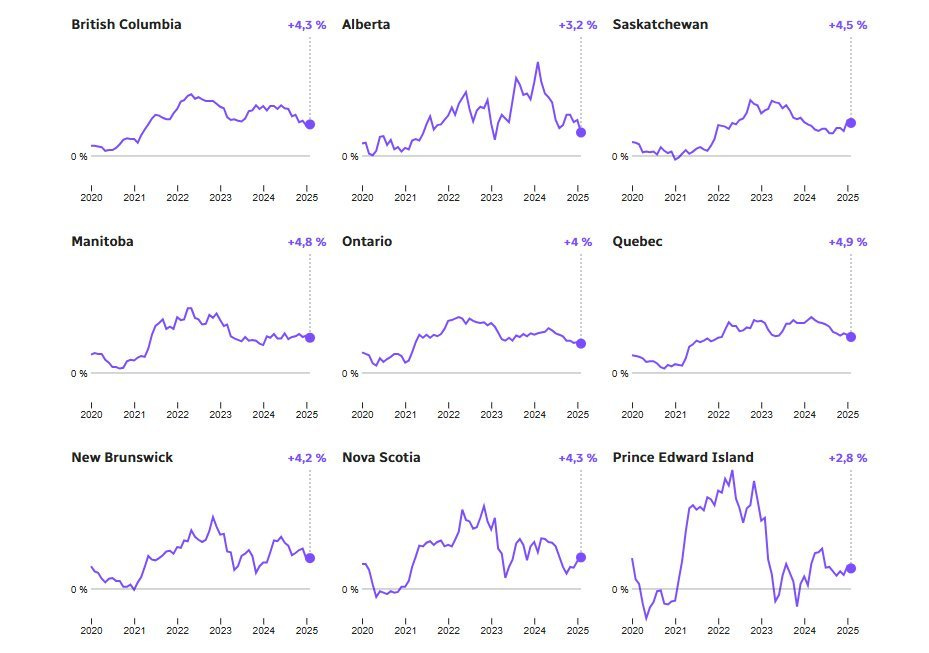

Contrary to the narrative driven by reduced immigration announcements and weakness in the Toronto market, the residential apartment asset class in Canada is rather healthy. I wrote about Northview months back, you can find the article here. In some parts of the country, the demand is at an all-time high whereas the vacancy rate is hovering at all-time lows with absolutely zilch for new builds in the pipeline. My favorite idea in the residential asset class is Northview REIT, a name that focused on Canada’s northern markets, including Northwest Territory, Nunavut and even northern Alberta and Labrador. Many of these rentals are backed by the government and even rented to remote Canadian federal government workers. Provincial employment and First Nations/Inuit communities make up a significant portion as well, making much of Northview’s rent nearly as safe as a government bond in our view. Most operating regions have a rather high “MOAT” to entry and where construction is extremely expensive or challenged by construction conditions such as permafrost, which limits the area a builder can build even when land appears to be vast and scarcely populated. Northview has also been growing the mainstream Alberta market in Calgary and Edmonton which has seen significant results with wide leasing spreads. Meanwhile, the Atlantic Canadian markets have seen some of the strongest rent growth in the country and the trend remains positive in 2025. Northview has no exposure to the GTA area where the negativity is being focused on and most of their markets have little to no impact from recent immigration changes.

Northview has seen record high occupancy, continued same property net operating rent growth, record high net operating income, a falling cost of capital, reduced debt leverage ratios and a continued trends towards a far more sustainable payout. At 7.3% yield with significant wiggle room with an AFFO payout in the 70% range is rather range. The current NAV discount is somewhere around ~32% and Northview has in recent months been disposing of non-core assets above or at IFRS NAV values which they have been using proceeds to deleverage and reduce debt. Northview currently trades at around $140,000 a door where replacement cost in northern markets can hover above $400,000 a door. It trades at the highest implied cap rate in the space and amongst the wide NAV discounts, something that matters when a REIT is disposing the worst “non-core” assets to private market buyers. Insiders were buying decent amounts into year-end and the small remaining portion of public equity leaves me to believe at some point Northview could be bought out by the remaining players in the consortium (KingSett, HazelView, Aimco, Starlight…)

InterRent REIT (TSX: IIP.UN)

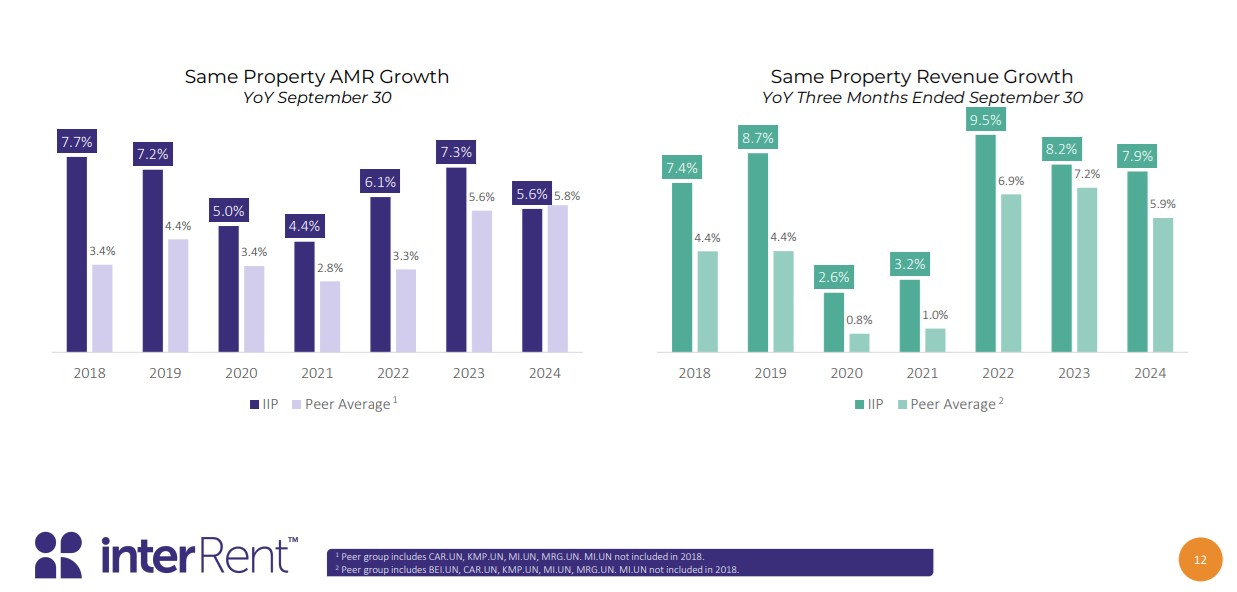

I wrote about InterRent last year and identified it as a top tax loss buying idea. To be fair and transparent I first got interested in it around $12-$13 and initiated a modest position so my timing wasn’t perfect but NCP has continued to add it along with Minto REIT in small amounts. Fast forward to 2025 and Inter Rent has been a top performer in the space after it was disclosed that Anson, a hedge fund, has taken an activist stake with approximately a 10% ownership in the REIT.

Canadian residential names have traded poorly since Justin Trudeau’s government announced a reduction in immigration numbers into the end of last year. Recent headlines about weakness in the Toronto condominium market may not have helped. Despite the negativity, InterRent still posted strong double digit FFO growth while average monthly rent prices continue to tick upwards and they are still trading at a 31% discount to IFRS NAV. In recent months InterRent has began to buyback units with the proceeds from non-core asset dispositions which NCP found encouraging, as without buybacks it is hard to close NAV gaps and take advantage of the public-private market arbitrage without sales to private market buyers. The fact there is now an activist involved makes InterRent’s story more impressive and we think there is a chance to cascade that impact to other residential REITs which could see upward motion off anything positive that stems from InterRent.

NCP will leave it to you to determine the path of Canada’s immigration but we are of the view that residential will remain an in-demand and defensive asset class. The newbuild cycle was plotted years back and with so much uncertainty it’s hard to see how new construction will see much stimulation outside of heavily subsidized purpose built rentals backed by the CMCH funding schemes. On Dream Impact’s recent calls, CEO Michael Cooper noted he believes that Canada’s multifamily market could be in a seriously positive bullmarket in a few years as the new construction pipeline comes to a standstill which could enhance the values of existing assets.

Riocan REIT (TSX: REI.UN)

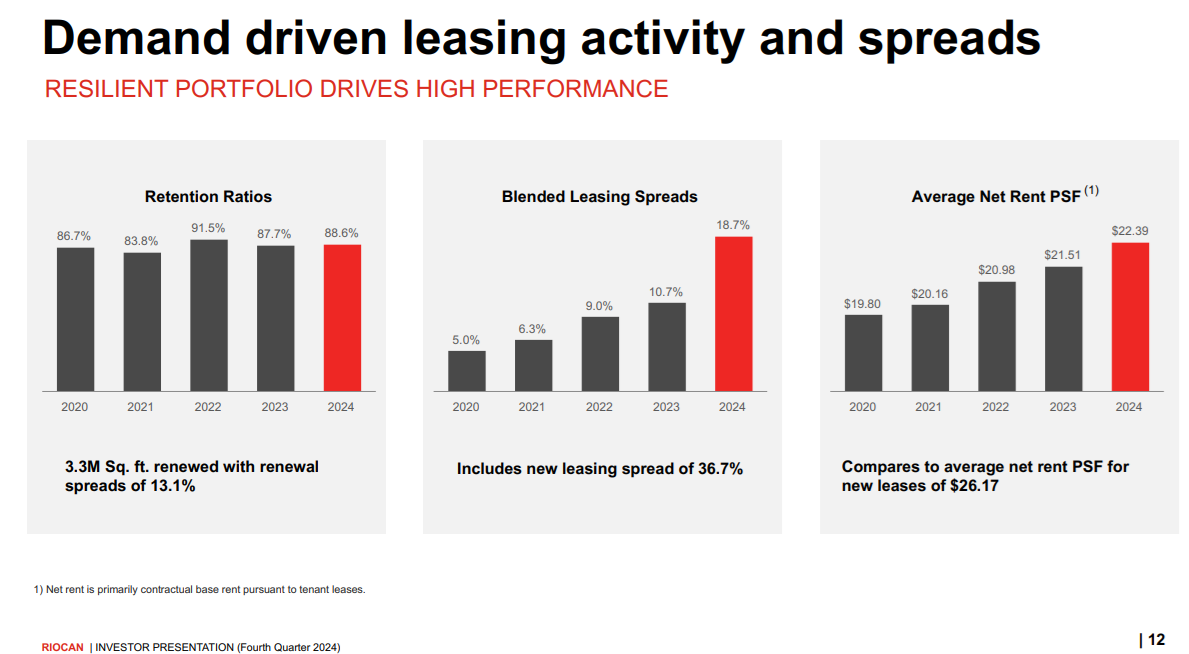

I wrote about Riocan last week (link) for the first time although it is a name very familiar to me as I followed the REIT for many years. Normally a name like Riocan doesn’t interest me for the same reason that something like Canadian Natural Resources doesn’t interest me much in oil, but in the case of unusually violent beatdowns and unsubstantiated sell-offs, NCP thinks both can be buys. Riocan offers investors access to the highest quality retail assets were there is nothing in the pipeline for new builds amidst a still growing urban population.

At a 6.8% implied cap rate, about the same distribution yield and a ~32% discount to IFRS NAV the opportunity in Riocan at the moment is rather splendid. In recent months the REIT began to buyback units with the proceeds of non-core asset dispositions. Without re-writing my entire article last week, I’ll just say that the leasing spreads are at historic bests and occupancy is at an all-time high. Over the years when the residential asset class was hot, Riocan forayed into the condo market and has a division called Riocan living. It’s on the books for around $900 million but recent analyst reports suggest that it may be worth $1.2 billion. On the recent conference call CEO Gitlin seemed to allude that further sales from Riocan Living were coming. If the entire division were sold it would equate to around ~20% of Riocan’s current market cap despite Riocan Living only contributing 4% to Riocan’s overall net operating income on a yearly basis.

Riocan’s current weakness can likely be attributed to the HBC stories about the company seeking creditor protection. Riocan has a joint venture with HBC which has a footprint in some of Canada’s most prized retail locations, locations which are in high demand and likely to be re-leased without much challenge over time. The overall contribution from the HBC joint venture with Riocan equates to around 3% OF the REIT’s net operating income yet Riocan is down approximately ~12% since the headlines began to break earlier this month and 22% off the 52-week high. Despite better fundamentals now then in 2022, the REIT is down 42%, On a multiple basis, Riocan is trading at Covid troughs and amongst the lowest levels in registered history. NCP is of the view that Riocan’s risk-reward is the best in the REIT space at the moment and we have initiated a large position over the past week which we intend to hold for a modest recovery due to oversold conditions or longer given the elevated yield depending on how the coming weeks plays out. Ultimately, for NCP to retain our Riocan units on a longer term basis we would require an active unit buyback and more asset dispositions to private market buyers to fund the program.

Disclosure: NCP is long Riocan REIT, Northview Residential REIT, Nexus Industrial REIT, Dream Residential REIT, Morguard REIT, InterRent Residential REIT.

Thank you for reading and as always, if you have any questions or comments please leave them in the comment section.

Yours truly,

Roger Lafontaine

Partner, Head Trader & Research Analyst, Nugget Capital Partners

Very good article as always. Thanks for the update!

I also have Nexus Industrial and Northview. I like the risk/reward at these prices in both. All the metrics are improving since a few quarters, but share prices not doing much.

And I am considering RioCan at these prices. I also have Primaris, but RioCan taking my attention here...

Keep up the good work!

Are you still holding H&R Reit and Minto?